- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Re: Interesting Credit Reporting Snafu - Disputabl...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Interesting Credit Reporting Snafu - Disputable?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Interesting Credit Reporting Snafu - Disputable?

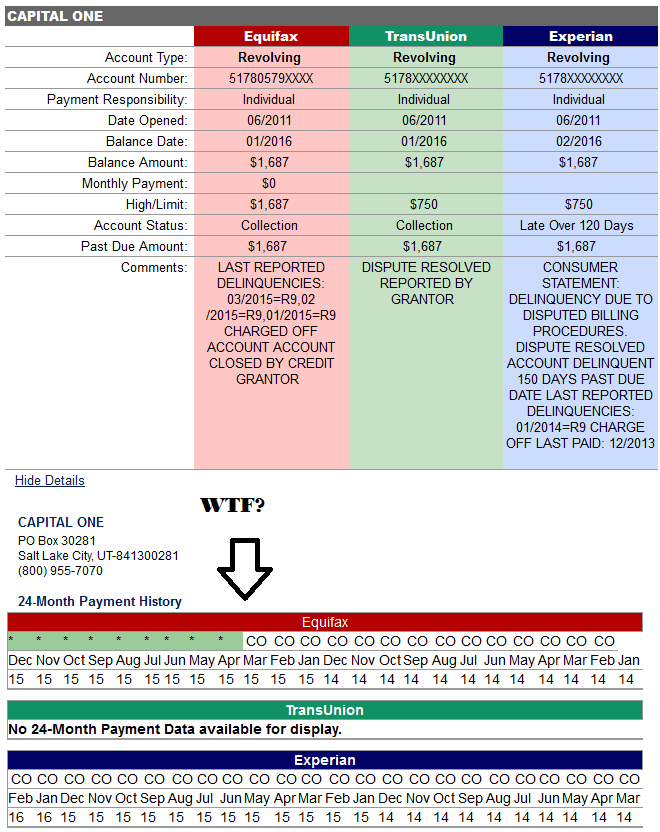

I ordered my trimerge from Equifax.

Looking things over, I noticed several of my chargeoffs are being reported as chargeoffs BUT under the 24-month payment history, there are accounts being stated as 'paid as agreed' for 3, 5 even 9 months! (by Equifax).

Obviously this is pretty misleading. A creditor may say, "He's got a chargeoff and is making imaginary payments that aren't being posted".

Should I dispute this directly with EQ, or do I take this to CFPB and tell them they're misleading myself and creditors? Do I hire an attorney and drag their a-- through litigation, maybe get a fat paycheck? Or is this just some glitch that will fix itself?

For your amusement, I included a screen shot of Capital One, which according to Equifax I have been paying judiciously for 9 months.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Interesting Credit Reporting Snafu - Disputable?

My 2 cents here: I would only dispute it if the incorrect data is having a negative impact on my credit and I expect to get some relief by disputing it.

I kinda doubt you would get a settlement check for this, more than likely Equifax will ask the creditor to validate their info within 30 days and you may end up getting stuck with attorney's fees. You can always call an attorney and get a free consultation and see what they say?

Best of luck!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Interesting Credit Reporting Snafu - Disputable?

It is common for commerical credit reports to show a green box under payment history if the furnisher did not make a reporting for that month.

It does not necessarily signify that the creditor made an actual reporting that any payment was made, or that the debt was now no longer delnquent, but was paid or paying as agreed. Creditor s often cease updatied reporting by adding new delinquencies after a CO.

They could continue to do so, and thus a dispute may have the opposite of the intended effect.... they mght add more monthly delinquencies, and continue to do so.

The furnisher can always, in investigation of any dispute, simply correct any inaccuracy. Even had they reported inaccurately, that is not per se a violation of the FCRA unless it is shown that they actually reported inaccurate informatin with the knowledge, at the time of their reporting, of the inaccuracy.

Finally, as for bringing legal action and receiving a big payout for an inaccuracy, a consumer has no right to bring their own private action for inaccurate reporting.

They must first file a dispute with the CRA, thus obtaining an investigation by the furnisher, and a determination of accuracy or corrrection by the furnisher.

It is only that investigation for which a consuemr can bring legal action, asserting lack of a reasonable investigation, and not for the assertion of inaccurate reporting per se.

If you have an legit case wherein they actually did report incorrect information, you would first need to obtain a verification by the furnisher based on their having conducted an investigation of the assertion of inaccuracy. That has not yet ocured, so you must first determine whether they would verify the information as shown in the report before you would have any basis for legal action.

I would suspect that they will respond by stating that they nvever reported paid or pays as agreed for the months shaded green in your credit report.

They can legitimately cease to update their reporting after reporting of the CO. That would not be inaccurate repoting, let alone knowingly false reporting.