- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Fastest way to delete a paid auto loan Charge off?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Fastest way to delete a paid auto loan Charge off?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Fastest way to delete a paid auto loan Charge off?

This account have 3 years old from a credit union. Any suggestions really appreciated.

Should i go to a credit repair company to make fast the process, i need to delete this chafge off from my TU asap.

Thanks in advance guys.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fastest way to delete a paid auto loan Charge off?

Even though it is paid, the chargeoff/collection does not necessarily get removed from your report - the reporter just updates it to "closed."

The balance should be zero, if you've already paid it off, but the item itself may continue on your report for the rest of its reporting life (generally 5-7 years after it appears, or 7-ish years after your date of first default on the underlying loan, whichever comes first).

There is nothing you can do to force them to remove it, but if they are reporting a balance when it should be zero, you can dispute that.

In all likelihood, if they are in fact reporting a balance when they shouldn't, once you dispute it they will probably just remove it to remove the question.

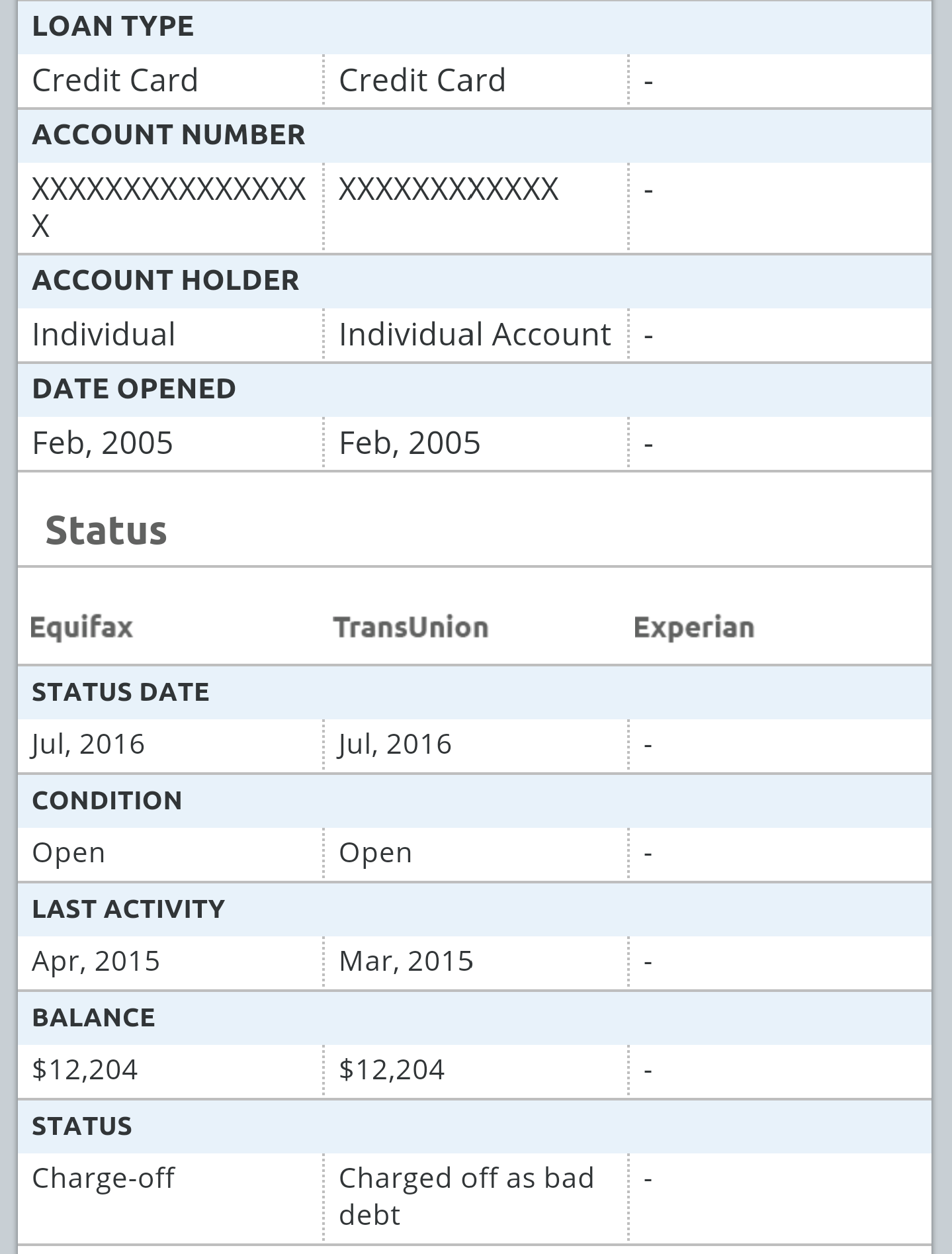

We need a few more details to provide you specific advice - what exactly is on your report, is it from the original creditor or from a collector, what was the date of first default on the original loan, did you pay it in full, etc.? If this is reporting inaccurately, fixing it may help you with your current lending needs, but that $12K credit card chargeoff may keep you shut out of auto lending territory as well.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fastest way to delete a paid auto loan Charge off?

hi hmw tha ks for the info, here the picture...the credit card is still open. Dont know why., and the car i already sold 2 years ago.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fastest way to delete a paid auto loan Charge off?

Once a charge-off is reported, payment of the debt does not negate the fact of that accounting action, and is not basis for deletion of the reporting of the CO.

The paid loan was updated to $0 balance, and appears to be reporting accurately.

Getting the CO removed thus requires their voluntary deletion. You should continue requests for GW deletion.

As for the credit card, you can make then a pay for deletion offer, seeking deletion of the reporting of the CO (or of the entire account) in exchange for your agreement to pay.

The reporting of Open is almost certainly inaccurate, as creditors dont keep severely delinquent accounts that have reached the stage of charge-off Open to further consumer use. That is apparently a simple oversight on their part in not updating the status to Closed.

You can dispute and get it correct to show Closed, but any such dispute will not require any removal of other accurate reporting, such as the CO.

In summary, there is no "fast" way to assure removal of the charge-offs, as that is totally discretionary on the part of the credtiors.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fastest way to delete a paid auto loan Charge off?

Thanks you very much!!