- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Pay for delete U.S. department of Education?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Pay for delete U.S. department of Education?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Pay for delete U.S. department of Education?

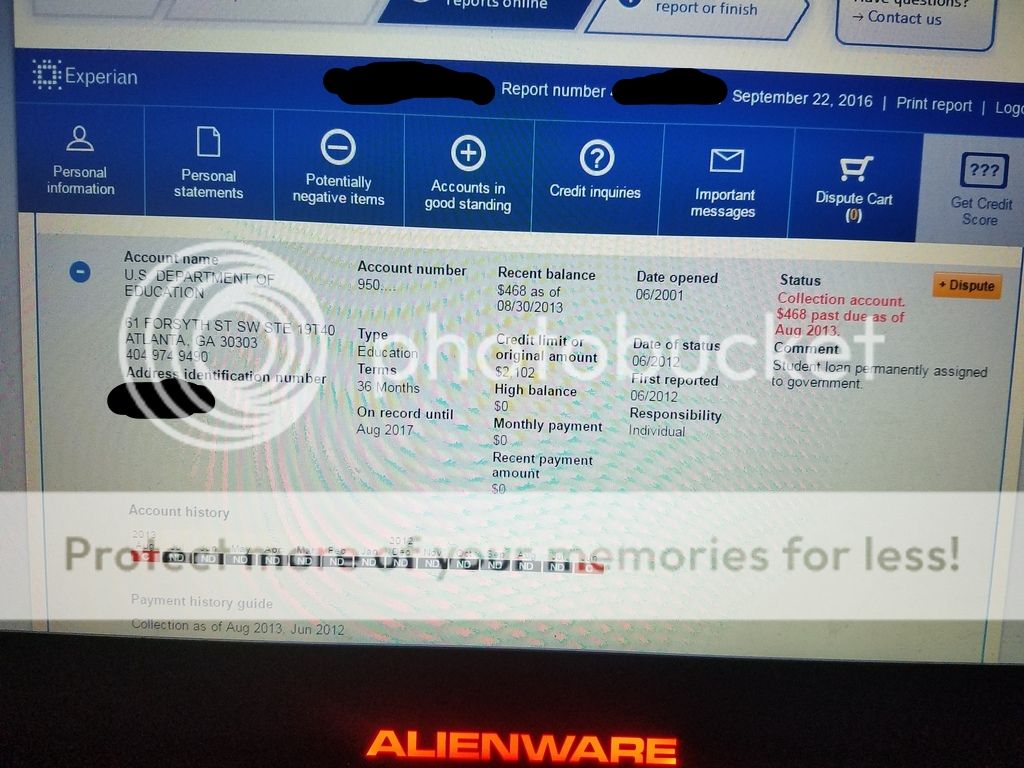

I have 2 student loans from 2001 that somehow were reported to my Experian report again in 2012 and 2013. Regardless of all of that I'm wondering what my best course of action is. Both loans are relatively cheap to pay off with one at $468.00 and one at $396.00.

My question is should I dispute them both with Experian and hope that the USDOE doesn't respond in the 30 days and if I do dispute will that have any negative effects on my profile or renew the 7 years on each?

My other question is if paying them off would be the better answer does anyone know if the USDOE will agree to delete them off of my record? If they won't I'm not going to pay them off. Currently my Experian fico8 is sitting at 641 and its my best profile because my history is the longest with installment loans on it as far back as 16 years ago. If I can clean this off my record I want to do so.

Also I might be impatient as both of these are reporting to come off in August of 2017 according to the Experian reports.

Thanks for any suggestions

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Pay for delete U.S. department of Education?

Unless I am mistaken, federally backed student loans can remain on credit reports until they are paid off. In addition, unless they are paid in full (since these are in collections), means you cannot qualify for any further student loans until these are either rehabilited are paid in full. Lastly, I think the U.S. Governement can have wages garnished, IRS refund checks being garnished, etc, etc.

I would advise you to pay off this student loan debt, and then once the 7 years pass by, they will fall off or your credit report.

Just my 2 cents.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Pay for delete U.S. department of Education?

Here is the problem with that, I was advised not to pay it because once I make a payment to pay it off they can restart the 7 years from the date I make the payment. Also if you look at the pics it clearly states these are coming off in August 2017. I don't have a problem paying them but imo they should come off my report as soon as I pay them since the accounts opened in 2001 and if they agreed to remove them from my report I would gladly pay them asap.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Pay for delete U.S. department of Education?

Filing of a dispute requires the assertion of a specific inaccuracy in reported information.

A dispute that does not include identification of a specific inaccuracy and some basis for the assertion that it is inaccurate can be dismissed without reinvestigation as "frivolous or irrrlevant" without any referral to the reporting party, and thus no requirment for their investigation and reply to the CRA.

Is there an actual, identifiable error in reported information?

Additionally, the disputed information is not required to be deleted if it can be corrected by the CRA, so lack of verification does not necessarily require deletion of the account or of the asserted inaccurate information even if it is not verified.

A dispute or a partial or full payment will not reset any credit report exclusion period or date.

Credit report exclusion of derogs is based on the date of occurence of the respective derog, not its date of payment.

Monthly delinquencies on will normally continue to be excluded at 7 years from their dates of occurence, and any charge-off or collection is based on a date-certain of no later than 7 years plus 180 days from the date of first delinquency.

I say "normally excluded" because unpaid federal student loans are not subject to the standard exclusion periods under the FCRA. The Higher Education Act includes specific exemptions from the normal exclusion periods for unpaid federal student loans. Uncle Sam gets extended reporting.

Once a federal student loan is paid, monthly delinquencies and collections/COs then revert to the normal periods set under the FCRA.

As for a pay for delete, the Higher Education Act requries reporting of delinquency on federal student loans, and based on that requirement, subjective deletions are often hard to obtain. You can try, but in addition to CRA policy opposing deletions based on payment of the debt is the underlying reporting requirement of the Higher Ed Act.

Give it a try.....

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Pay for delete U.S. department of Education?

@Anonymous wrote:Here is the problem with that, I was advised not to pay it because once I make a payment to pay it off they can restart the 7 years from the date I make the payment. Also if you look at the pics it clearly states these are coming off in August 2017. I don't have a problem paying them but imo they should come off my report as soon as I pay them since the accounts opened in 2001 and if they agreed to remove them from my report I would gladly pay them asap.

Hi there LilCeez,

Thanks for your reply. I have to echo what RobertEG stated and that I also mentioned, that federally backed loans are exempt from the normal 7 years. But no matter what, after paid, then they can/will come off the reports once the 7 years go by. For sure if not paid, and if they are federally backed student loans, Uncle Sam can/still will come after you to get their money.

I would advise you to pay it, but the choice is totally yours though.

I do understand your dilemna but speak from personal experience regarding federally backed student loans.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Pay for delete U.S. department of Education?

@Anonymous wrote:Here is the problem with that, I was advised not to pay it because once I make a payment to pay it off they can restart the 7 years from the date I make the payment. Also if you look at the pics it clearly states these are coming off in August 2017. I don't have a problem paying them but imo they should come off my report as soon as I pay them since the accounts opened in 2001 and if they agreed to remove them from my report I would gladly pay them asap.

You recieved bad and incorrect advice. Its a very common misconception. Making a PARTIAL payment can reset the SOL on a debt, but that does not effect its reporting time clock, only the ability of the creditor to file suit. Paying the debt off completely resets/restarts nothing.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Pay for delete U.S. department of Education?

It's true. It happened to me. I had two student loans that I had taken out back in 2001. I defaulted on both and eventually paid one of them off in 2012 and still owed on the other one. I wasn't able to apply for any financial aid because of the outstanding debt. The IRS garnished one of my tax returns earlier this year and got their money. I'm actually glad that they did because it allowed me to qualify for financial aid after returning to school.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Pay for delete U.S. department of Education?

RobertEG, if you're still reading this thread, could you explain this more, please: "Once a federal student loan is paid, monthly delinquencies and collections/COs then revert to the normal periods set under the FCRA"?

I currently have two loans, too, that went to collections. They're currently being rehabbed and I was told that after 9 months, they would waive the remaining fees, etc, and resubmit to the bureaus that the account is in paid as agreed status. After that, I can PIF or settle, I was told, by the USDOE when setting up the rehab agreement. The thing is that the original loan, to my knowledge, won't be updated, so I have to wait some more years for that to fall off :-/ I think it quite unjust that they took the one loan, derog'ed it on my reports, and then split it into two and reported those, too, but so it goes. In a few months I'll know if they stick to their word or not. Anyone else have experience with USDOE?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Pay for delete U.S. department of Education?

Yep, what the others said. Regardless of what you think or were told, these aren't going away, you will not get them removed, and there is pretty much nothing to do but pay them and wait. Thank goodness they are small and easily handled. I dealt with some of these problems in the past and if you can manage to make headway with those folks, you are a better person than I. Knowing what I know now, I would pay them yesterday. Happy to say I owe nothing in student loans, and my reports are all clear. Here's wishing you get there quickly as well.

My experience with them is that the late reporting stays regardless of the current paid status of the loans. In the end, I got virtually no relief, and they (lates) stayed on my reports the full seven yards from the date of first delinquency, i.e. 30 days after the first missed payment plus seven years.