- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- CFPB RESPONSE :(

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

CFPB RESPONSE :(

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CFPB RESPONSE :(

Hi,

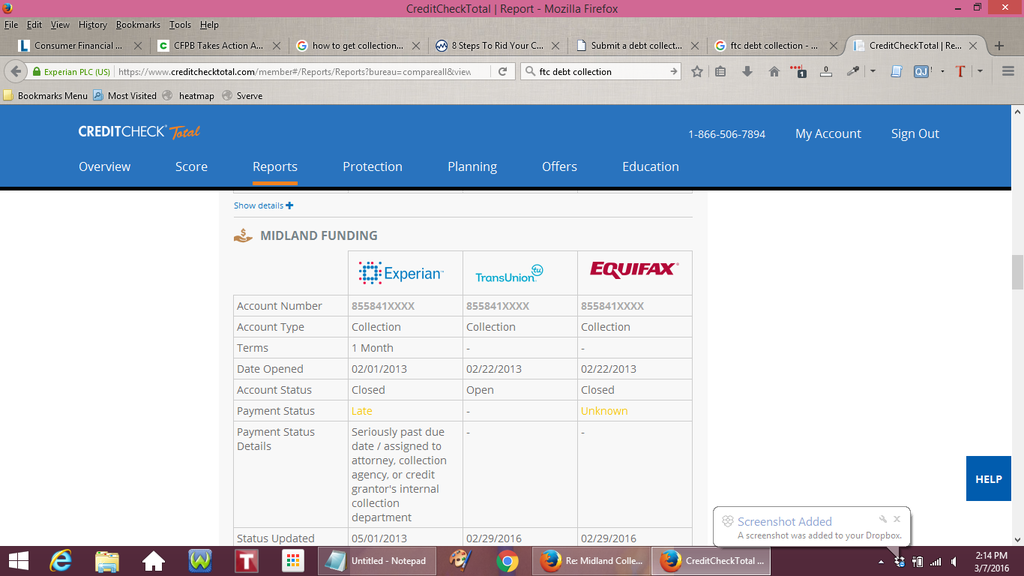

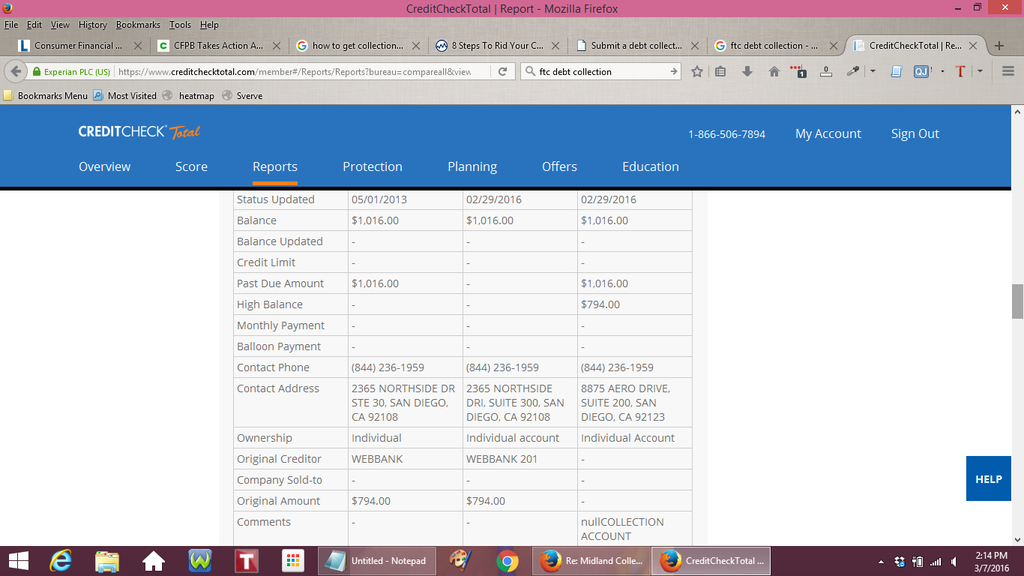

I submitted a complaint against Midland on March 7th, just received the letter from them stating that everything on my husbands report is accurate! Yet this is a company that's just as slimy as PRA!

Since when is a dbt buyer having monthly terms OK??

When a creditor "charges off" an account, it means that the creditor no longer believes the consumer will pay the bill and has written the debt off of its books. Often, they then sell the debt to a collection agency. The underlying promissory obligation remains valid, due and owing. Just as the original creditor had the right to legally seek repayment of the promissory obligation, the new third-party purchaser has the right to repayment of the credit account. The account remains collectible, due and owing to Midland Credit.

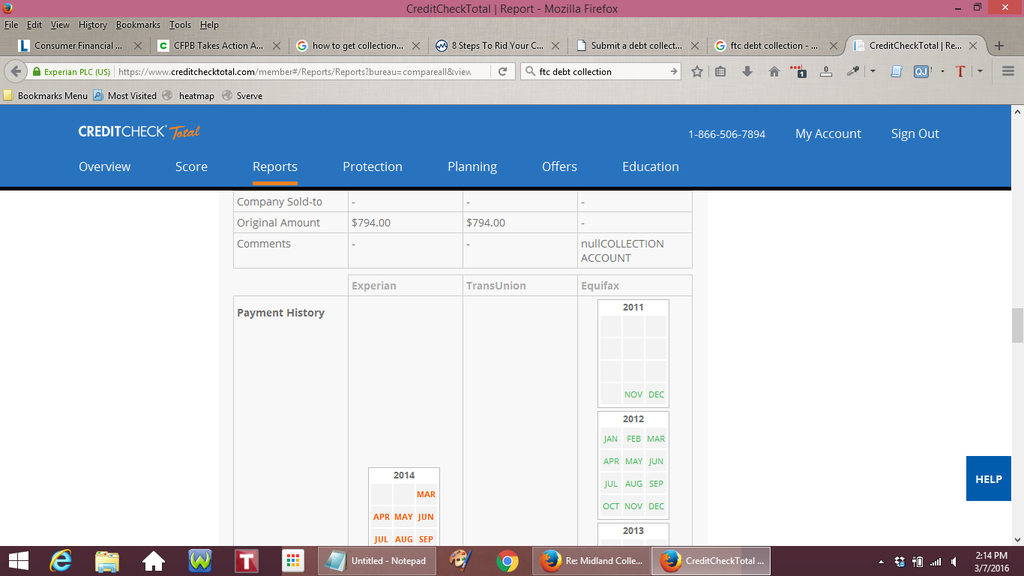

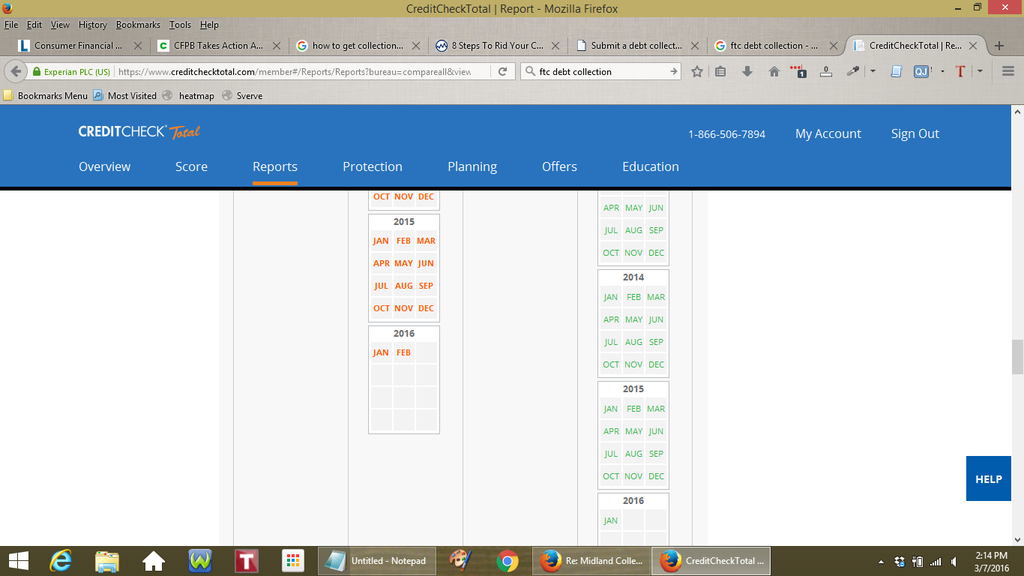

You further express concern about the information appearing on your credit report, namely that it is appearing as "Closed" with Experian and Transunion, and shows a payment history with monthly terms, and different dates. You are encouraged to communicate directly with the credit bureaus with concerns about the types of data that appear on your file. Based on the law and guidelines governing credit reporting, it would appear that the account information being furnished is accurate. If you obtained your credit report from a compilation source, the information being reported may appear to vary. The credit bureaus have advised that it appears this way because they do not directly populate the fields on credit reports pulled from any source other than directly from the credit bureau itself.

OK so the only thing the CRA will do is change it? Not sure how to do that with the CRA.

I'm shocked, I thought they'd remove it. I have read time and time again that a Debt Buyer CAN NOT have monthly terms or show a payment history! I included CCT screen shots of it and it being closed!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CFPB RESPONSE :(

It is difficult to determine what was or was not reported by the debt collector from the post.

It is very common for commercial credit reports to include information, such as payment history, that was reported on the OC account under the collection heading, and it does not necessarily mean that the debt collector is reporting delinquencies or monthly terms of any contract with them.

Can you post details both of the reporting and of the CFPB response?

What speciically did the CFPB state should be changed?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CFPB RESPONSE :(

@RobertEG wrote:It is difficult to determine what was or was not reported by the debt collector from the post.

It is very common for commercial credit reports to include information, such as payment history, that was reported on the OC account under the collection heading, and it does not necessarily mean that the debt collector is reporting delinquencies or monthly terms of any contract with them.

Can you post details both of the reporting and of the CFPB response?

What speciically did the CFPB state should be changed?

Hi Robert,

Here are the Credit Check Total screen shots I sent to CFPB. They didn't state anything should be changed, just to call the CRA's about it reporting closed. OC (fingerhut) isn't on all 3 reports, just 1.

You are encouraged to communicate directly with the credit bureaus with concerns about the types of data that appear on your file. Based on the law and guidelines governing credit reporting, it would appear that the account information being furnished is accurate. If you obtained your credit report from a compilation source, the information being reported may appear to vary. The credit bureaus have advised that it appears this way because they do not directly populate the fields on credit reports pulled from any source other than directly from the credit bureau itself.

I have read in a few places, (I can't find the sites right now) that Debt Buyers are NOT allowed to have monthly terms.

To the fact that they have monthly terms (1) Means we signed a contract, we did with Fingerhut, never signed a contract with Midland Credit. Their CFPB reply: When a creditor "charges off" an account, it means that the creditor no longer believes the consumer will pay the bill and has written the debt off of its books. Often, they then sell the debt to a collection agency. The underlying promissory obligation remains valid, due and owing. Just as the original creditor had the right to legally seek repayment of the promissory obligation, the new third-party purchaser has the right to repayment of the credit account. The account remains collectible, due and owing to Midland Credit.