- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- I've neglected my scores long enough. Now how can ...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

I've neglected my scores long enough. Now how can I improve them?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I've neglected my scores long enough. Now how can I improve them?

Might not have been the most irresponsible thing I've ever done, but boy is it up there. Made some mistakes, missed payments and wound up in collections for some accounts a few years back. Paid them in full/at a lesser amount to close out the account when it got to that point. I am not a smart man.

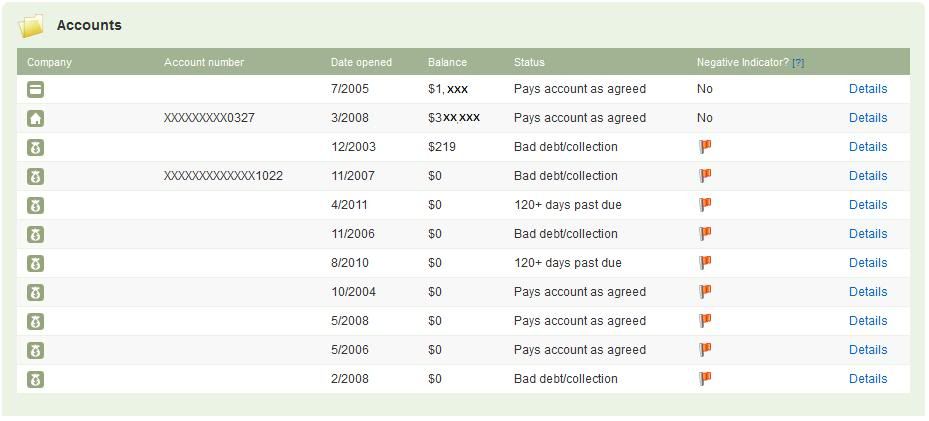

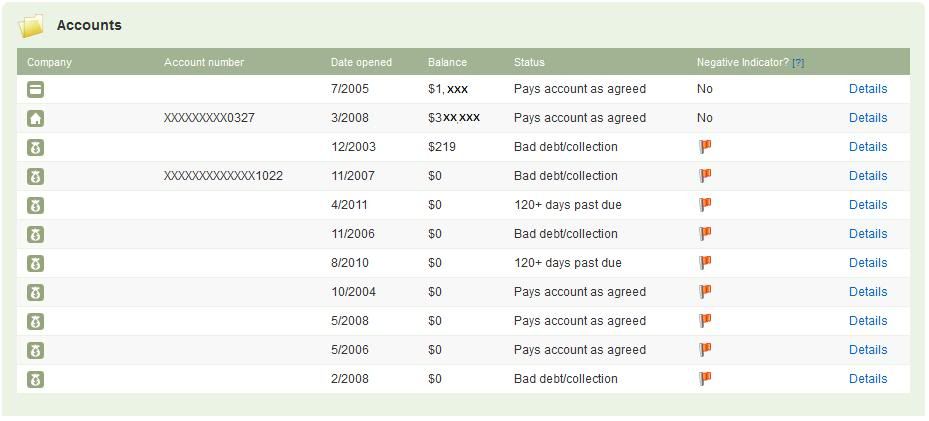

Take a peek at the pics below. Only had two inquiries on my EF in the past 2 months (thought about getting a card from an appliance store when getting new appliances for the new kitchen, got turned down so paid in full. The last inquiry was from my CU when I tried to get a new car loan a few days ago. Declined. Now I know why) No inquiries on my TU report.

Pay the Amex Gold Rewards Plus card in full every month, between $1K and $2K for the past 7+ years.

Pay the mortgage on time every month, $2600.

Would love to know what I can do about improving these scores and a reasonable amount of time to think to elapse before I can try for an auto loan. The Saturn is on its last legs and I have to get something new soon. Have about $5K available to put down on a $25K loan.

Thank you,

mrorange

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I've neglected my scores long enough. Now how can I improve them?

If it were me, I would start with sending a pay-for-deletion letter to the unpaid collection account you have, and goodwill letters to all the other paid derogative accounts

Here's a couple of threads that could be useful to you, it has samples of other members' GW letter

GW letter Q&A, Examples, and GW Success Stories

Hope it helps

Current Score: TU08: 741

Goal Score: Stay in the 700s; keep reports clean

Take the FICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I've neglected my scores long enough. Now how can I improve them?

Thank you Guava. I'm still going through my reports and found that two of the entries on the EF report are CAs to match up with two of the OCs (Entry #3 Verizon for $219 and Entry #7 dated 8/2010 showing 120+ past due, then Entry #5 dated 4*/2011 showing 120+ past due and Entry #6 dated 11/2006 showing bad debt/collection)

First step I am considering:

- phone call to Verizon to ask about why they are reporting the $219 balance if I settled it with the CA already

- or do I call the CA to try to clean up the 120+past due?

- or would a straight PFD letter to Verizon and/or the CA suffice?

Second step I am considering:

- sending a GW letter to the OC after paying off the debt in Entry #4. Everything was paid in full in 6/2011, but when I look at the payment history I see two late payments from 9/2011 and 10/2011. Thats puzzling.

Your help is greatly appreciated, and any addiotnal guidance that can be offered is welcome!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I've neglected my scores long enough. Now how can I improve them?

Step 1) I sent a PFD off to the CA for my Verizon/$219 balance. Hoping to kill both birds with one stone.

Step 2) I sent a GW letter to the OC on Entry #4

Step 3) not pictured I'm going to try for a small limit Orchard Bank card. Watching my utilization to keep it between 5-15% and keep a small balance of between 5-10% each month.

Any other suggestions to reduce the number of red flags on these reports?

Thank you!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I've neglected my scores long enough. Now how can I improve them?

I would also ask the crediitors who on 4/2011 and 08/2010 are reporting you late with a zero balance. I would investigate that as well.

Discover 09/90 19,000, JCPenney 10/2008 4,700 US Bank Cash 12,000 Citibank Custom Cash 5/2015 11,100 State Dept. FCU 15,000 06/2023 , 02/2024 Redstone FCU Signature VISA 10,000 Banking: Ally Bank Credit Unions: Lafayette FCU Fortera FCU State Department FCU Pelican CU

Pelican State CU Redstone FCU

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I've neglected my scores long enough. Now how can I improve them?

Thank you Andy.

The creditor on 8/2010 is AFNI, and they are the CA for the $219 Verizon balance. No word yet from AFNI on the PFD sent earlier this week.

The creditor on 4/2011 is MidlandMCM, and they are the CA for Chase/CC (entry #6 dated 11/06)

Should I send my GW request to MidlandMCM first, as I paid them for the debt to my OC after it went to collections.

Thank you

mrorange