- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- How bad are these late payments affecting my score...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

How bad are these late payments affecting my score?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How bad are these late payments affecting my score?

I havent had any late payments in quite some time, but there are still quite a few lates on my credit. I am going to send GW letters but since there are multiple lates for each creditor, I am not sure what my chances are of getting them removed? If it was just one late payment, It seems more likely... but writing Midland Mortgage and asking them to delete 9 late payments seems alot less likely.

Couple questions.... what are the chances any of these get removed from GW letters? How much are these actually affecting my score? About half these are from 2009 and will be 7 years old next year. And if anyone has any good contact information for any of these to send a GW letter to, i would greatly appreciate it.

1. Late Payments with Citibank/Shell Credit Card (1x30, 1x60, 1x90 back in 2009) - closed

2. Late Payments with Wells Fargo Dealer Services (4x30 back in 2011) - closed

3. Late Payments with Capital One Auto (3x30 back in 2009) - closed

4. Late Payments with Midland Mortgage (9x30 back in 2012-2013... went through divorce, got HAMP modification) - current mortgage

Current FICO 8: 687 EQ, 683 TU, 700 EX

Goal Score: 680

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How bad are these late payments affecting my score?

@ScottL wrote:I havent had any late payments in quite some time, but there are still quite a few lates on my credit. I am going to send GW letters but since there are multiple lates for each creditor, I am not sure what my chances are of getting them removed? If it was just one late payment, It seems more likely... but writing Midland Mortgage and asking them to delete 9 late payments seems alot less likely.

Couple questions.... what are the chances any of these get removed from GW letters? How much are these actually affecting my score? About half these are from 2009 and will be 7 years old next year. And if anyone has any good contact information for any of these to send a GW letter to, i would greatly appreciate it.

1. Late Payments with Citibank/Shell Credit Card (1x30, 1x60, 1x90 back in 2009) - closed

2. Late Payments with Wells Fargo Dealer Services (4x30 back in 2011) - closed

3. Late Payments with Capital One Auto (3x30 back in 2009) - closed

4. Late Payments with Midland Mortgage (9x30 back in 2012-2013... went through divorce, got HAMP modification) - current mortgage

Honestly, the only late that's really impacting you is the 90 day late. 30 - 60 day lates usually have no affect after 4 years but 90+ day lates hurt until they fall off your reports.

At this point, you could GW but you are in year 6 so if you could, just wait til they fall off. With TU, you can dispute as obsolete and get an early removal, generally 6 months before it's scheduled to fall off).

| 769 | 774 | 764 | UTIL: 2% | AAoA: 5yr 8mos | Total Credit Line: $873,950 |

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How bad are these late payments affecting my score?

sent GW letters out today and just received a call from Citibank/Shell and they are going to look into and make a decision and get back to me within a couple days ![]() fingers crossed.

fingers crossed.

Current FICO 8: 687 EQ, 683 TU, 700 EX

Goal Score: 680

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How bad are these late payments affecting my score?

@ScottL wrote:sent GW letters out today and just received a call from Citibank/Shell and they are going to look into and make a decision and get back to me within a couple days

fingers crossed.

Oh cool. I wish you luck.

| 769 | 774 | 764 | UTIL: 2% | AAoA: 5yr 8mos | Total Credit Line: $873,950 |

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How bad are these late payments affecting my score?

lets say that 30/60/90 day (mainly the 90 day) late payments from 2009 get removed. any guesses on how much of an increase i might see? 5-10 points? more?

Current FICO 8: 687 EQ, 683 TU, 700 EX

Goal Score: 680

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How bad are these late payments affecting my score?

@ScottL wrote:lets say that 30/60/90 day (mainly the 90 day) late payments from 2009 get removed. any guesses on how much of an increase i might see? 5-10 points? more?

That varies as to what else is on your report but generally you can expect a 20+ point jump

| 769 | 774 | 764 | UTIL: 2% | AAoA: 5yr 8mos | Total Credit Line: $873,950 |

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How bad are these late payments affecting my score?

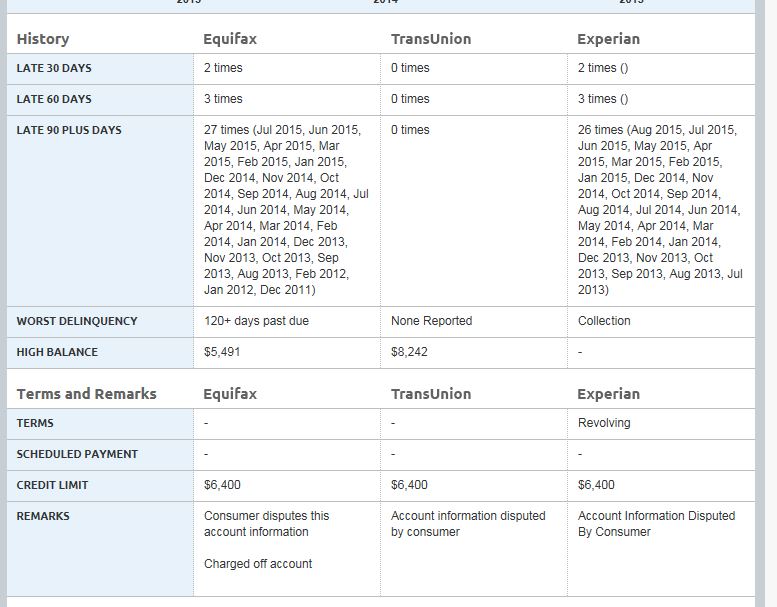

well currently the only badies on my credit are these late payments, along with a collection and a chargeoff. But, i dont know if the chargeoff is reporting correctly or not, but according to my report here on myfico, the chargeoff with Discover says 30 days late once, 60 days late once, and 90 days late 27 times.

Current FICO 8: 687 EQ, 683 TU, 700 EX

Goal Score: 680

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How bad are these late payments affecting my score?

thing is, it says

27 times late on EQ

26 times on EX

and 0 times 30/60/90 times on TU. just says charged off but no lates.

Current FICO 8: 687 EQ, 683 TU, 700 EX

Goal Score: 680

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How bad are these late payments affecting my score?

apparently they are still reporting me late every month? some of the dates it shows as being late are as recent as August 2015 and as old as 2011

Current FICO 8: 687 EQ, 683 TU, 700 EX

Goal Score: 680

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How bad are these late payments affecting my score?

Charged off accounts cannot be late as they have already been written off as a loss. I would dispute that ASAP and see if you can either get it updated to show correctly or removed totally. FCRA 623(a)(1)(a) states that it's illegal to knowingly furnish incorrect data and a "late" payment on a charge off is as incorrect as it gets.