- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Chase Still Reporting Balance after issuing 1099C

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Chase Still Reporting Balance after issuing 1099C

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Chase Still Reporting Balance after issuing 1099C

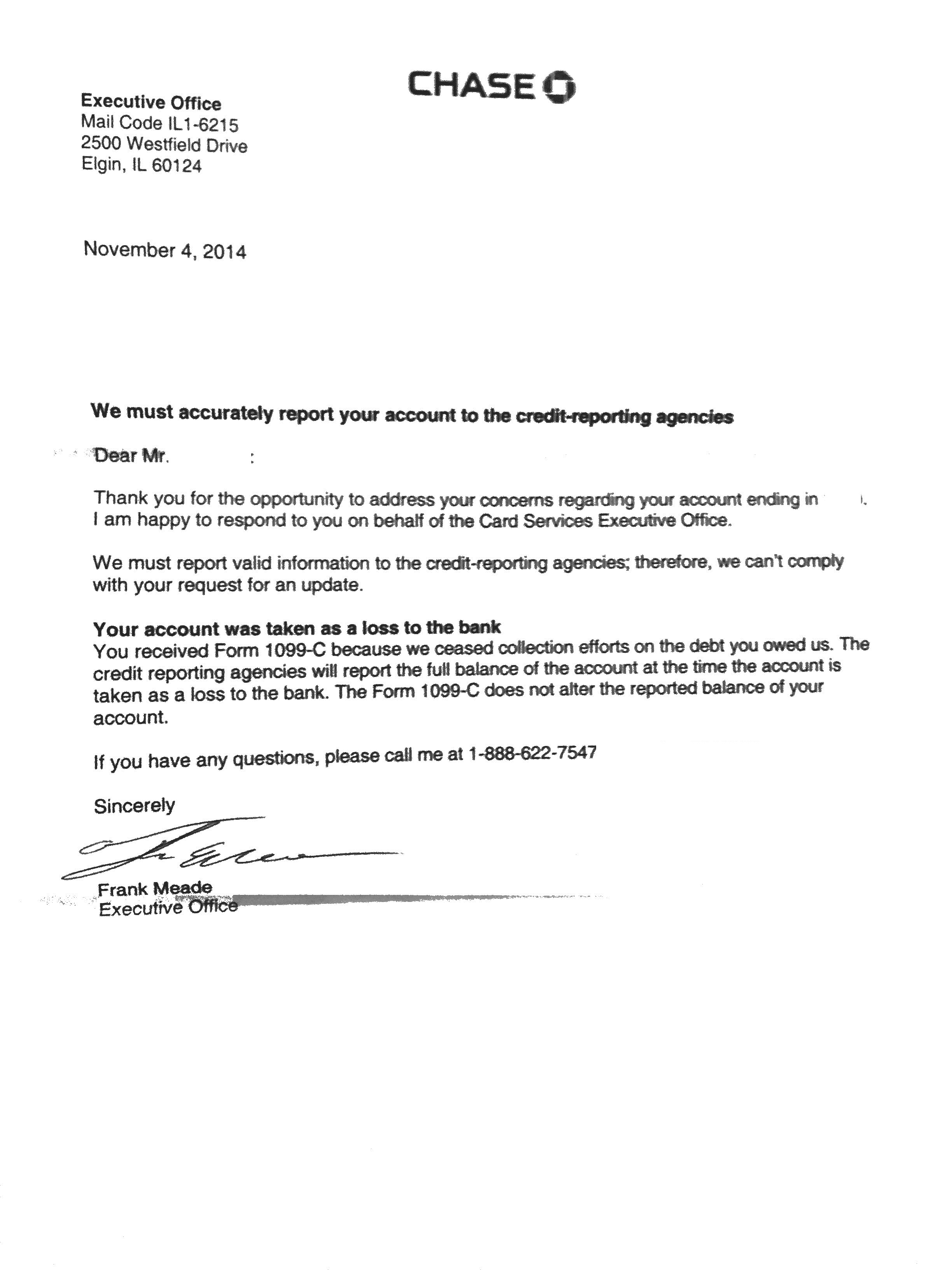

From the research I've done, after a bank issues a 1099C they should no longer report a balance to the CRA's. I've disputed this multiple times with the CRA's with no change. I contacted their Executive Office this past week about the issue and I received the attached letter today indiciating that the issuance of a 1099C does not alter the balance/what's reported to the CRA's. Does this sound accuate? Where should I go from here?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Still Reporting Balance after issuing 1099C

I'm in the same boat as you. Unfortunately they have not budged on any of my Goodwill attempts nor my deleting late payments/balances. I gave up and I'm waiting for them to fall off.

Short Term Goal: 700 Across the Board Long Term Goal: 750+

| Macy's: 1k | Barclay's Rewards: 3.3K | Quicksilver 3.8K | QuickSilverOne 1.5k | AMEX BCE 5.5K | DiscoverIT 6.1K |

USAA VISA Rewards 7K |

Last App 12/2014. In The Garden Till 12/2015... Hopefully

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Still Reporting Balance after issuing 1099C

If they are legally required to update the balance to $0, I would think the next step would be to send them an Intent to Sue letter if they are violating the FCRA.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Still Reporting Balance after issuing 1099C

This is a controversial topic, as some creditors assert that they must send a 1099c in situations where they are not actually cancelling the debt.

That position has its critics.

I suggest you do some googling on whether a 1099c actually cancels debt, and read the opinions.

Chase apparently feels that in your case, it does not.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Still Reporting Balance after issuing 1099C

The thing is though, even if you wanted to pay the balance in full now you legally can't correct? Since the debt has been cancelled with the IRS and they are no longer able to collect.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Still Reporting Balance after issuing 1099C

That is part of the dilemma with the theory that a 1099c sometimes does not cancel the debt.

You cannot be asked/required by the IRS to pay taxes on the amount as income and yet still have the debt. It is contradictory.

The basis for IRS consideration of former debt as becoming income is that while it is debt, you have an obligation to repay it, but once the debt is cancelled, you no longer are obligated to pay, and thus it is net "income" to you.

Thus, those who contest the position taken by chase would assert that they cant have it both ways..... hold the debt to be cancelled, and yet inform the IRS, via a form titled cancellation of debt, that you are obligated to pay taxed on it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Still Reporting Balance after issuing 1099C

See Here - footnote 11 indicates that if a debtor is subsequently compelled to repay a debt after a 1099-C is issued, they may be able to file an amended return for refund of the taxes paid.

From the article it seems like the courts mostly side with the creditors, with the exception of the Reed case.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Still Reporting Balance after issuing 1099C

I found some great and interesting information here about 1099C's and credit reporting:

http://www.stcwlaw.com/images/legal-primer/the-issuance-1099-C-fair-credit-reporting-act.pdf

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Still Reporting Balance after issuing 1099C

The CFPB has lawyers.

It would be helpful to attempt to get the CFPB to weigh in on this issue.

I would recommend also filing a formal complaint with them over the issue of whether cancellation of debt by sending a 1099c requures concurrernt update of their credit reporting to show a $0 debt balance.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Still Reporting Balance after issuing 1099C

I have already submitted a previous complaint to the CFPB in the "credit reporting" complaint section and received a response back from Bank of America that they maintain they can continue to report the full balance even after issuing the 1099C, and that the 1099C is just a tax instrument required by the IRS.

I have also disputed with all 3 CRA's with negative results from each.

I have just submitted a second complaint to the CFPB in their "debt collection" section. It seems the CFPB acts very similar to the BBB where they don't actually look into the issue themselves, rather they pass it along to the defendant to respond and then just pass that response on to the complainant. Not sure how to get them to actually look at the detail of the complaint and have them form an opinion on the legality of the matter, but I will investigate further.

I have also contacted a consumer attorney to see if I can get legal aid in pursuing this case. There is more and more court activity on this issue and at some point the now blurred line needs to be clearly defined.