- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Long Road

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Long Road

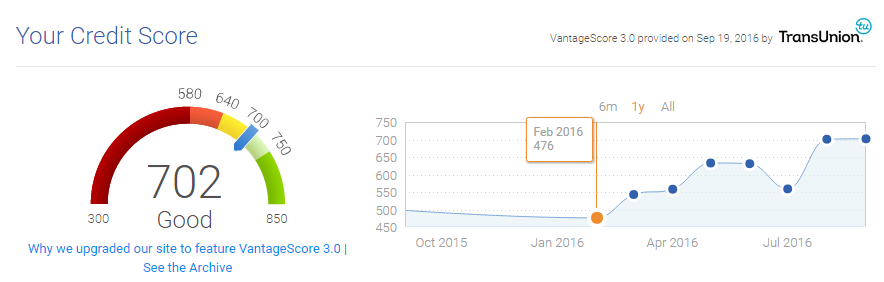

It has been an amazing journey from rebuilding my credit to where it is at right now. I started out with a 476 earlier this year and told myself that i needed to do something about it. I paid off EVERYTHING that i owed and hired up LL to get my items deleted.

Everything is deleted except for verizon [go figure] and USAA [Only deleted from 1 credit beurau so far, trying to get the other 2 removed]

My score is at a 702, good, but not perfect....... I am a perfectionist and i would love to be in the 775 range, how do i go about this?

I have a capital one credit card [$300] completely paid, I have a care credit card completely paid [$2500]

My credit just seemd to be at a standstill right now, no car loan, no home mortgage.... opinions?

Thanks in advance.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Long Road

Lol seriously nice job and great goal I hope you hit it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Long Road

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Long Road

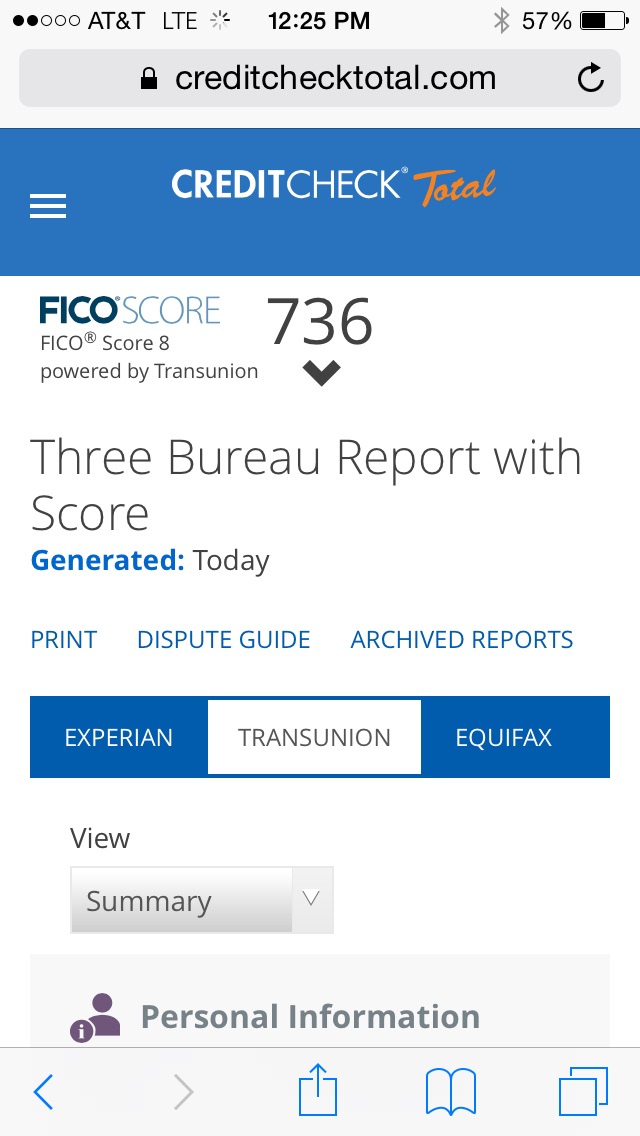

That looks like a Credit Karma score... make sure to get a real Fico score (through myfico or Credit Check Total).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Long Road

My EX and EQ are both at 610-613

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Long Road

What's still on your EX/EQ that are keeping you in the 610-613 range? Depending on where you are app'ing will affect which score they will pull and possibly decline.

i started my clean up at about 500 credit score 8 months ago and am up about 670-675-693.

I started with a $1k cap1 secured. 6 months later app'ed for QS1 and a platinum at 500 a piece. CLI to 1500(platinum) and and 2k(QS1). Just PC'ed platinum to regular quicksilver. Doing one more CLI with QS1 before I consolidate with QS. Will be closing out the secured this month. PIF cards every month. Cap 1 is a rebuilders friend. Check their prequal site for offers with a SP before you HP. Cap1 pulls TU.

i also got got a toy card with finger hut for $900. It's a POS, but it helped. Closing it now and just opened a VS store card for $500 with a SP SCT to keep one retail card open and that I will actually use.

Opened an account with a CU this week took one hard hit but did get a loan approval for 10k (which I needed) against a 1 year old car (that I had to pay cash for when no one would touch me) at 2.99% as a cash out refi and a CC with $1.5K limit and rewards. If you can't get an approval you can always get a small loan secured by a CD. Point of that is get in with a CU, they are usually willing to manually underwrite. I wasn't even asked for proof of income and I am self employed.

what is hurting me now my AAoA is really low but I figure I have only one more move which I will do in February and then I am off to garden for a while.

Good credit mix, paying things on time and just time itself.

I say all this b/c it takes a bit of work and a lot of help from the fellow ficoers.

Current Scores: October 2017 EQ: 715 TU: 710 EX: 716

In My Wallet:

Cap1 QS: $4.8K - AMEX BCP: $4.2K - Old Navy Visa: $7K - Nordstrom $3.8K - VS $500 (FTW!)

BofA AU: $12K AMEX AU: $25K

Business: AMEX BCP $15K

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Long Road

Congratulations. I was wondering if you could comment on your experience with LL? I used Skyblue in the past with negative results. They did refund me however. I guess I don't even know what LL does for you? goodwill letters? Dispute?

Thanks and congrats again.