- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Re: Collections Letter, PFD?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Collections Letter, PFD?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Collections Letter, PFD?

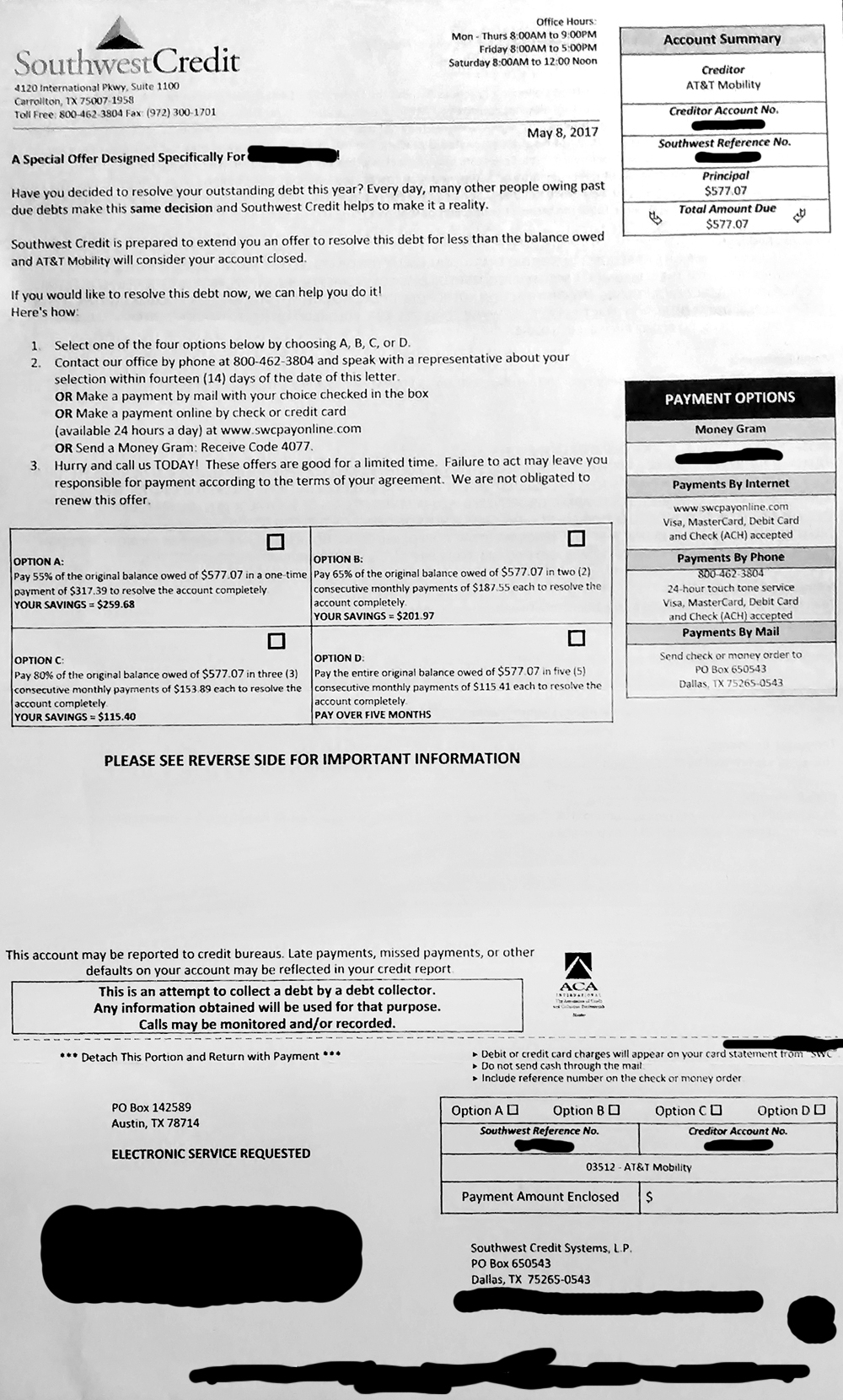

Trying to get family credit in shape (spouse and I are sick of renting and hoping to someday be able to buy a house). Received this collections letter in my spouse's name about a week ago. Original account was with AT&T.

The letter says if we pay some percentage of the total amount owed, the debt will be considered resolved and AT&T will close the account. If we were to just pay them what they're asking for in the letter, what would that mean for my spouse's credit report? Should I ignore the letter and go through the process of reqesting debt validation letter and then offering to pay 50% for a PFD instead?

The collections account is showing as open, placed for collections to SW Credit Systems, for the full amount of $577 on his report, first reported in March, most recently reported the same date as the letter.

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Collections Letter, PFD?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Collections Letter, PFD?

Whether or not to first send a DV request depends upon whether you consider the debt as legitimate, or whether you first want more info in order to make that determination.

If you send a DV request within 30 days of their notice, it will impose a cease collection bar on the debt collector, which will remain in place until such time as they choose to send validation. There is no period for or requirement to ever send validation. If they choose to discontinue further collection activities, they can choose not to send any validation. You will thus be in limbo, and if you later decide to negotiate payment terms, such as a PFD or settlement, they cannot respond until they have first removed the imposed cease collection bar by sending validation.

Sending a timely DV will not require deletion of their reporting of the collection. It will remain regardless of whether they send validation.

If you wish to seek immediate removal of the collection, you should contact the debt collector prior to sending any DV, and make an offer to pay in exchange for their agreement to delete the reported collection.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Collections Letter, PFD?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content