- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Free FICO score from Penfed

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Free FICO score from Penfed

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Free FICO score from Penfed

I logged into my Penfed account today and saw a link saying my "FICO Score is Ready."

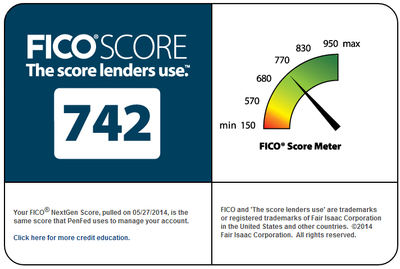

I clicked it, and found the image shown below. It shows a score date of 5-27, which is not a hard pull on my report. I assume it's Equifax; my EQ score on 8-12 was lower, but utilization was higher at that point.

What is even more interesting is they say it is the "Nextgen FICO Score" they use to evaluate my account. I assume that means Penfed is using a FICO Equifax RISK score.. If so, it has little value to me for other apps, but it does tell me when my file is ripe for a Penfed approval! And it gives a little help to any of you applying for credit with Penfed.

Intersting stuff.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Free FICO score from Penfed

Penfed explains the score here, saying:

"There are two general FICO® Scores available through the three major U.S. credit bureaus. The FICO® Risk Score, Classic, is the most commonly used score, though some lenders use the FICO® Risk Score, NextGen."

and, "FICO® Scores most often fall within a 300-850 score range. For the FICO® NextGen Score, the scores will fall within a 150-950 range. Higher FICO® Scores are considered lower risk, and lower FICO® Scores indicate higher risk."

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Free FICO score from Penfed

Discover gets their FICO score from TransUnion. I can't find anywhere that says where PenFed bases theirs on. Is it TransUnion, Equifax, or Experian?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Free FICO score from Penfed

@Anonymous wrote:Discover gets their FICO score from TransUnion. I can't find anywhere that says where PenFed bases theirs on. Is it TransUnion, Equifax, or Experian?

I don't know. My score on there says I'm 742 because of a serious delinquency, but it was pulled back in September, 98 days after the first one they pulled in May. That would be Equifax or Transunion based on the timing. The fact that they use Equifax for their hard pulls makes me think it would be that, but it's hard to say.

I'm disappointed to see that they don't update it quarterly, mine is over 3 months old... If they update in the next 3 months I will be able to tell which it is, as that baddie has fallen off of Eq but not Tu.

Weird that it's the exact same score...

It is good to know what they're looking at; I got membership and their best loan rate in the low 700's with baddies.