- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Making progress on my BF's rebuild.

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Making progress on my BF's rebuild.

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Making progress on my BF's rebuild.

Update from post on 5/25/17

My boyfriend literally has 5 items on his credit report:

- 1 - closed/never late auto loan that will report until 11/2024

1 - Verizon collection for $2174(removed on 7/17/17 from TU, still reporting on EQ, dispute pending)1 - TMobile collection for $2400 (account he opened for his brother)As of 6/27 - this is only showing on TU. 7/17 - deleted from all 3 CRAS.1 - DirectTV (Convergent) collection for $890 (unreturned equipment) on EQEXonly.(deleted 9/2017)1 - car loan account repossession but was paid in full(6/27 update: balance now shows paid, it didn't before. 7/17 - deleted from all 3 CRAs)- 7/5 Update: In addition to the car loan, he also had a civil judgment reporting for $2500 (the balance of the car loan) which was removed today.

I have disputed the Verizon, TMobile and DirectTV. His Experian Fico8 is 496 via Credit Check Total. I set up an $1100 Selflender secured 1-year installment loan (first payment due 7/15) and set up a $300 secured Discover IT.

06/26 - We received the Discover cards and added me as an authorized user (I filed BK7 and am awaiting discharge). Based on the packet we received it said his FICO was 610 (Vantage score maybe?). Per Credit Check Total, today his Experian FICO is 504 (TMobile collection dropped off). No score reporting for TU or EQ. The Discover Card account isn't yet reporting - hopefully we'll see a boost in his score once it and the installment loan starts reporting.

He was declined for Capital One secured and unsecured. Denied for Credit One and First Premier (which may be a blessing in disguise).

Opened a Fingerhut account and made the first purchase - waiting for the bill to cut so we can pay it off. This account isn't yet reporting either.

It's been just over 30 days and we haven't heard back on any of the other disputes.

Trying to get him a 3rd revolving account to report. Once the loan, Fingerhut and Discover start reporting, I think I'll try again with Capital One (I didn't recon because we didn't want to put up more cash for a secured card as we're also trying to build an emergency fund).

I'm very excited about his progress and am trying to get his FICO to over 650 within the next 7 months or so to make him a viable candidate to have his Discover become unsecured!! Wish us luck!

07/05 - Some good news to report! This morning, I checked CreditCheckTotal and 1) my boyfriend's civil judgment has dropped off of all 3 bureaus and 2) his FICO jumped to 562. The Discover card is reporting but not the SelfLender loan or the Fingerhut account.

On June 30th, after the T-Mobile collection fell off, I applied for the Credit One card again and he was approved for an unsecured limit of $300. So this will be his 3rd revolving account.

So now he has the following:

Discover IT (secured) | $300

CreditOne (unsecured) | $300

Fingerhut | $180

Selflender Loan | $1100

So in less than 60 days, his FICO went from 496 to 562! Thank you all for the advice and suggestions!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Making progress on my BF's rebuild.

Good progress so far. OpenSky offers secured with no credit check

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Making progress on my BF's rebuild.

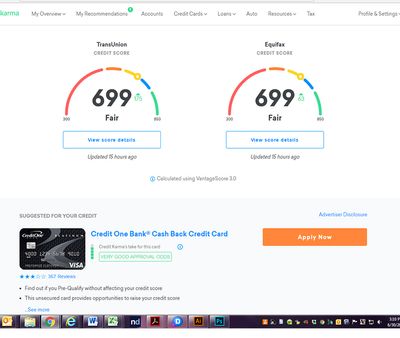

Trying not to obsess but can't help it! Checked CreditKarma today and my BF's CK scores went up to 699 for both TU and EQ!

While I know these are not legit - it's nice to see that the one baddie fell off of his credit report and is reporting! I'm waiting for the Credit Check Total site to reset - 4 more days - for his actual FICO scores.

Based on CK's referral of "very good approval odds" for a Credit One card, I applied again today and he was approved for a $300 limit!! Also, we spoke to DirectTV and will be returning the equipment this weekend (we still have it, just were lazy) and they said once they receive the equipment, they'll remove the delinquency.

So now he's got his 3 revolving and 1 installment accounts:

Discover - $300 limit ($50 balance, will pay down to $10 before statement cuts)

Fingerhut - $180 limit (paid in full)

Credit One - $300 limit (new)

Selflender Installment - $1100

Baby steps, baby steps. Thank you guys for all the advice and I'm hoping this is setting him up to have a nice limit when the Discover becomes unsecured.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Making progress on my BF's rebuild.

Congrats on the rebuild. Just remember, time is your friend. let his new accounts age and show some positive payment history. You don't want lose points for opening too many new accounts with a thin file. Best of luck in the disputes!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Making progress on my BF's rebuild.

Gdale6 - Thanks for the suggestion - I was trying to not have to put up more money for another secured card. If we didn't get the Credit One approval, that would have been my next step.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Making progress on my BF's rebuild.

@Gidget - Thank you. It's nice to see such immediate progress as it keeps us motivated.

We're done applying for new accounts and plan to only use the Discover. Charge to 30%, pay down to $10 before the statement cuts and pay in full. (I think I read on here that the statement should cut at 1% or at least $10 to optimize credit score) Rinse and repeat.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Making progress on my BF's rebuild.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Making progress on my BF's rebuild.

Thanks @rmduhon - I've been reading about all the fees! I am also added as an authorized user so there is an additional $19 fee (!).

After thinking it through, I'll probably pay the Discover down to 0 so as to not be over 30% utilization when the Credit One card is mailed, especially since Fingerhut is not yet reporting, just to be on the safe side.

I've already calendared May of 2017 to cancel the card after one year.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Making progress on my BF's rebuild.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Making progress on my BF's rebuild.

Got it, thanks!