- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- CC account "CLOSED" for 7+ years, but still paying...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

CC account "CLOSED" for 7+ years, but still paying off . . .

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CC account "CLOSED" for 7+ years, but still paying off . . .

I have a Visa credit card that my credit union revoked from me back in mid-2007 when I fell behind by 90 days. Since 2010, I have been making on-time payments every single month on this account, and have gotten the balance down from its original $7700 to a little over $3000.

On my Equifax FICO report, it shows as "Account closed -- July 2007" (I'm pretty sure that's when the credit union revoked it), but it also shows my continued on-time payments every month since then as well as the $3,000+ current balance.

My question is, is there a way I can get get this TL completely deleted from my report since the last negative info on it was more than 7 years ago? And if not -- if it's still considered "open" (altho it says "closed") because I'm making payments on it, did I screw myself by keeping it open all this time, as it would have fallen off my report by now?

Pigeye

2007 - 2010 low point: mid-500s

With the help of myFICO community, now: 714 EQ FICO

"At the end of every hard-earned day, people find some reason to believe." (Bruce Springsteen)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CC account "CLOSED" for 7+ years, but still paying off . . .

If the original deliquency was over 7 years ago, then that derog should not be reported and the account would actually be a psitive influence on you score, even though its closed - at least thats the way its supposed to work.

I would just leave it alone and keep paying as agreed.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CC account "CLOSED" for 7+ years, but still paying off . . .

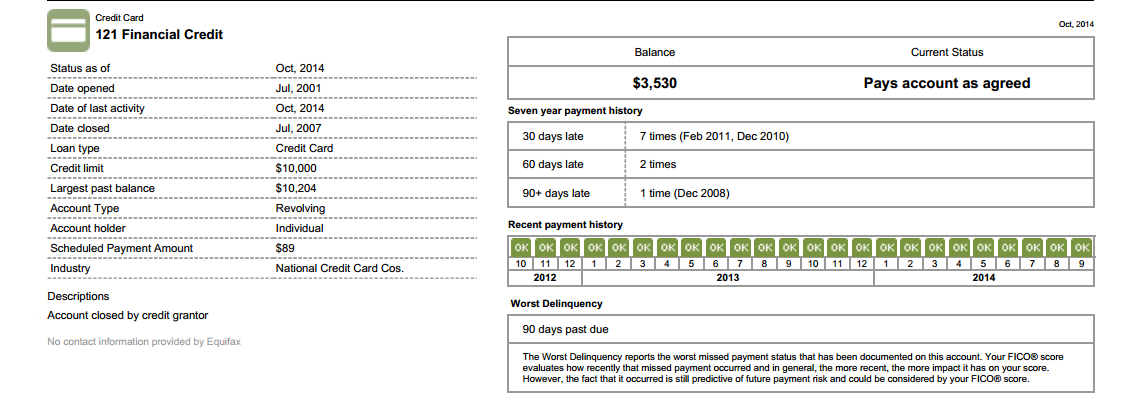

This is how it looks in my Equifax FICO report:

2007 - 2010 low point: mid-500s

With the help of myFICO community, now: 714 EQ FICO

"At the end of every hard-earned day, people find some reason to believe." (Bruce Springsteen)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CC account "CLOSED" for 7+ years, but still paying off . . .

Since the account was never charged off, there is no excusionary requirement for it. The individual lates will fall off on their own as they age past the 7 year mark. The 30's are past the 24 month point so they no longer hurt you. I would assume that the 60's occurred just before the 90, correct? So they will fall of the end of next year. Then you will have a positive 7+ year old account reporting - even though its closed. In my opinion the positives outweigh the negatives in the long run.

The only bad thing is that the balance may go against UTI, but if you get your CL's up enough that won't hurt.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CC account "CLOSED" for 7+ years, but still paying off . . .

Yes, the 60s occured just before the 90.

And I have, actually, increased my CLs just recently, so my utilization is still good. Do you think it's $10,000 CL -- even though the account is closed -- is counting toward my current credit utilization?

Any benefit to transferring this balance to a current card and closing this account out completely? Or should I just keep making the monthly payments? It does have a nice low APR on it.

Thanks for the replies, Norman.

Paul

2007 - 2010 low point: mid-500s

With the help of myFICO community, now: 714 EQ FICO

"At the end of every hard-earned day, people find some reason to believe." (Bruce Springsteen)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CC account "CLOSED" for 7+ years, but still paying off . . .

On the reported CL - not sure but my geuss is probably not.

"Any benefit to transferring this balance to a current card and closing this account out completely? Or should I just keep making the monthly payments? It does have a nice low APR on it."

Not that I can see. Unless the card is zero interest and you would save a few dollars... You'll be paying one way or the other.

Once its close to being paid off, I would contact them and see if they would be willing to re-open the account and let you keep the payment history and age on it. Would be a nice boost to AAoA

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CC account "CLOSED" for 7+ years, but still paying off . . .

Good deal. Thanks again!

2007 - 2010 low point: mid-500s

With the help of myFICO community, now: 714 EQ FICO

"At the end of every hard-earned day, people find some reason to believe." (Bruce Springsteen)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CC account "CLOSED" for 7+ years, but still paying off . . .

There is, in my opinion, an advantage to paying.

The account is currrently delinquent, and even though closed, they can report a new delinqueny at any time.

They could also charge-off the debt or refer for collection, which will remain for 7 years plus 180 days from DOFD.

Even when the delinquencies become excluded, the account will show an unpaid balance, clearly suggesting delinquency.

By paying, you terminate any further delinquencies and obtain a curent status of paid.

Where you obtain the $ to pay is kinda immaterial to the reporting of that account.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CC account "CLOSED" for 7+ years, but still paying off . . .

2007 - 2010 low point: mid-500s

With the help of myFICO community, now: 714 EQ FICO

"At the end of every hard-earned day, people find some reason to believe." (Bruce Springsteen)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CC account "CLOSED" for 7+ years, but still paying off . . .

@Pigeyex wrote:Yes, the 60s occured just before the 90.

And I have, actually, increased my CLs just recently, so my utilization is still good. Do you think it's $10,000 CL -- even though the account is closed -- is counting toward my current credit utilization?

Any benefit to transferring this balance to a current card and closing this account out completely? Or should I just keep making the monthly payments? It does have a nice low APR on it.

Thanks for the replies, Norman.

Paul

- If a closed CC account with a balance continues to report the original credit limit, then both the balance and the CL of the closed account will be used in the utilization calculations.

- If a closed CC account is reporting a zero CL, even if there is a balance on the CC, the card will not be included in the calculations.

- If a closed CC account is reporting a non-zero CL but has a zero balance, the card will not be included in the calculations.

- If a closed account reports a CL that is equal to the balance (balance chasing), then this will be included in the calculations. This is the worst-case scenario with regard to utilization.