- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Cancel our secured credit card?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Cancel our secured credit card?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cancel our secured credit card?

Hi all,

Need some help with a secured card. When mine and my husband's credit scores were in the 500's we took out a secured credit card to improve our credit. We put down 500.00 for the depost with 17.9% interest, although I do pay the balance off before interest accrues. Now that our credit scores are now in the high 600's we are going to apply for the Barcly credit card. If we qualify, what would be the best way to go, should we close the card? The 500.00 would very helpful paying off 2 collections on my credit report. If so how much would it effect our credit scores? Any help would be greatly appreciated.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cancel our secured credit card?

@cjane1 wrote:Hi all,

Need some help with a secured card. When mine and my husband's credit scores were in the 500's we took out a secured credit card to improve our credit. We put down 500.00 for the depost with 17.9% interest, although I do pay the balance off before interest accrues. Now that our credit scores are now in the high 600's we are going to apply for the Barcly credit card. If we qualify, what would be the best way to go, should we close the card? The 500.00 would very helpful paying off 2 collections on my credit report. If so how much would it effect our credit scores? Any help would be greatly appreciated.

Closing an account whether it is secured or unsecured will still report for 10 years. How it affects your credit scores will depend on what is in your reports at the time of closure. As long as you have 3 cards reporting and a mixture of loans on your report, you should be fine.

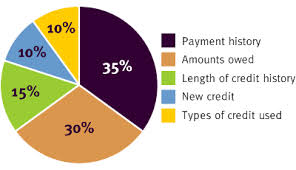

Keep in mind, your credit limit will be decreased by $500 and depending on your utilization, it can be negative. Here is how the scores are calculated in case you haven't seen this already.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cancel our secured credit card?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cancel our secured credit card?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cancel our secured credit card?

I would keep it open. You need to build a foundation of good credit. I would take care of the collections ASAP. Barclay told me on the phone that they don't like collections that aren't paid.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cancel our secured credit card?

Thanks for all of your help, I will try to get the collections paid off within the next 2 months. I paid off my Afni collection last week and has already reported as paid on my credit report. I will be sending out a goodwill letter to AFNI this week, hopefully it will be successful with the first letter. Is emailing the goodwill letter alright or should I mail one?

I have a fingerhut card, the secured card and an authorized user on my husbands Walmart card. Those 3 have helped my credit score go up approx 75 points and I just started working on my credit scores in February. We are working on purchasing a home and hopefully in the next 6 months I can get my score high enough to get a reasonable interest rate.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cancel our secured credit card?

Side question, did you try a PFD with AFNI before paying the collection?

On topic: you might lose points if the secured card was your oldest - when it comes to lenght/ history of credit. I might be wrong though.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cancel our secured credit card?

@Anonymous wrote:Side question, did you try a PFD with AFNI before paying the collection?

On topic: you might lose points if the secured card was your oldest - when it comes to lenght/ history of credit. I might be wrong though.

Closed accounts remain on reports for 10 years so that isn't the case. If you close it, you should be fine, although I wouldn't until you're in a good enough position to get unsecured cards.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cancel our secured credit card?

@cjane1 wrote:Thanks for all of your help, I will try to get the collections paid off within the next 2 months. I paid off my Afni collection last week and has already reported as paid on my credit report. I will be sending out a goodwill letter to AFNI this week, hopefully it will be successful with the first letter. Is emailing the goodwill letter alright or should I mail one?

I have a fingerhut card, the secured card and an authorized user on my husbands Walmart card. Those 3 have helped my credit score go up approx 75 points and I just started working on my credit scores in February. We are working on purchasing a home and hopefully in the next 6 months I can get my score high enough to get a reasonable interest rate.

Along with the Barlays app, I would suggest you both apply for Capital one QS1 cards as well. Once you get some more accounts going, its fine to close your secured accounts. No sense in tying up funds that could be better used elsewhere.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cancel our secured credit card?

I didn't do the pfd, I know should have but just wanted to get it paid. Afni was one of the accounts that I sent t a letter to verify collection. I guess on a good note the rep said they had it down as a dispute but he took that off for me.