- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- I feel like I was just kicked in the gut!!!

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

I feel like I was just kicked in the gut!!!

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I feel like I was just kicked in the gut!!!

I know someone on here will make me feel better, but I just checked my EQ report, and my final CA which was in dispute, has been removed! Thats the good part, but the bad part is it must have lowered my AAoA, becuase my score just dropped 27 pts!! The account was over 7 years old I know they will recover, but WOW! That was a shocker!

Ive seem my numbers range up and down on all 3 CR's a few points but myfico scores are WAY better (EX - 600 , EQ - 615 , TU 625), so Im figuring that must be the culprit as my util has actually decreased since I pulled them previously! I pulled a myfico full report last night to see how things were progressing and I was actually feeling good about them. I know I've read all over when rebulding, make sure you are paying more attention to whats IN your report, keep util to 0 and 1 account report to 9%, pay before statement cuts, etc but this REALLY hurt. Someone please tell me I will recover from this as I am heartbroken. The same items have been removed off TU and EX without that drastic of a drop? Can someone explain how quickly I will recover?

NFCU Plat Visa 15,000 | NFCU Cash rewards 15,000 | Lowes 7500 | Fingerhut 1100 | Amazon Store Card 1,500 | Discover IT 1300 | CAP 1 Qsilver 1300 | JC Pennys 1500 | Dressbarn 1100 | Walmart 2500 | Kays Jewelers 500} Mattress One 4500 \ Ashley Furniture 1500 \ American Home Furnishing 2000

Loans:

NFCU Auto 30,000 | NFCU Nav check 15,000 | NFCU Debt Cons 4100 |

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I feel like I was just kicked in the gut!!!

REALISTICLYSPEAKING2014 wrote: I know someone on here will make me feel better, but I just checked my EQ report, and my final CA which was in dispute, has been removed! Thats the good part, but the bad part is it must have lowered my AAoA, becuase my score just dropped 27 pts!!

Bummer. You might take a closer look to see if there is any other difference on your report. How does your Utilization % look on your cards?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I feel like I was just kicked in the gut!!!

Most of my accounts (9 total)are relatively new - (6-8 months) and are high (63%) at the moment, but I monitor VERY closly and I have actually decreased UTIL on 2 of my accounts and had 1 new amazon open but its only reporting $10.00 right now? I plan to have all paid within 6 weeks to zero with one remining at 9 % which is my NFCU Plat Visa. Could the new tradeline be a factor?

NFCU Plat Visa 15,000 | NFCU Cash rewards 15,000 | Lowes 7500 | Fingerhut 1100 | Amazon Store Card 1,500 | Discover IT 1300 | CAP 1 Qsilver 1300 | JC Pennys 1500 | Dressbarn 1100 | Walmart 2500 | Kays Jewelers 500} Mattress One 4500 \ Ashley Furniture 1500 \ American Home Furnishing 2000

Loans:

NFCU Auto 30,000 | NFCU Nav check 15,000 | NFCU Debt Cons 4100 |

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I feel like I was just kicked in the gut!!!

When a final CA is removed, you are moved into a different FICO bucket and this often causes a fall in FICO. The good news is that you will recover more quickly and should see good rises in score shortly.

Current Score: EQ:703 TU: 729 EX:737

Goal Score: 750

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I feel like I was just kicked in the gut!!!

@REALISTICLYSPEAKING2014 wrote:Most of my accounts (9 total)are relatively new - (6-8 months) and are high (63%) at the moment, but I monitor VERY closly and I have actually decreased UTIL on 2 of my accounts and had 1 new amazon open but its only reporting $10.00 right now? I plan to have all paid within 6 weeks to zero with one remining at 9 % which is my NFCU Plat Visa. Could the new tradeline be a factor?

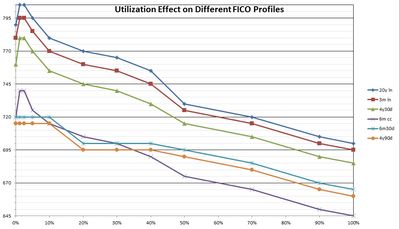

Yes, a new tradeline will affect your score. As will the inquiry that came with it. And I can just about guarantee that the UTIL is a huge factor. Probably more now that your file is thinner.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I feel like I was just kicked in the gut!!!

Thanks all for the feedback - I should expect a dramatic score once the utilization is down as well as the TL aging correct? I know that it is a uphill battle trying to rebuild and I appreciate the encouragement from all! How long does it take the new accounts to age? I have read 1 year , 2 years and I understand the longer they remain positive and open that my scores will continue to flourish![]()

I bought the monthly scorewatch here on Myfico and havent seen that move a bit, but the Fico score on equifax is scary low![]() I dont even want to look at it again...Takes me back to where I almost started....Why is it at 530 when myfico is at 600? I know they are different scoring models, but geesh...give a girl a break! Most posts I have read here say that their EQ score is alsways higher than the Myfico version?

I dont even want to look at it again...Takes me back to where I almost started....Why is it at 530 when myfico is at 600? I know they are different scoring models, but geesh...give a girl a break! Most posts I have read here say that their EQ score is alsways higher than the Myfico version?

NFCU Plat Visa 15,000 | NFCU Cash rewards 15,000 | Lowes 7500 | Fingerhut 1100 | Amazon Store Card 1,500 | Discover IT 1300 | CAP 1 Qsilver 1300 | JC Pennys 1500 | Dressbarn 1100 | Walmart 2500 | Kays Jewelers 500} Mattress One 4500 \ Ashley Furniture 1500 \ American Home Furnishing 2000

Loans:

NFCU Auto 30,000 | NFCU Nav check 15,000 | NFCU Debt Cons 4100 |

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I feel like I was just kicked in the gut!!!

A cleaner report will allow your score to grow better. Congrats!

July 2013 score: EQ FICO 819, TU08 778, EX "806 lender pull 07/26/2013

Goal Score: All Scores 760+, Newest goal 800+

Take the myFICO Fitness Challenge

Current scores after adding $81K in CLs and 2 new cars since July 2013

EQ:809 TU 777 EX 790 Now it's just garden time!

June 2017 update: All scores over 820, just pure gardening now.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I feel like I was just kicked in the gut!!!

REALISTICLYSPEAKING2014 wrote:...the Fico score on equifax is scary low...Why is it at 530 when myfico is at 600?

Be sure to take a look at Credit Scoring 101 if you need help unsderstanding the different scores. If you got a score from EQ, it might not be a FICO score. Check your paperwork to see if it says FICO or if it is a different score model.

The Equifax website says "Equifax 3-Bureau credit scores are based on an Equifax Score model and not the same score used by 3rd parties to assess your creditworthiness."

In other words, their number is an Estimate. Not a real FICO score.

As far as your FICO score, you need to do a better job managing your utilization. That will help. Try to only use one card at a time, and pay it in full every month.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I feel like I was just kicked in the gut!!!

@Shogun wrote:A cleaner report will allow your score to grow better. Congrats!

This x 100.

Also TIME will help. That has actually been my biggest score booster over the past year after getting pretty much everything that I could resolved done I just focused on paying everything on time, not applying for anything, and gardening my best card. Remember, your scores will take a roller coaster ride while rebuilding. Don't let that distract you.

NFCU Cash Rewards $14K | Chase Sapphire Preferred $5K | Amex Blue Cash Preferred $6K | Cap1 Quicksilver One Visa $9K