- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Old collection advice needed

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Old collection advice needed

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Old collection advice needed

So back in 2011, I moved and left a $632 balance with Progress Energy in the Carolinas. It was sold to Online Collections in July, 2012 and I never received the letter because it didn't get forwarded.

Since then, Progress Energy was bought by Duke Energy so technically, Progress Energy doesn't exist anymore.

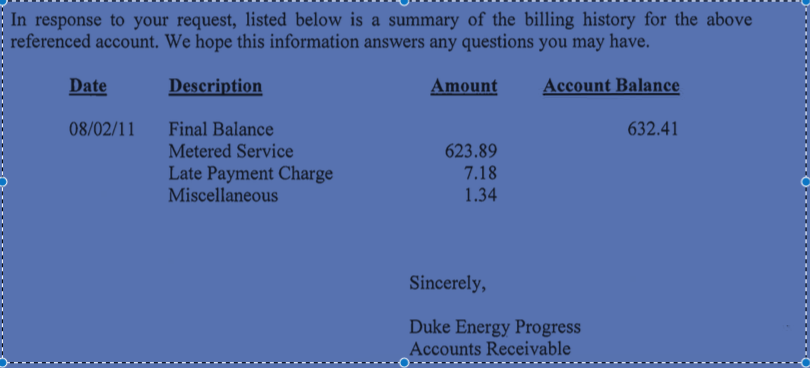

Online Collections has recently started reporting to all the CRAs just out of the blue. I disputed with all and also filed a claim with CFPB. They responded with a letter saying that they "verified" the debt with Duke Energy (though they list Progress Energy as "their client".) Duke's "verification" was just a typed letter saying that I owe them 632 as read from meter. But it doesn't list the address for which the utilities were provided -- it listed my address from 2012. It also did not mention Online Collections at all.

All 3 CRAs viewed that as "verification" and left the collections on my credit report.

BTW, I'm outside the SOL for this debt which is 3 years.

So I figure I have 2 options:

1. Get agressive and require VALIDATION -- not just verification. I'm pretty sure that they do not have any original documentation/bills etc since alot of that was probalby purged/lost when Duke bought out Progress.

2. Go for the PFD route.

From what I have read about Online Collections, they play hardball and won't do PFDs or they'll make a deal and not follow through.

However, are they legally required to provide validation or just verification? As I said, I never received the initial dunning letter that would have provided me with the opportunity to deal with this prior to it being reported by the CAs.

FWIW -- if it makes a difference, I'm in North Carolina.

I'm going to have to deal with this one way or the other because I want to qualify for a mortgage next year and I'm sure a requirement is that any collections be paid off. I would really like to make this one go away, if possible... but the operative word, there is "if possible"...

Suggestions and words of wisdom would be greatly appreciated.

Thanks in advance.

06/15/2019:

03/02/2021:

04/06/2021:

05/28/2021:

Lesson Learned: DON'T POKE THE BEAR!!! THE BEAR WILL WIN!!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Old collection advice needed

@designated_knitter wrote:So back in 2011, I moved and left a $632 balance with Progress Energy in the Carolinas. It was sold to Online Collections in July, 2012 and I never received the letter because it didn't get forwarded.

Since then, Progress Energy was bought by Duke Energy so technically, Progress Energy doesn't exist anymore.

Online Collections has recently started reporting to all the CRAs just out of the blue. I disputed with all and also filed a claim with CFPB. They responded with a letter saying that they "verified" the debt with Duke Energy (though they list Progress Energy as "their client".) Duke's "verification" was just a typed letter saying that I owe them 632 as read from meter. But it doesn't list the address for which the utilities were provided -- it listed my address from 2012. It also did not mention Online Collections at all.

All 3 CRAs viewed that as "verification" and left the collections on my credit report.

BTW, I'm outside the SOL for this debt which is 3 years.

So I figure I have 2 options:

1. Get agressive and require VALIDATION -- not just verification. I'm pretty sure that they do not have any original documentation/bills etc since alot of that was probalby purged/lost when Duke bought out Progress.

2. Go for the PFD route.

From what I have read about Online Collections, they play hardball and won't do PFDs or they'll make a deal and not follow through.

However, are they legally required to provide validation or just verification? As I said, I never received the initial dunning letter that would have provided me with the opportunity to deal with this prior to it being reported by the CAs.

FWIW -- if it makes a difference, I'm in North Carolina.

I'm going to have to deal with this one way or the other because I want to qualify for a mortgage next year and I'm sure a requirement is that any collections be paid off. I would really like to make this one go away, if possible... but the operative word, there is "if possible"...

Suggestions and words of wisdom would be greatly appreciated.

Thanks in advance.

They have already validated with that letter that you owe the money, it takes very little to validate.. You need to move to the PFD

http://ficoforums.myfico.com/t5/Rebuilding-Your-Credit/PFD-Q-amp-A-Examples-and-PFD-Success-Stories/...

http://ficoforums.myfico.com/t5/Rebuilding-Your-Credit/PFD-Example-Letter/td-p/4519

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Old collection advice needed

You say that you disputed and also filed a claim with the CFPB.

Did you file a dispute under the FCRA, or was it a request for debt validation under the FDCPA?

If it is assumed that your dispute was was a DV request, then it was not a dispute under the FCRA.

They are required to investigate and make a finding of validity. That does not require that they "prove" the validity.

They have provided whatt they consider to be adequate validation.

Debt validation is a debt collection practices matter under the FDCPA, and lack of validation is not basis for reqquirng any deletion of their credit reporting, so I see no issue with the

If you disagree, then that does not make their response a violation of any provision of the FDCPA. It would simply mean that, in your opinion, they have not provided adequate validation. That is not, per se, a violation. It means that, in your opinion,they remain under a cease colection bar (assuming your DV was tmely).

Violation of the FDCPA would then occur if/when they continue collection activity without having validated.

Recourse would then be with the courts, asserting violation of their cease collection bar. That is a determination to be made by the courts, not the CFPB.

If it is assumed that your dispute was sent to a CRA, it was required to have asserted a specific inaccuracy in their reporting of the collection,

What was the asserted inaccuracy that was the basis for your dispute with the CRA?

A simple request for validation would only be under the FDCPA, not as a dispute under the FCRA....

Can you clarify the facts of your "dispute" ?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Old collection advice needed

Here was the text of my CFPB complaint:

I received an alert this morning that a company called Online Collections (PO BOX 1489,WINTERVILLE,NC), reported a new collection on my Experian credit report in the amount of 632. The alert that showed up on MyFico and Credit Sesame did not even list a telephone contact or original creditor for which they were reporting. Because of the dollar amount, I was able to link it to a collection that was placed on my report in 2011 by Progress Energy. Progress Energy no longer exists as a business entity. The last time I had an account with Progress Energy was in early 2011. I have NEVER heard of Online Collections nor was I ever given the opportunity to dispute this debt -- or even know exactly what it was for. I believe that Online Collections has violated FCRA and FDCPA for the following reasons: 1. I was never contacted by this company nor given the opportunity to dispute this collection prior to it hitting my credit report. 2. IF there was any amounts owed to Progress Energy, the debt would have been incurred over 3 years ago -- well outside the statute of limitations for debt collection in my state (NC). 3. I already have a collection showing on my credit report from Progress Energy -- therefore, this constitutes a duplicate collection. It is my understanding that there can only be one entity pursuing debt collection for the same debt. 4. By filing a collection at this late date -- over 3.5 years AFTER I have had any dealings with the original creditor, they have effectively "reset the clock" by which this collection activity will remain on my credit and continue to impact my ability to secure credit long after it should age off.

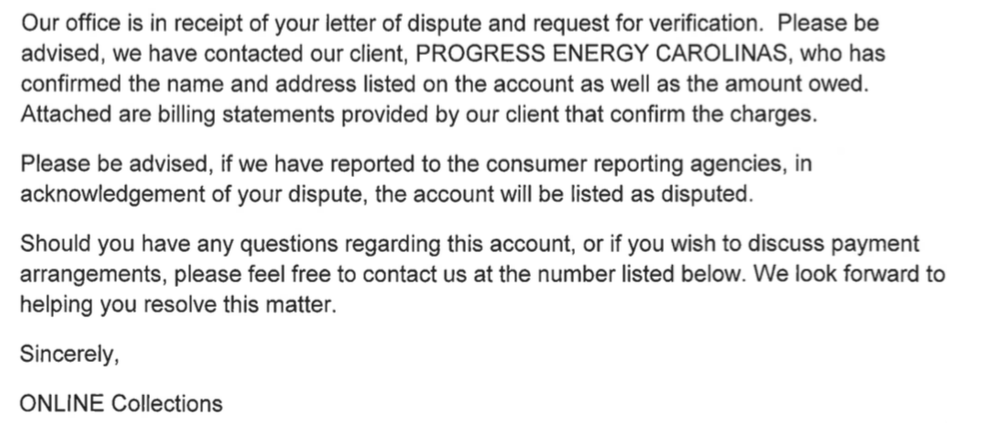

Here is the response from ONLINE COLLECTIONS:

06/15/2019:

03/02/2021:

04/06/2021:

05/28/2021:

Lesson Learned: DON'T POKE THE BEAR!!! THE BEAR WILL WIN!!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Old collection advice needed

Having all reportable debts and judgements paid is preferred, but not necessarily an absolute requirement. Regardless, paying the $632, even if it's not PFD (you can still GW afterwards), will help your credit score going forward, since the TL should then stop updating. Low credit scores could cost you far more than $632 in the longrun due to less than favorable loan terms; higher interest rate. My view is, pay in full asap - one less thing to deal with / worry about later on.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Old collection advice needed

I am also dealing with a Progress/Duke/Online collection. I noticed they recently changed their name (from Online Information Svcs to Online Collections) so the collection was updated on my report in March and is showing as a "new" collection. I sent out a PFD on May 22nd but have not heard back yet. Please update this thread if and when you are successful in getting this deleted off your reports! I'll update if/when they respond to my PFD. Thanks!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Old collection advice needed

1. FCRA requires a dunning notice to be sent "within 5 days" of an item being placed on your reports. Often these notices will go to old addresses. Thats just the nature of the business, and is not, in itself, a violation - unless it can be shown to be intentional. They've already validated the debt, so this is really a moot issue.

2. SOL is completely irrelevant with regards to FCRA/FDCPA. SOL only addresses whether a lawsuit would be considered timely.

3. Progress Energy is the OC. The OC and the CA with collection authority may both report on a single item. This is not double reporting. Yes, it sucks.

4. By law they must attempt to obtain and use the same DoFD as the OC. Simply reporting it now does necessarily not mean the clock is reset. MyFICO and Credit Karma do not show the DoFD or estimated drop off date of items. You can call the CRA's to verify the DoFD of the CA's reporting of this item. You can also get your free reports from Annualcreditreport.com and see this info as well.

Not trying to be a wet blanket, but I see no violations of FCRA or FDCPA here.