- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Re: Maxed out cards

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Maxed out cards

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Maxed out cards

@xiownthisplacex wrote:

- $9,000 15.49%

- $9,500 15.74%

- 4,500 13.74%

- 14,750 8.9%

- 4,800 13.49%

- 3,000 14.74%

- 7,800 18.24%

- 3,000 17.74%

Those are my rough balances, it's actually 8 cards not 7 like I mentioned in the first post.

I have just submitted all the docs (DL and paystubs) to Payoff for final approval.

The $14,750 is my lowest APR card of only 8.9%. I should payoff the higher APR cards first with this loan right?

How much money do you have to put toward each of these cards per month? How much is your payoff loan payment estimated to be?

My estimation of your minimum payments is this:

1. $210

2. $225

3. $90

4. $250

5. $100

6. $65

7. $200

8. $75

______

$1215/mo

In 3 months, without adding any other spend to the cards, each would cost about this in interest:

1. $375

2. $380

3. $150

4. $330

5. $165

6. $140

7. $365

8. $210

So as you can see, even though #4 has the lowest interest rate, it is going to cost you nearly as much as some of the smaller ones to make the minimum payment on.

So depending on how much money you have to pay each month towards these, the strategy would be different, because keeping yourself afloat now is the main priority.

And realistically, combined APRs and also APR vs balance, is a factor here, too, so there's a myriad of different ways this could be split to benefit you now, your score impact, or your long-term savings on these APRs.

If I were you, I'd pay off 3, 5, 6, 7, and 8 completely. This brings your monthly payment down $530/mo to about $685/mo and saves you about $1030 in interest over the next three months versus $2115, based off my rough calculations. This also brings you down to less than half your cards reporting a balance, so it's going to be the best bump to your current credit score.

This leaves you with $1900 to add to whatever you already had dedicated to paying the cards to spread out among the remaining 3 cards. Ultimately, you want to get all three of those cards out of "maxed" out range so it is possible for you to see if you can get a second consolidation loan. Also, you'll be paying more than the minimum on all three which will ultimately save you the most on interest across the board. Like I said, even though your highest limit is your lowest APR, right now it's costing you nearly as much as 1 & 2 because of its higher balance. It's just less per dollar borrowed.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Maxed out cards

- $9,000 15.49% $193

- $9,500 15.74% $209

- $4,500 13.74% $100

- $14,750 8.9% $255

- $4,800 13.49% $96

- $3,000 14.74% $89

- $7,800 18.24% $190

- $3,000 17.74% $71

You are pretty much on the money with the min payments there.

The Payoff loan is pending at $805.39 for the 36 months. Still hasn't been finalized, they are calling me today to wrap it up.

I see what you're saying to payoff a large number of cards first in order to see a score increase, should better the odds of getting another loan for them.

Yes they are all already sock drawered, not going to be using them any time soon ![]() Unfortunately I am learning the hard way, but hey I'm learning at least lol.

Unfortunately I am learning the hard way, but hey I'm learning at least lol.

A lot of great feedback from everyone and I appreciate all of the input and suggestions provided!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Maxed out cards

I always did excel in math ^_^

Ok, so your min payments around about $1203, do you have more than that to devote to the paydown?

If you go the route I suggested, you'll drop $546 in payments in trade for $1900 up front and around $400 leftover from your original budget with the cc payoff payment.

When is the first payment going to be due and will payout happen before your due dates? This could help you bump those payments a bit more.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Maxed out cards

They have denied my application because I am 100% commission based income ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Maxed out cards

@xiownthisplacex wrote:They have denied my application because I am 100% commission based income

They pre approved you, then denied you when it came to Income verification. Is that correct?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Maxed out cards

Yes I sent my 2 most recent paystubs, didn't lie on income, and they said because there's no base guarantee that they were unable to verify income in the email they sent.

So I called them today and the representitive said the same thing without any clarification. Clearly my paystubs show everything from Year to Date, taxes, 401k, etc, so I was a little confused as to why they said they were unable to verify income, but he guessed it's just because it 's 100% commission (which I mentioned in the phone interview). He didn't offer any other explanation and I asked to speak to someone else and he said it wasn't possible and even if someone could clarify better the decision wouldn't be reversed.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Maxed out cards

Now what? Can you afford to keep paying and slowly whittle down those balances? Maybe get a PT job to help bring them down so the interest doesn't destroy you? I'm sure others here will have ideas too if you don't mind sharing more details.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Maxed out cards

I am slowly paying them down, but I would've liked to pay them off faster!

No can do on the part time job, I already work 60-70 hours a week lol.

What about another route? I was reading up on Lightstream. They allow a co-applicant, I can possibly ask my mom/dad to help out with the co-applicant. Do you guys think with me being maxed on this cards, with a great co (they are 800 scores), I would have a shot with them? I have no derogs, no late payments, no collections, nothing bad except maxed cards. Payoff pulled a 691 score.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Maxed out cards

A co-signer might very well do the trick. I'm not familiar with that particular lender but if they won't accept the co-signer then I would think a credit union would while also having decent interest rates.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Maxed out cards

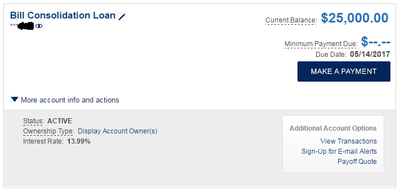

Penfed has approved me for the $25,000 (no co applicant) and they already made the funds available. They didn't even ask for any paystubs ![]()