- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- How should I approach this collection?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

How should I approach this collection?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How should I approach this collection?

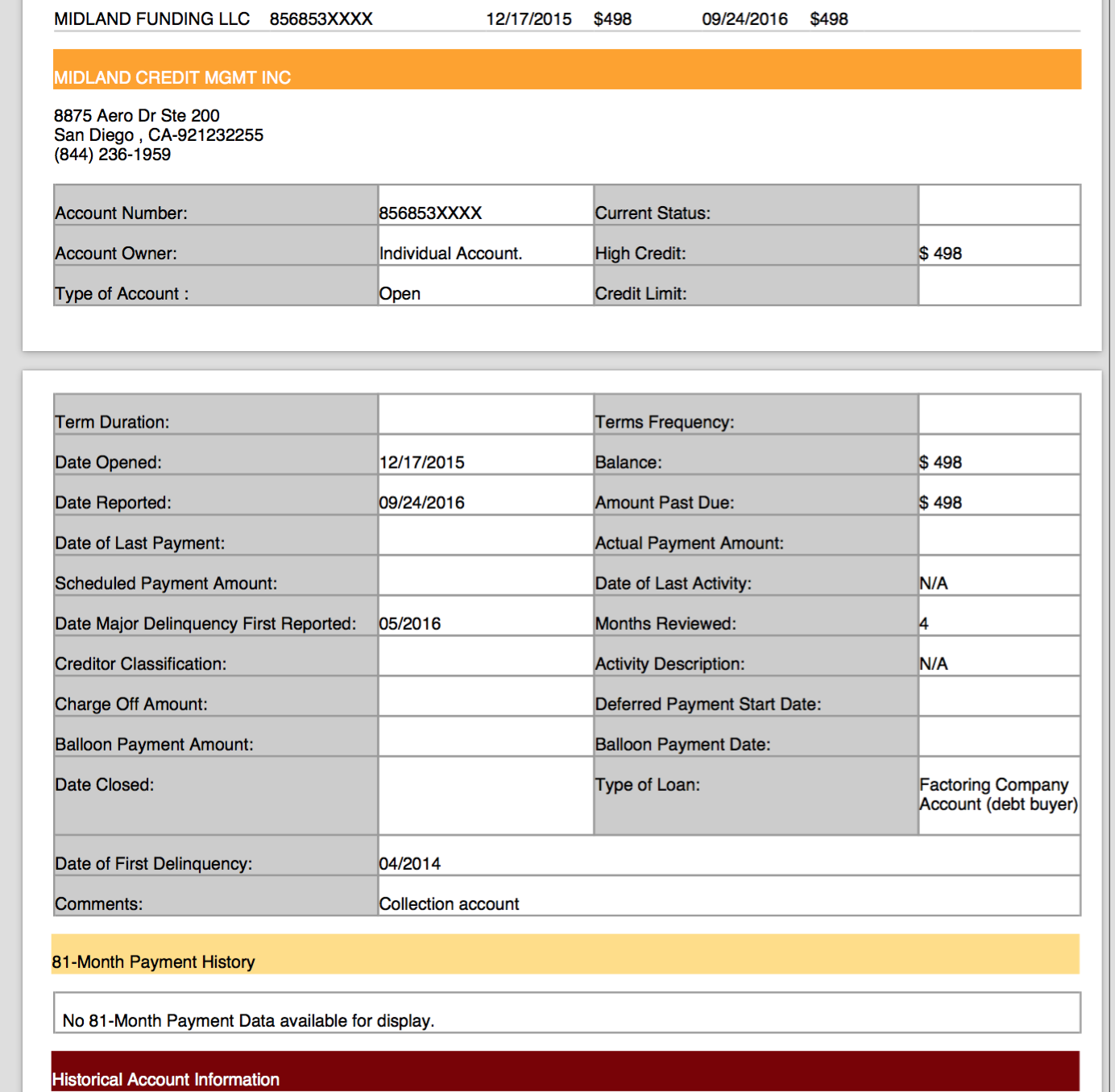

My husband has this collection on his credit report, I have the money to pay it per the settlement letter they have sent, but I am not happy about how it's being reported. It's a collection, but it's not reported under collections on his credit report. It's for an old Cap1 debt that was opened in 2011 and first went past due in July of 2013. However, it's not reporting that way at all. So, should I dispute it t the CRA's? Or should I just go ahead and pay it off? I'm afraid if I dispute it that they will just delete and put it under collections, which I wold assume would hurt his credit score. Is my thinking correct about that? But, I am also worried that if I pay it, they could still delete and rereport it under collections after it is paid. Although, I'm not even sure if that'd be allowed. So, here's a screen capture of how the collection is reporting on his EQ credit report. The debt currently has a balance of $498.30 and if I make a payment by October 28th, they will settle for 40% off. What should I do? I'm really lost, and I've been spending hours upon hours reading the forums but there's so much information that it's hard to find the information to help me make an educated decision as to what I should do. Please help! Thanks so much!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How should I approach this collection?

So now I'm even more confused. The screen capture is fro his free annual credit report from last week from EQ, however, I just looked at Credit Karma for his EQ and the Midland collection is listed under collections.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How should I approach this collection?

Try to negotiate a pay for delete. If you just pay it off it will may remain as a collection account for 7 years, albeit with a slightly better status, I believe.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How should I approach this collection?

After it was past due in 2013 was it ever brought current? If not the DOFD in 2014 is inaccurate and you should try disputing on that.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How should I approach this collection?

No, it's wasn't ever brought current after that. We were making payments, but they were never enough to bring it current.

How does one go about disputing this?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How should I approach this collection?

@GiveJoy wrote:No, it's wasn't ever brought current after that. We were making payments, but they were never enough to bring it current.

How does one go about disputing this?

First off - what does Cap Ones listing for the account show for the DoFD?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How should I approach this collection?

@Anonymous wrote:

@GiveJoy wrote:No, it's wasn't ever brought current after that. We were making payments, but they were never enough to bring it current.

How does one go about disputing this?

First off - what does Cap Ones listing for the account show for the DoFD?

04/2014

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How should I approach this collection?

@Anonymous wrote:

@GiveJoy wrote:No, it's wasn't ever brought current after that. We were making payments, but they were never enough to bring it current.

How does one go about disputing this?

First off - what does Cap Ones listing for the account show for the DoFD?

04/2014

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How should I approach this collection?

I would first try to get Cap One to adjust their reported DoFD to what you believe to be the correct DoFD. They may argue that your partial payments made during the delinquency period reduced the level of delinquency and effectively moved the DoFD up - RobertEG may be able shed some light on whether that is legit or not.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How should I approach this collection?

If you research the forum, you will see that this is a common and recurring reporting problem with Midland.

They will often report their collection for accounts they have purchased as being an installment account with the consumer.

They refer to it being a "collection" by way of a comment, but many commercial credit reports will fail to place the collection under their normal "Collections" heading when formatting their credit reports.

You can file a dispute with the CRA of the accuracy of their reporting of their collection as a loan with the consumer.

Midland will respond that their status as a debt buyer makes it accurate reporting.

The CRA routinely accepts that verification by Midland, and does not correct their reporting, so your dispute is not likely to result in CRA correction, but it is a necessary first step.

The next step is to then file a complaint with the CFPB over their reporting of a loan with the consumer.

While this has been a common an recurring issue, the CFPB has not, to my knowledge, yet taken a formal position compelling Midland to cease this practice.