- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Gonna do this all over again

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Gonna do this all over again

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Gonna do this all over again

After contemplating BK almost a year ago...........gonna move forward with rebuilding and repairing....

scores are in the low 5's

AAoA - 4yrs 11m

7 inquiries

1 judgement

5 Collections

6 Closed Positive Accounts

Current Score EQ : 726

Current Score (TU Walmart): 676

Goal Score: 750

Take the FICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Gonna do this all over again

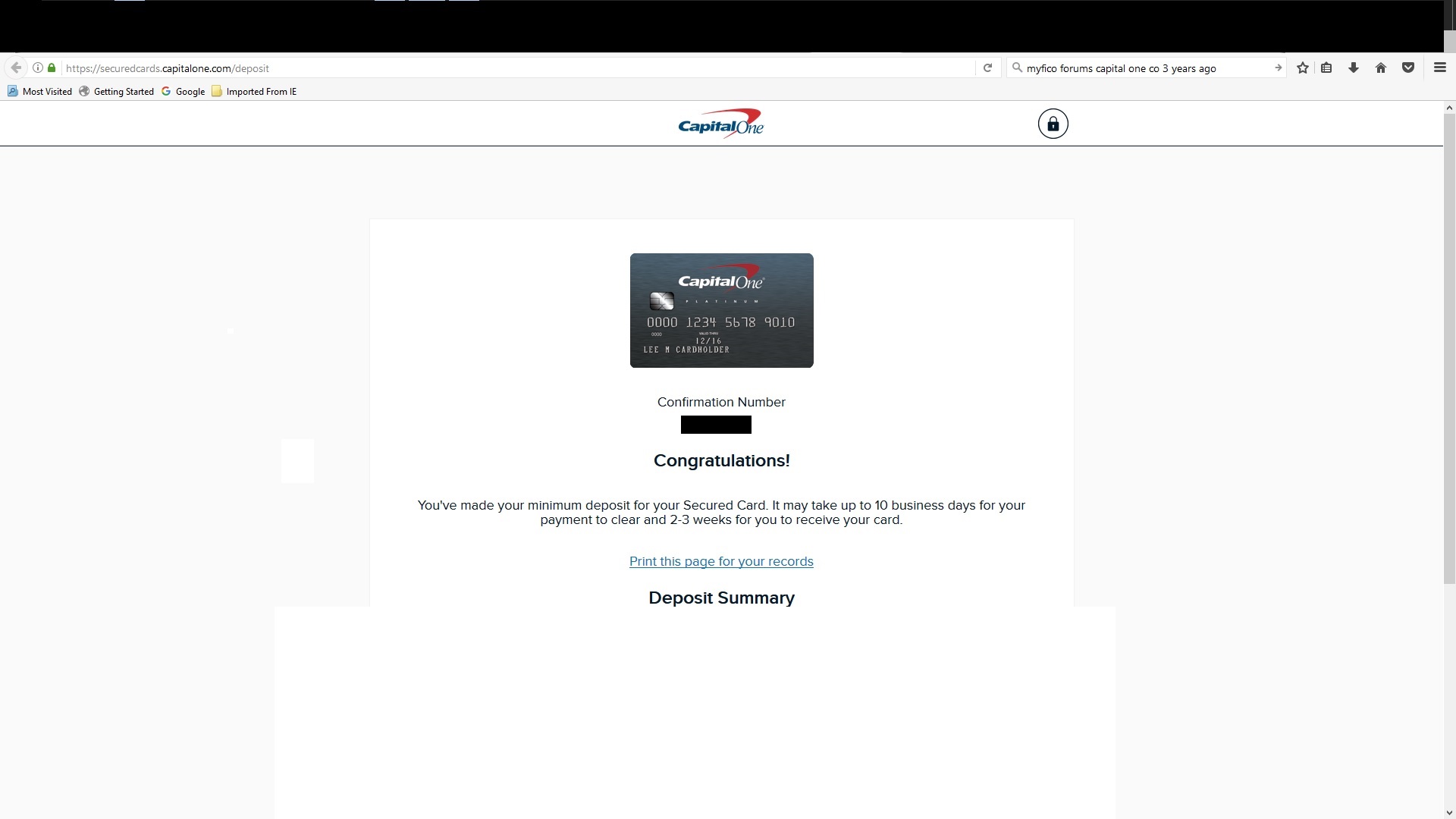

Welcome to rebuilding! Congrats on the Capital One Secured card -- it will be a great rebuilder for you as long as you pay it on time and don't keep a high utilization.

With the current Capital One secured card, you can only raise the deposit amount BEFORE you activate the card, so if you want to put a larger deposit on that CL, don't activate the card. I activated my card on the LAST DAY I could send a bigger deposit, which gave me a few months to max out my deposit amount (helps with utilization if you ever carry a balance over to another month).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Gonna do this all over again

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Gonna do this all over again

@Anonymous wrote:Welcome to rebuilding! Congrats on the Capital One Secured card -- it will be a great rebuilder for you as long as you pay it on time and don't keep a high utilization.

With the current Capital One secured card, you can only raise the deposit amount BEFORE you activate the card, so if you want to put a larger deposit on that CL, don't activate the card. I activated my card on the LAST DAY I could send a bigger deposit, which gave me a few months to max out my deposit amount (helps with utilization if you ever carry a balance over to another month).

That's actually really useful information. I saw that you couldn't raise it, but I assumed that was after the initial deposit. I'll have quite a decent income next month, so I'll have to remember not to activate until then.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Gonna do this all over again

Yep and they have a page for putting additional deposits down and showing you what's been deposited. Really nifty!

I should mention I was approved for the card March 14, 2017 but didn't send my $49 in for the card until late April! They shipped the card well over 10 days after that (early May) and then I started depositing more money beyond the $49 to max it out. After I made my last deposit and the website showed it went from pending to deposited, I activated my card but only showed a $200 credit limit ($49->$200) so I chatted them on web chat and they said the money will show up "about 10 days after you made the deposit".

Here are the dates when I made the deposit, when it showed on my credit limit and when it was actually available to use!

| 5/5/2017 | $800 | $1,000 | 5/13/2017 | 5/14/2017 |

| 5/7 | $1,000 | $2,000 | 5/16/2017 | 5/17/2017 |

| 5/9 | $650 | $2,650 | 5/17/2017 | 5/18/2017 |

| 5/10 | $350 | $3,000 | 5/18/2017 | 5/19/2017 |

So basically I activated the card around the second week of May (May 12th or something) and slowly the credit limit started increasing on the site.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Gonna do this all over again

Good stuff. Thank you for the heads up as I plan on making the additional deposit thanks to ABCD2199's advice.

Current Score EQ : 726

Current Score (TU Walmart): 676

Goal Score: 750

Take the FICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Gonna do this all over again

@Anonymous wrote:Welcome to rebuilding! Congrats on the Capital One Secured card -- it will be a great rebuilder for you as long as you pay it on time and don't keep a high utilization.

With the current Capital One secured card, you can only raise the deposit amount BEFORE you activate the card, so if you want to put a larger deposit on that CL, don't activate the card. I activated my card on the LAST DAY I could send a bigger deposit, which gave me a few months to max out my deposit amount (helps with utilization if you ever carry a balance over to another month).

Not trying to hijack the OP's thread, but I noticed that you, ABCD2199, have secured cards with large amounts, in the thousands of $. Does that mean that you gave the bank, say, $3000 for a $3000-secured card. Just curious how it works.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Gonna do this all over again

Hate to drag this back up...... There is no way to add to secured deposit after account has been opened? Got the card in the mail earlier this week....Ready to open it and get it reporting

Current Score EQ : 726

Current Score (TU Walmart): 676

Goal Score: 750

Take the FICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content