- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Planning - worst case scenario (need advice on tim...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Planning - worst case scenario (need advice on timing)

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Planning - worst case scenario (need advice on timing)

My scores are moving at a slower pace than my initial jumps but they are still trending up. Right now I have TU 672, EQ 635 and EX (FAKO either 651 or 712). Im trying to GW my lates and Verizon CO but having little success. SO assuming that Im unsuccessful in my GW attempts, how should I proceed in my rebuild? (In particular Im worried about applying for new credit cards).

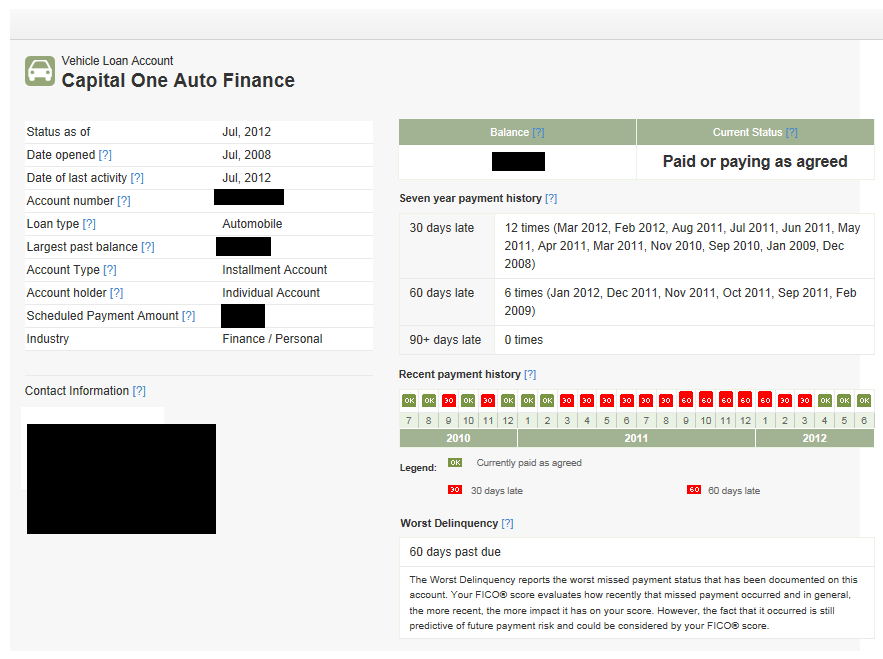

My last late was 30 days in March. I have a 90 day late in SM July 2011 and a 30 day late Dec 2010. The Verizon CO is from summer 2009. Here is my mess that is cap1 Auto.

How long can I expect these derogs to keep me from getting good credit cards? March next year (which would be 1 year from last late), 2 years? 3? What can I do to minimize the impact of the lates I currently have other than paying on time? Open new accounts? (IF so which ones should I aim for?)

Thanks,

Duncan

Starting Score: EQ 551 TU 548 CK 607on 6/8/12, EX 542(AMEX pull 3/4/12)

Current Score: EQ 808 TU --- EX --- CK 804(FAKO-EX 821, EQ 823, TU 803)

Goal Score: 750

Take the FICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Planning - worst case scenario (need advice on timing)

I'd beg them to delete the account and eat any lost history/AoAA. Not being harsh but it'll take you a long, long time to bounce back from that rough patch.

Current Score: EX 753 FICO, EQ 737FICO, TU 738

Goal Score: 776 FICO

Take the FICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Planning - worst case scenario (need advice on timing)

Its a mess of mine and CSR's at Cap1 doing. Im trying as best I can but getting little progress. My scores will probably be in 700's but I'll have this one horrible account. I dont know what to do? I dont want crappy cards for multiple years.

So any suggestions???

Starting Score: EQ 551 TU 548 CK 607on 6/8/12, EX 542(AMEX pull 3/4/12)

Current Score: EQ 808 TU --- EX --- CK 804(FAKO-EX 821, EQ 823, TU 803)

Goal Score: 750

Take the FICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Planning - worst case scenario (need advice on timing)

@drkaje wrote:I'd beg them to delete the account and eat any lost history/AoAA. Not being harsh but it'll take you a long, long time to bounce back from that rough patch.

This right here. thats alot of lates and i know you maybe had some hard times we all have but those lates are going to keep you away from good cards for awhile. It would take a miracle from cap one to gw those lates. have you thought about asking for the whole TL to be removed?

Chase Freedom 1.5k | Amazon 3K | Walmart 3K | Buckle 300 | AMEX BCE 2.5K | CHASE CSP 12K | CITI sears 6k | Kay 2k

On the prowl for Chase Sapphire Preferred! APPROVED 12K!

scores 7/14 647 622 630 (85%util)

scores 8/14 767 760 758 Boom! finally in the 700 club

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Planning - worst case scenario (need advice on timing)

I have a balance on the loan so would I send them a PFD type letter?

Starting Score: EQ 551 TU 548 CK 607on 6/8/12, EX 542(AMEX pull 3/4/12)

Current Score: EQ 808 TU --- EX --- CK 804(FAKO-EX 821, EQ 823, TU 803)

Goal Score: 750

Take the FICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Planning - worst case scenario (need advice on timing)

Start asking for goodwill the minute they're paid off.

Current Score: EX 753 FICO, EQ 737FICO, TU 738

Goal Score: 776 FICO

Take the FICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Planning - worst case scenario (need advice on timing)

Starting Score: EQ 551 TU 548 CK 607on 6/8/12, EX 542(AMEX pull 3/4/12)

Current Score: EQ 808 TU --- EX --- CK 804(FAKO-EX 821, EQ 823, TU 803)

Goal Score: 750

Take the FICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Planning - worst case scenario (need advice on timing)

Try digging through the threads here to see if anyone's had success that way.

Pretty sure I've read about credit card goodwill/deletions from Cap1. Don't recall PFDs, though.

Re-read to make sure. I've read here Cap1 auto can be a bear.

Current Score: EX 753 FICO, EQ 737FICO, TU 738

Goal Score: 776 FICO

Take the FICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Planning - worst case scenario (need advice on timing)

Starting Score: EQ 551 TU 548 CK 607on 6/8/12, EX 542(AMEX pull 3/4/12)

Current Score: EQ 808 TU --- EX --- CK 804(FAKO-EX 821, EQ 823, TU 803)

Goal Score: 750

Take the FICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Planning - worst case scenario (need advice on timing)

Starting Score: EQ 551 TU 548 CK 607on 6/8/12, EX 542(AMEX pull 3/4/12)

Current Score: EQ 808 TU --- EX --- CK 804(FAKO-EX 821, EQ 823, TU 803)

Goal Score: 750

Take the FICO Fitness Challenge