- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Re: Can BOA do this?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Can BOA do this?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can BOA do this?

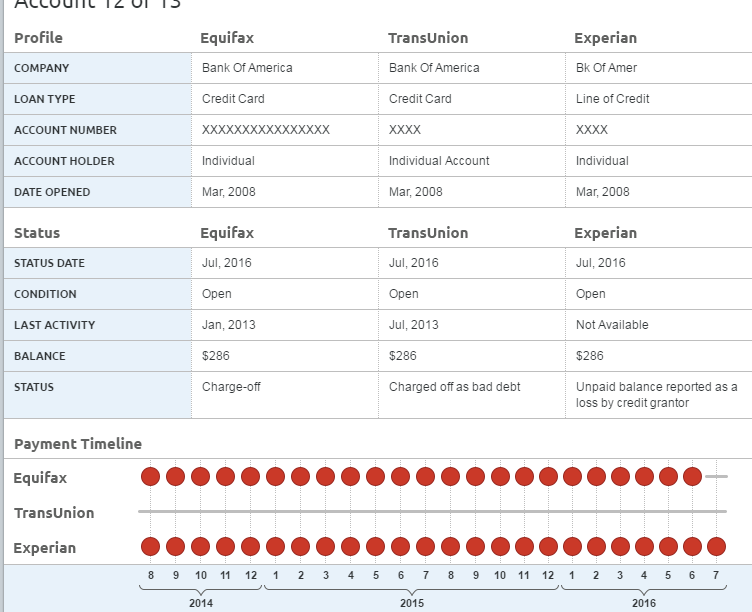

I had a secured card with BOA back in 2008 that I treated very well. My family hit on hard times starting in late 2012 and the card waspushed to the side and was in turn closed in 2013. It was listed as a charge off. A couple months ago, BOA started updating my my reports with 90+ lates on EQ and EX. Can they do that? I still have a balance of $286. I was wondering if I should contact them to pay the $286. After looking at the account, I've noticed a bunch of inaccurancies; such as the card is listed as open. What should be my next steps?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Can BOA do this?

You said it was a secure card, why not call them and have them use your deposit to pay off the charge off.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Can BOA do this?

I agree with the above poster. Call them and also dispute the inaccuracies with the credit bureaus.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Can BOA do this?

Once the account becomes delinquent, then it can be reported each month thereafter with the current level of delinquency until the full delinquency has been repaid.

Taking of a charge-off is a separate accounting action which can be reported, and does not end delinquency on the debt or prevent additional, continued reporting of delinquencies. Many creditors will cease reporting of additional delinquencies after having reported a charge-off, but are not required to do so.

The scoring of the CO effectively includes the combined effect of monthly delinquencies that led up to that CO, so the number of actually reported monthly delinquencies is likely not impacting your score.

The DOFD is apparently sometime in early 2013, so theoretically, progressive derogs could be reported each and every month thereafter, up to and including 180+ days.

A dispute could result in the addition, and not removal of, delinquencies, so a dispute is not, in my opinion, wise.

With a DOFD of approx 01/2013, the charge-off will not become excluded until sometime in early 2020.

Additionally, things could get worse, as creditors will often either refer to a debt collector or sell the debt after taking a charge-off, which could result in the addition of a collection to your credit report.

As for the other inaccuracies, yes, you can get them corrected, but any dispute of their accuracy will relate only to their correction, and will not result in any required deletion of the reported derogs, such as the charge-off and monthly delinquencies.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Can BOA do this?

Thanks everyone.... I will contact them and get this paid ASAP. I don't want this hanging over my head. (BTW..they did take my deposit. My deposit covered the fees they charged, so I'm basically stuck with the charges I actually used.)