- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Re: Does this look right and is it affecting my sc...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Does this look right and is it affecting my score?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

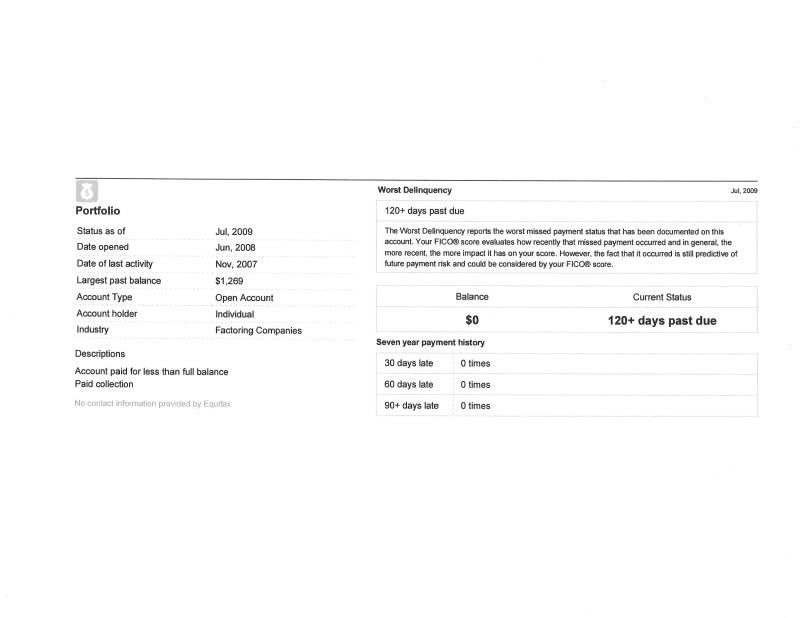

Does this look right and is it affecting my score?

Note that this account has been paid off for 2.5 years, yet it still lists the Current Status as 120 Days Late with a $0 balance. I guess I question how it can currently be 120 days late after it was settled 2.5 years ago. Is this hurting my score at all? Should I dispute the current status?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does this look right and is it affecting my score?

Current Score: EQ 642 TU 636

Goal Score: 660

Take the FICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does this look right and is it affecting my score?

It hurts. It's still viewed as a collection (as indicated in the comment) and scored as such as opposed to a 120+ day late. Basically scored the same anyway. Are they responding to your GW letters?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does this look right and is it affecting my score?

I haven't sent any goodwill letters yet, I'm trying to initate my game plan at the moment. The thing is I don't dispute that this was a collections account, and I realize that despite the fact that I paid it it will remain on my cr for 7 years and 180 days (unless I get a goodwill). But I also know that these things should hold less weight as they age, but it seems to me that it's showing as currently 120 days late that it might have more weight than it should using the Last Activity date of Nov 2007 (which is actually the date of first late) or June 2008 the date it was sold to the collection agency. So I guess my question is, is it being weighed as a more "current" collection than it should with this "current status".

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does this look right and is it affecting my score?

There is no such thing as a current status of 120-late on a paid account, so the answer to the basic question is no, it is not correct.

Unfortunately, the printout does not specifically list the current status. It says "Status as of..." without identifying the status bein referred to. It identifies the highest level of prior delinquency, which again, is not a current status.

The right side of the printout is apparently based on OC reporting taken from the OC account portion of your credit file, while the left side appears to be based on the collection as taken from the collection segment of your credit file. The credit report is thus a mix of unidentified information that does not give you the answer you seek.

What is apparent is that the OC account went to collection, and that the debt was subsequently paid for less than the full amount. Based on those facts, here are what the various status and reporting codes should show:

OC Account:

Current status: Paid. One four-letter word. Current status is a current snapshot code that is irrelevant to any prior levels of delinquency. Once paid, it can only read Paid.

Paid for less than the full amt is reported separately by a Special Comments code, and is not a part of current status code. So you have a jumbling of code titles

Prior levels of delinquency are retained, not in Currene Status, but rather in your "Payment Rating" status code, which essentially stores your highest level of delinquency prior to the required update of Current Status to "Paid," and in your Payment History Profile, which details each prior deliquency.

Current balance: $0

Payment Rating: 120-days late

Special Comment: Paid for less than the full amount

Collection Account:

Collection status: Closed

Collection balance: $0

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does this look right and is it affecting my score?

So based on that, shouldn't the "Current Status" on the right hand side say "Paid", while the Worst Delinquency should remain at "120 Days Late"? I just wonder if that status in that particular box is adding weight where I want it to age?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does this look right and is it affecting my score?

If the 120 late is their last reporting of the current status, yes, that is incorrect and needs to be updated. A current status of still delinquent is directly contradictory to the statement on the left that the deb was paid.

Is it affecting your scoring? No, I dont think so, since FICO is scoring the delinquency, not the payment status of the debt. A scoring impact might be occuring if you did not settle the debt for less, but rather paid in full, making the special comment code inaccurate. That would be my primary concern.

I would clear up their failure to update the current status code to paid, not so much for scoring reasons, but to clear up any negative interpretation of your CR by one doing a manual review. They would most likely conclude, from the special comment and the $0 balance, that the current status is paid. However, it is always good to have the official reporting of the OC that they no longer have any claim for any remaining debt on the account. That is what current status of paid says.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does this look right and is it affecting my score?

From what i have read is that +120 days late (from what i have seen) is a code for TU to shoe it is a collection account, but if you look at the time line, it is listed as CO or whatever.

I started my journey here years ago, and thanks to MyFico, it really is possible.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does this look right and is it affecting my score?

OP, the alternative reporting would be to have it list as a "charge-off/collection" in that status field. You can't get a "paid as agreed" to show in that field for a collection like this, because a CA or CO can never show as "paid as agreed" because it wasn't.

I'd GW them, but I wouldn't fight the reporting. You would not want them to update the status date by 2+ years. If so, I bet you'd see a score drop.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does this look right and is it affecting my score?

Thanks all, I'll let that one ride for now. I'm trying to priortize, I have 5 total accounts I want to try to get rid of on my record. I've sent my first Goodwill letter to a different creditor and hope I get a postive response, I don't take rejection very well, lol. I'm really not even worried about getting them all gone, I just want to clean up enough to get to 660 as I think I will be satisfied with my new car interest rate if I can get there (not the best but not the worst), then its garden mode and just letting some of these weeds die.