- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Paying Off Open vs Closed Revolving

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Paying Off Open vs Closed Revolving

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Paying Off Open vs Closed Revolving

Does it matter if I pay off an open or closed account first? Does one option have a better effect on my FICO/credit score?

Accounts:

Total: 14

Open: 2

Closed: 12 (7 are positive deferred student loans)

Negative: 2

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paying Off Open vs Closed Revolving

Well, closed accounts don't count toward your current utilization, so paying down current accounts will lower your utilization where paying down closed accounts I don't believe would impact current utilization.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paying Off Open vs Closed Revolving

The balance continues to be included in scoring of your % util of a revolving account after the account is closed.

Which account to pay first primarily depends upon whether it is delinquent.

If delinquent, there is potential for reporting to get worse as long as it remains delinquent.

For example, the debt could be charged-off, could be referred or sold to a debt collector, or could become basis for a civil action.

Are any of the closed revolving accounts currently delinquent, and if so, how old is the debt, has a CO or collection been reported, and what is the SOL status?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paying Off Open vs Closed Revolving

The 2 accounts reporting negative are Charge-Off. I have a payment arrangment with both of them.

The SYNCB/WALMART - $875 (reporting as 0%)

-Paying off with a lower agreed amount next week, hoping to call SYNC B and set something up. IF fail, writing GW.

-They said they would tell SYNC B it was paid and they have nothing to do with reporting (it is through First Source Advantage, INC.)

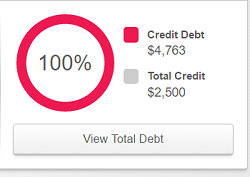

CAPITAL ONE BANK USA N - $2,291 (reporting as 115%)

-Making small payments of $15 till next month (just to keep it out of collections) to save money after I pay off WALMART and still have funds for other other cards/savings.

-Planning to request around 40-70% of the balance to be paid within 3 months on auto pay starting mid-late november.