- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Re: PC RICHARDS - Dispute?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

PC RICHARDS - Dispute?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

PC RICHARDS - Dispute?

So I've been reviewing my credit reports recently. I found a really old account for PC Richards store card that I used to have back in 2010. The account has been closed. I don't believe I ever received any further notifications or requests for payment of the balance. You can see the last payment I made was in 5/2010. My question at this point is, should I wait for this to fall of next year or should I put in a dispute for this?

This was never sent to collections and given the current state of PC Richards' as a company, IDK if disputing this will reawaken a hunt for money from me.... Any advice? Should I send in a GW Letter for this one? If so, who do I send it to? lol

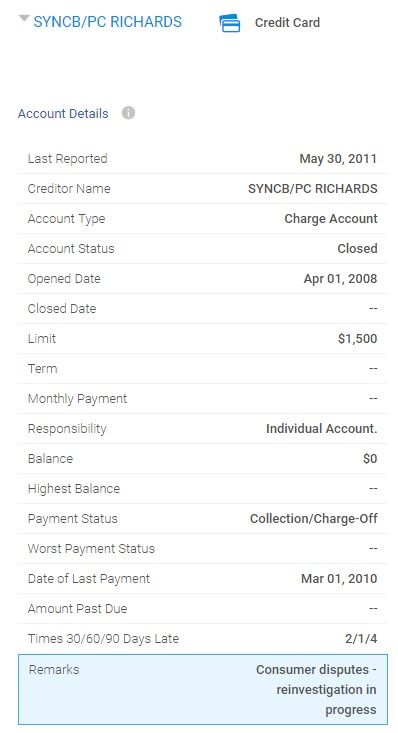

This picture is from EQ;

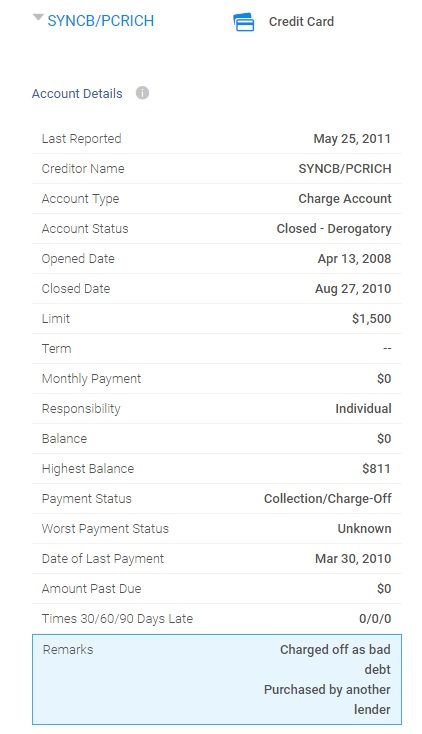

This one is from Transunion;

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PC RICHARDS - Dispute?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PC RICHARDS - Dispute?

The report shows that they charge-off the debt, so you have a major derog reporting on the account.

The charge-off will become excluded no later than 7 years plus 180 days from the reported DOFD.

While your posting does not show the reported DOFD, it will either be shown elsewhere, or can be estimated based on other reporting.

If your last payment, for example, was adequate, then your DOFD may be the next month. It appears that your DOFD is sometime around the date of your last payment?

It appears to have approx a year to a year and a half before exclusion.

As for paying, the creditor has reported an updated balance of $0.

If you know that you did not pay the debt, then the balance of $0 is the statement in the file that they have sold the debt.

Thus, you can no longer pay them. Any payment of the debt would be directed to the current owner.

I assume no debt collector has ever contacted you?

You can always call the creditor and ask who they sold the debt to.

You can also request a good-will deletion of the reported charge-off, but having taken a loss on the debt, they are not likely to be a mood of good-will.

I have no idea what inaccuracy you assert as the basis for a dispute. Is something in that reporting inaccurate?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PC RICHARDS - Dispute?

@RobertEG wrote:The report shows that they charge-off the debt, so you have a major derog reporting on the account.

The charge-off will become excluded no later than 7 years plus 180 days from the reported DOFD.

While your posting does not show the reported DOFD, it will either be shown elsewhere, or can be estimated based on other reporting.

If your last payment, for example, was adequate, then your DOFD may be the next month. It appears that your DOFD is sometime around the date of your last payment? According to my Equifax report, the DOFD occurred on 11/2010

It appears to have approx a year to a year and a half before exclusion.

As for paying, the creditor has reported an updated balance of $0.

If you know that you did not pay the debt, then the balance of $0 is the statement in the file that they have sold the debt.

Thus, you can no longer pay them. Any payment of the debt would be directed to the current owner.

I assume no debt collector has ever contacted you? I have not been contacted by anyone regarding payment for this account. No debt collectors have reached out via phone/mail

You can always call the creditor and ask who they sold the debt to.

You can also request a good-will deletion of the reported charge-off, but having taken a loss on the debt, they are not likely to be a mood of good-will.

I have no idea what inaccuracy you assert as the basis for a dispute. Is something in that reporting inaccurate? Nothing seems inaccurate on the reports. Just looking for options to have it potentially removed from them. I can attempt a goodwill deletion I guess. I'm just not sure who to contact considering the downfall of the company... I shouldn't have used the word "Dispute" per say. Was more so looking for a way to remove if possible before the 7 yrs + 180 days

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PC RICHARDS - Dispute?

@RobertEG wrote:The report shows that they charge-off the debt, so you have a major derog reporting on the account.

The charge-off will become excluded no later than 7 years plus 180 days from the reported DOFD.

While your posting does not show the reported DOFD, it will either be shown elsewhere, or can be estimated based on other reporting.

If your last payment, for example, was adequate, then your DOFD may be the next month. It appears that your DOFD is sometime around the date of your last payment?

It appears to have approx a year to a year and a half before exclusion.

As for paying, the creditor has reported an updated balance of $0.

If you know that you did not pay the debt, then the balance of $0 is the statement in the file that they have sold the debt.

Thus, you can no longer pay them. Any payment of the debt would be directed to the current owner.

I assume no debt collector has ever contacted you?

You can always call the creditor and ask who they sold the debt to.

You can also request a good-will deletion of the reported charge-off, but having taken a loss on the debt, they are not likely to be a mood of good-will.

I have no idea what inaccuracy you assert as the basis for a dispute. Is something in that reporting inaccurate?

This is what I would do. It very well may not work, but it will not hurt to try. Other than that, I think just waiting for it to fall off would be the thing to do.

| Total CL: $321.7k | UTL: 2% | AAoA: 7.0yrs | Baddies: 0 | Other: Lease, Loan, *No Mortgage, All Inq's from Jun '20 Car Shopping |

BoA-55k | NFCU-45k | AMEX-42k | DISC-40.6k | PENFED-38.4k | LOWES-35k | ALLIANT-25k | CITI-15.7k | BARCLAYS-15k | CHASE-10k