- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Re: Collection report as "collection" and "open ac...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Collection report as "collection" and "open account"?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Collection report as "collection" and "open account"?

Hello all!

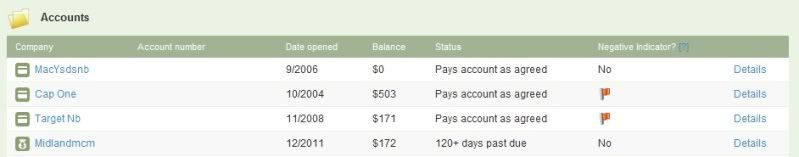

I've done a search and read on some old posts on what Midland is doing to the credit reports of others, but wanted to compare and see if it's along the same lines. I had them showing up as a Collection on my report for quite a while now and upon pulling my report recently, noticed that they have now not only kept their COLLECTION hit on my report, but now also show the same thing as an OPEN ACCOUNT on my report, posting it as 120+ days past due, and adding the $172 onto my revolving balance still owed. UGHH.

I just paid off all my credit cards (Capital One and Target) so was excited to see a jump soon in my score, but with that $172 now showing up there it's foils my plan.

Was this resolved for anyone or am I out of luck until I can get it paid? If I DO just pay them the $172 (been trying to PFD for over a year now) will this come off the open account portion? I will be livid if they are able to put a 120+ day mark on my report. I am only up to two 30 day lates on my credit after years of repair.....

Thanks in advance for any advice!

Current: 638 (EQ) FICO 9/2012

Goal: 640 - Mortgage here I come!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Collection report as "collection" and "open account"?

I have the same problem with them reporting it as an open account, but I haven't figured out if this is "legal" for them to report this way. I know they can't report the same item twice, so you may have better luck with them!!

Have you looked at all 3 reports? Mine reports differently to each of the credit bureaus. Same amount, but one is a collection, one is open account, and one is something else. Is this just the wording of each bureau or them?

Hopefully you get some adivce I can use too!!! : )

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Collection report as "collection" and "open account"?

From what I understand, they can report as "Open" if there is still an outstanding balance.

I could be wrong though. Trying to figure out what is legal and what isn't is headach inducing...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Collection report as "collection" and "open account"?

At one point I called Equifax to try to determine if this is "legal" for them to do on their end and she said they can do this as it's still technically true information. Whatever that means. Who knows if this lady was misunderstanding me, or just not informed. Either way it's annoying.

Current: 638 (EQ) FICO 9/2012

Goal: 640 - Mortgage here I come!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Collection report as "collection" and "open account"?

Why does myfico say there is no negative indicator on that account? Mine also has that, but I mean how can it not be negative considering it is a collection account.... How is it affecting my score?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Collection report as "collection" and "open account"?

Hahah - I'm not laughing at you, I'm laughing at the fact that I have posted the SAME question on this forum quite a few times, and STILL dont know the right answer.

It doesn't have a negative indicator because you're disputing the account. Everyone says that CA's are still scored during a dispute, but clearly, they are not (as there is no negative indicator on the account). Either that, or the CA isn't reporting as a true CA. It's super confusing, and even more frusturating...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Collection report as "collection" and "open account"?

Simply put: "Account Type" =/= "Account Status" so the account type is "Open Account" which, when you hover over the question mark, defines open as:

"Open (or Charge): An account that must be paid in full every period (usually monthly)."

IMO, they really need an account closed date field in these myfico reports. I have an EQ digital CR and I have some CA's listed under the closed accounts category (that have not been paid), but the myfico report doesn't give you that specific information, as far as I can tell.

Current: EQ-639 TU-630 EQ-615 (8/20/13)

History: EQ-560 TU-588 (6/11/12); EQ-549 (5/09/12) TU-514 (5/11/12)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Collection report as "collection" and "open account"?

Ashcash is right about the fact that is not affecting right now while is under investigation,but once the remarks are gone...bam! Your score will take a plunge,the FICO gods ignore the accounts in dispute for scoring,that's why you wont get funded for a mortgage if you have accounts in deputes or dispute comments for that matter.Can some of the gurus here correct me if I'm wrong and enlighten us on the matter? Thanks in advance.![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Collection report as "collection" and "open account"?

The interesting thing is that I never disputed the account. The only thing I can think of is that Midland got my GW request either on the phone or through letters and did the usual and considered that an "account dispute". As a side question on that note, how long do accounts remain in dispute at the longest? It's been like this a while now...

Hopefully we can get to the bottom of the question of Midland having this double posted through the reports. They are in a way, able to ding me in 2 places! UGH!

Current: 638 (EQ) FICO 9/2012

Goal: 640 - Mortgage here I come!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Collection report as "collection" and "open account"?

Collections are never accounts with a consumer. They are "accounts" with a CRA to report t their collection on a debt. They are stored in an entirely different segment of the consumer's credit file. The proper status code for a collection is "Open" until it becomes closed, either due to termination of their collection authority, or satisfaction of the debt under collection.

Similarly, the reporting of a prior delinquency status is based on information provided to them from the creditor as to its delinquency status with the creditor.

You dont accrue new delinquencies with a debt collector, as you have no account agreement with them upon which to base a delinquency in date of a due payment.

If you were never 120 late with the OC, then their reporting as such would be inaccurate, but I would not approach it as a reporting of a new delinquency with them.

File a direct dispute with the debt collector for inaccuracy in reporting.