- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- 800 club across the board... and new score models ...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

CREDIT REBUILD PROJECT LOG

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Achievement unlocked: 800 club!

ramocita wrote: ...about your TU...have you tried calling TU to remove the lates based on early exclusion?

I haven't tried that. I'm a little worried that I might cause the account to be deleted, and it's my oldest by far, so I'm a little nervous. It would take a year off of my file age if it went away. How did it work for you?

I might just let it age off naturally as it's so close, and I don't have any apps planned before then.

Ozix wrote: Awesome work! I'm about 18 months out until all baddies have aged out I have a calendar event each time an item falls off. I like your quote about on time payment history equaling perfect credit in seven years, everything else just speeds up the procces LOL....

Thanks, Oz. I'm glad to hear others learned from my mistakes; I certainly figured out a lot along the way.

cartwrna wrote: Great thread! Hope to be where you are eventually! ... Once again CONGRATS and keep updating us. It's threads like this that give people inspiration!

Thanks; If I can do it, anyone can. Hang in there!

workingfor850 wrote: Thanks so much for documenting your journey. This is my first post, always had good credit then things fell apart in 2008... We had to buy a car recently and it was humiliating to have such terrible credit at our age ... I will start my own rebuilding thread soon but wanted to tell you that your efforts have helped someone have both hope and some strategies to rebuild.

I know the feeling; I used to shop for cars just hoping to be financed and making all of my decisions based on payment amount. It amazes me that I can now buy a new car for about the same payment I used to make on a used one, when the interest goes from 19% down to 1.49. Instead of feeling like I'm begging them to sell me a car, they are begging me to buy.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Achievement unlocked: 800 club!

I think you can call TU and ask for early exclusion for your lates and not to delete the trade line. There have been many success stories regarding this. If you can wait then that is fine and let it fall off naturally. So happy for you!

@p- wrote:

ramocita wrote: ...about your TU...have you tried calling TU to remove the lates based on early exclusion?I haven't tried that. I'm a little worried that I might cause the account to be deleted, and it's my oldest by far, so I'm a little nervous. It would take a year off of my file age if it went away. How did it work for you?

I might just let it age off naturally as it's so close, and I don't have any apps planned before then.

Ozix wrote: Awesome work! I'm about 18 months out until all baddies have aged out I have a calendar event each time an item falls off. I like your quote about on time payment history equaling perfect credit in seven years, everything else just speeds up the procces LOL....

Thanks, Oz. I'm glad to hear others learned from my mistakes; I certainly figured out a lot along the way.

cartwrna wrote: Great thread! Hope to be where you are eventually! ... Once again CONGRATS and keep updating us. It's threads like this that give people inspiration!Thanks; If I can do it, anyone can. Hang in there!

workingfor850 wrote: Thanks so much for documenting your journey. This is my first post, always had good credit then things fell apart in 2008... We had to buy a car recently and it was humiliating to have such terrible credit at our age ... I will start my own rebuilding thread soon but wanted to tell you that your efforts have helped someone have both hope and some strategies to rebuild.I know the feeling; I used to shop for cars just hoping to be financed and making all of my decisions based on payment amount. It amazes me that I can now buy a new car for about the same payment I used to make on a used one, when the interest goes from 19% down to 1.49. Instead of feeling like I'm begging them to sell me a car, they are begging me to buy.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Button love from the stingy

I clicked the love button for the fifth time in the last 60 days, and got a nice 2k bump from Capital One on my Quicksilver Card.

That brings it from 2,200 to 4,200. I know it's still only a third of my highest card, but with soft increases twice a year, and no AF, it will keep growing. The best part is this is my old 300 dollar Orchard Bank Card. With the buyout a few years ago, it became a Cap1 card, and now has over ten times the original limit.

Call me nostalgic if you like, but it's a nice reminder of the contrast between then and now. I'm glad I didn't close it way back when.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

800 club across the board... and new score models available?

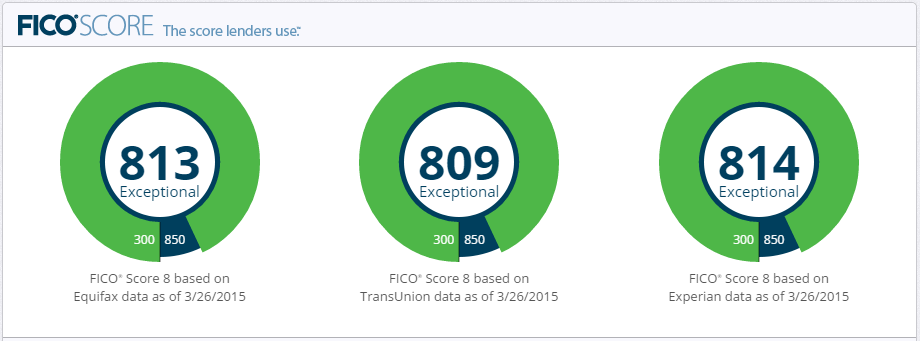

What a ride... My last and final late payment has aged off, and my oldest student loan account is now positive status.

Checked the scores, and sure enough I'm over 800 on all 3. The difference with my lowest score is AAOA, one old account doesn't report to TU and changes my AAOA from a solid 6 to 5.9. Eq has a 10 month old inquiry that will stop affecting my score within a couple of months, but it is higher. It's nice to know I can stay over 800 even if I actually apply for credit.

At the time of this pull I had two credit cards reporting a statement balance, with a total overall utilization of 1.08%.

Interestingly enough, my report detail showed a number of additional industry-specific scores. That's new, and pretty nifty. My scores breakdown as follows:

Standanrd Fico Scores:

Eq - TU - Ex

813 - 809 - 814

All-Industry Version (mortgage):

807 - 768 - 825

-Interesting that I got a much heavier ding for the AAOA on that one.

Fico Auto Score 8:

829 - 841 - 836

Fico Auto Score 4:

812 - 772 - 858

Fico Bankcard Score 8:

836 - 840 - 836

Fico Bankcard Score 5:

829 - 802 - 852

Fico Score 3:

- - 815

What a ride; thanks to all of you for the help and support along the way.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 800 club across the board... and new score models available?

@p- wrote:What a ride... My last and final late payment has aged off, and my oldest student loan account is now positive status.

Checked the scores, and sure enough I'm over 800 on all 3. The difference with my lowest score is AAOA, one old account doesn't report to TU and changes my AAOA from a solid 6 to 5.9. Eq has a 10 month old inquiry that will stop affecting my score within a couple of months, but it is higher. It's nice to know I can stay over 800 even if I actually apply for credit.

At the time of this pull I had two credit cards reporting a statement balance, with a total overall utilization of 1.08%.

Interestingly enough, my report detail showed a number of additional industry-specific scores. That's new, and pretty nifty. My scores breakdown as follows:

Standanrd Fico Scores:

Eq - TU - Ex

813 - 809 - 814

All-Industry Version (mortgage):

807 - 768 - 825

-Interesting that I got a much heavier ding for the AAOA on that one.

Fico Auto Score 8:

829 - 841 - 836

Fico Auto Score 4:

812 - 772 - 858

Fico Bankcard Score 8:

836 - 840 - 836

Fico Bankcard Score 5:

829 - 802 - 852

Fico Score 3:

- - 815

What a ride; thanks to all of you for the help and support along the way.

Grats!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 800 club across the board... and new score models available?

P- thanks so much for documenting your journey, I am early in the process of rebuilding and your story helps give me the confidence that I can get this done.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

More button love

The love button must be hot... Just hit the six month mark on my WMC and clicked for a 12k to 14k jump. This is my good old credit steps card, and Cap1 remains my highest limit to date.

Sweet.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CREDIT REBUILD PROJECT LOG

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: More button love

Congrats on your success and thank you for sharing your journey!

Barclays: Arrival+ WEMC

Capital One: Savor WEMC, Venture X Visa Infinite

Chase: Freedom U Visa Signature, CSR Visa Infinite

Citibank: AAdvantage Platinum WEMC

Elan/US Bank: Fidelity Visa Signature

Credit Union: Cash Back Visa Signature

FICO 08: Score decrease between 26-41 points after auto payoff (11.01.21) FICO as of 5.23, EX: 812 / EQ: 825 / TU: 815

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 800 club across the board... and new score models available?

Hey P,

Welcome to the 800 club across the board.... I haven't posted or visited in some time and it's really inspiring to see you're still at it. I had recommended PenFed auto loan to you some time ago and have followed your post when I was rebuilding in 2009. I implemented many of the strategies you were posting and went from the low 500s to 800s in 4 years. My quick bounce was due to many of my graduate loan baddies dropping off, Chase forgiveness, and my 27+ year credit history with AMEX that I was able to renew with three (3) backdated cards. Who knew getting an AMEX card as a freshman in college in 1987 would help me rebuild my credit in 2011. Gotta love it...

Appreciate your posts and let's continue the journey.