- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- How to boost score with AEZO?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

How to boost score with AEZO?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to boost score with AEZO?

Hi everyone. I need some help again. Here is the situation. I have to capital one credit cards. My due date is every 3rd of the month and statement cuts on every 6th of the month. I wanted to know how should I approach this as far as how much to pay and when every single month? Off course I won't have these high balances once I pay it off. Thanks for your help in advance.

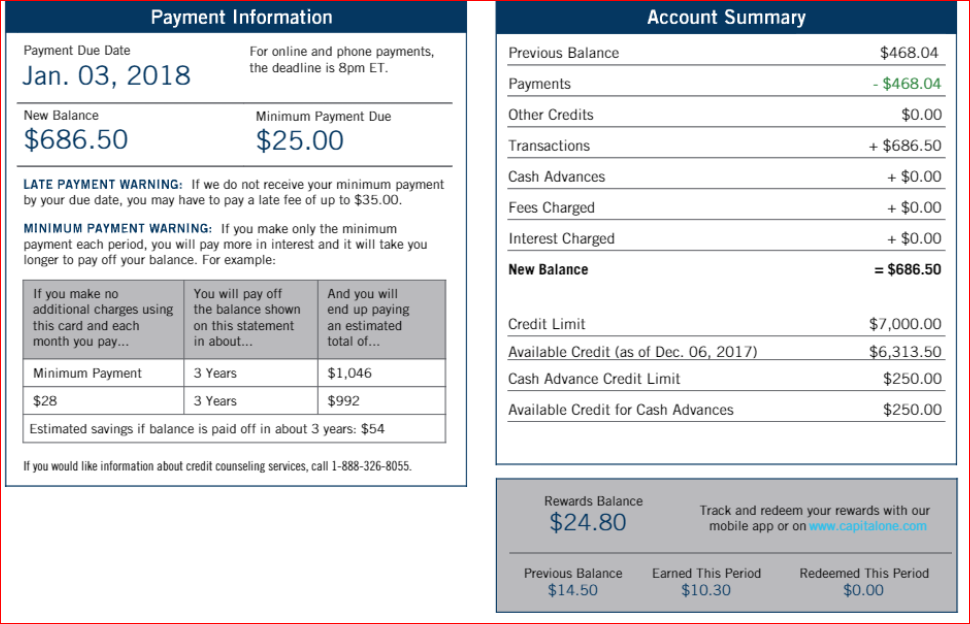

Credit Limit $7000, current balance is $2260.

Credit Limit $3000, current balance is $1985.00

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to boost score with AEZO?

The due date is when you have to make your minimum payment as dictated by your PRIOR statement date. If you don't pay the PRIOR statement balance in full before the due date, you will get interest posting on the NEXT statement date.

So the first question is what was the PREVIOUS statement balance on each of these? If you want to avoid interest, pay that amount before the DUE DATE.

If you want to maximize FICO scoring, you want to let $623 or less report on the $7000 card, and $0 to report on the $3000 card.

Note that if you are going to get charged any interest on the $7000 card, your balance reporting should be ($623-interest that you know will post) on the statement date.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to boost score with AEZO?

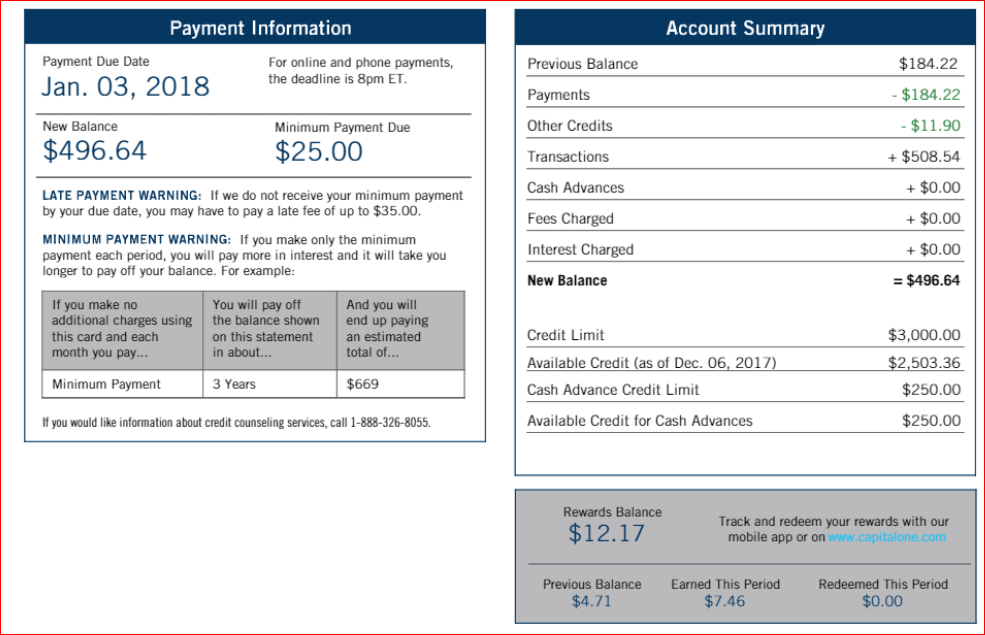

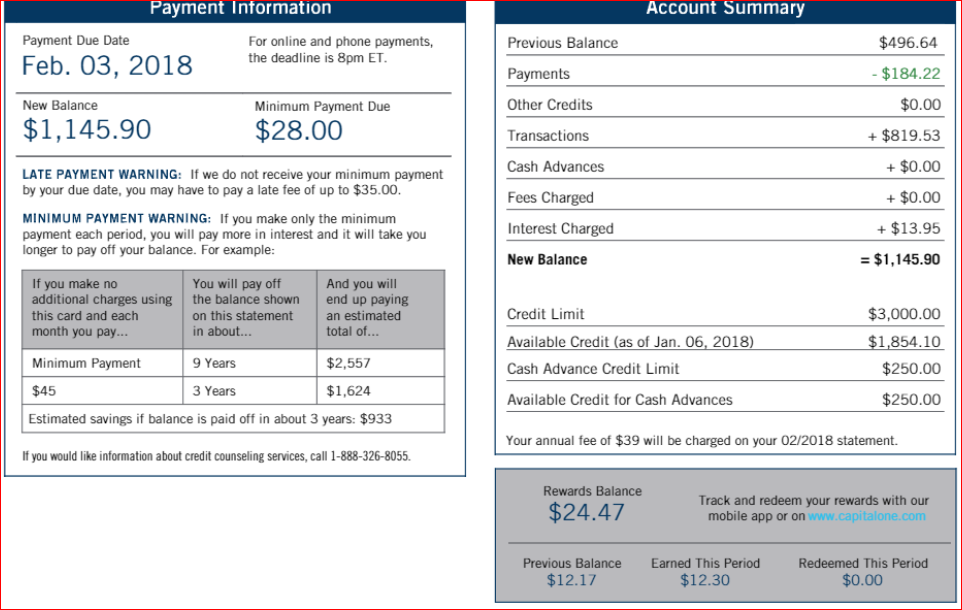

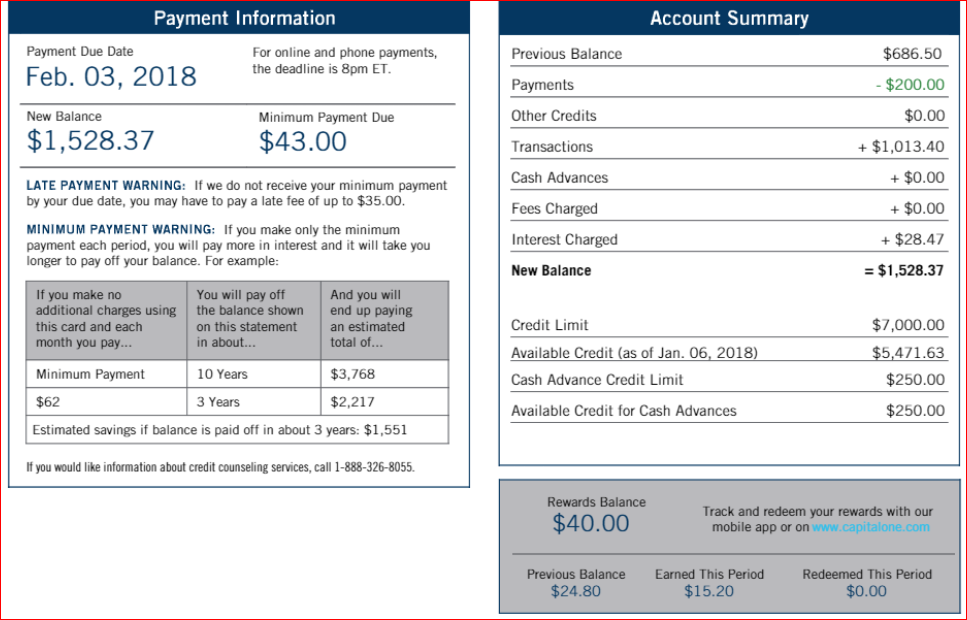

here are the screen shot for both accounts.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to boost score with AEZO?

Images are tough for me to go through because I'm on mobile but I'll look this over shortly and see what I can write down on a napkin.

But if you want to maximize AZEO, just pay one card to $0 before statement balance posts and the other card to 8% or less before the statement balance posts. You don't want $0 on both cards, you want one card at $0 and the other card at $5->8% range. If you have interest posting on your balance card, pay it down to 5% at statement date so you're safe from interest posting and throwing you over 8.9%.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to boost score with AEZO?

ok. Thanks for the response.

So, for $3000 limit, the balance on last statements is $1145.90

for $7000 limit, the balace on the last statements is $1528.37.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to boost score with AEZO?

That means to avoid interest on both of those, you want to pay AT LEAST that much before the due date.

If you want to maximize AZEO, pay those balances BEFORE the due date but then pay the remaining balances down to $0 on one card and < 8.9% on the other -- before statement date.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to boost score with AEZO?

thanks again. So, let's say i pay $200 on each card before due date, will that bring down my credit score. Because, I have direct deposit coming on the 4th feb, then i ll be able to pay everything in full.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to boost score with AEZO?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to boost score with AEZO?

How I do it is:

Every payday I pay off all balances except one that I leave under 8.9% util. Not sure if I am actually achieving AZEO or not, but probably pretty close. Rarely do I every have anything but zero on minimum payment due when my statements cut.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to boost score with AEZO?

Possibly if she has no other installment loans it will lower her scores and it could be significant but if she has other installment loans and the percent of utilization is considerably lower than the auto loan it could raise it slightly.

wrote:

One more question. My wife has a auto loan and the balance os about $11000.00. I m able to pay the entire amount. If i pay the entire amount, will it have any impact on her score? Thanks.