- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Re: Re-aging resulted in positive account?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Re-aging resulted in positive account?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re-aging resulted in positive account?

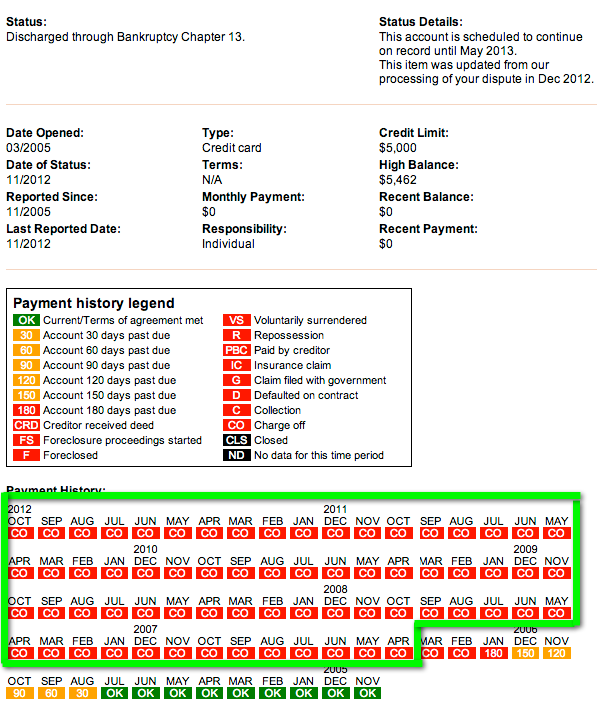

I'm trying to determine if this reporting is accurate or not from Experian. My chapter13 was filed Mar 2007 and through the 5 plus years to my discharge they have reported CO each month. I thought that they couldn't report negative after the filing but I'm not finding anything that specifically states that, so is this inaccurate or not? TU and EQ as everyone else has said is reporting nothing after the filing so what gives with EX? I just need to know if this is valid and if not how do I go about changing it. This is scheduled to come off in 5 months so one part of me says to forget it and just wait but another part of me says that this just isn't right.

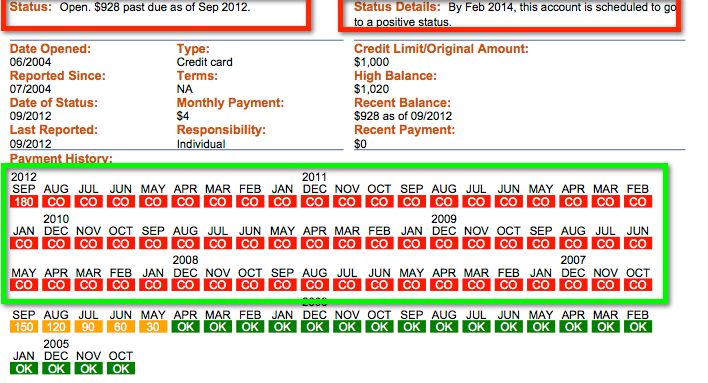

Here is 2nd account one that they screwed up. In essence I think they reaged this account, but done so in a way that makes the account positive except with the notation of IIB. This account I disputed as IIB, should be a zero balance and no lates after bk and here is the before pic:

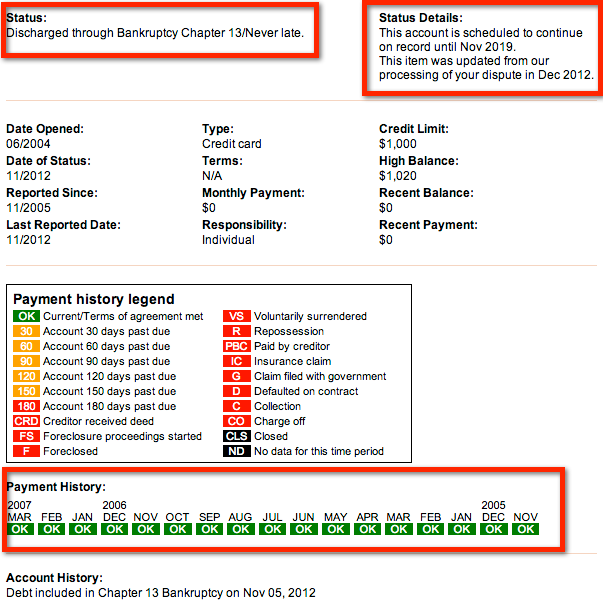

And now here is this same account above after the dispute. They removed all of the CO's as shown above and only left the positive payment history WITH a notation of IIB/Never Late. So I think that the fact that this account will be on my report 5 years after my Chapter13 PR is gone (deletion is Mar 2014) off of my reports is still a negative. So what gives here? Should I dispute again or leave it as is?

Major CC's - Barclay's ($5.5K) | Barclay's Sallie Mae MC ($5K) | DCU ($7.5K) | Discover IT ($1.4K) | Genisys Visa ($1.4K) | NFCU Visa ($22K) | Navcheck ($15K) | Chase Freedom ($5K) | SDFCU Visa ($8K) | Amex BCP ($9.5K) | Amex Delta ($10K) |Store CC's| -Amazon ($4K) | Catherines ($850) | JCP ($4K) | Macy's ($1.7K) | Avenue ($850) | Victoria's Secret ($1.4K) | Walmart ($4.1K) | Paypal SC ($1.3K) | HSN ($2.5) | Sears ($2.6K) | Sams Club ($4.1K) |Goal|: Age with grace to 750 across the board |Last app|: 3/3/2014

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: EXP Reporting POST BK-Dispute made it worse!

I am not sure how chapter 13 works, but after a 7 it should show zero balance. And they cannot reage it, it should come off 7.5 years after DOFD. It depends on what you want to do, if you can wait out the 5 months I would let it age off, unless you need to app for credit in the meantime.

Current Score: EQ 674 TU 679 Ex 686 EX

Goal Score: For now: 640s

Take the FICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: EXP Reporting POST BK-Dispute made it worse!

@jandj80 wrote:I am not sure how chapter 13 works, but after a 7 it should show zero balance. And they cannot reage it, it should come off 7.5 years after DOFD. It depends on what you want to do, if you can wait out the 5 months I would let it age off, unless you need to app for credit in the meantime.

Yea the first account I was thinking about just riding it out since its been dang near 6 1/2 years anyway.

As for the second account, you can see the before and after results of the dispute. What they have done is remove all of the lates, which were accurate, and add in the IIB notation. With the lates showing, the account was scheduled to fall off in May 2013. When they removed the lates and showed only timely payments, this account will report until 2019. The bad thing about this is that even if the account looks positive, the IIB notation will be there 12 years from the date that I filed and 5 years after the bankruptcy PR falls off. So I am trying to determine if the way it is reported, is it best to keep it as is (since its now a positive account) or to re-dispute to get it removed.

Major CC's - Barclay's ($5.5K) | Barclay's Sallie Mae MC ($5K) | DCU ($7.5K) | Discover IT ($1.4K) | Genisys Visa ($1.4K) | NFCU Visa ($22K) | Navcheck ($15K) | Chase Freedom ($5K) | SDFCU Visa ($8K) | Amex BCP ($9.5K) | Amex Delta ($10K) |Store CC's| -Amazon ($4K) | Catherines ($850) | JCP ($4K) | Macy's ($1.7K) | Avenue ($850) | Victoria's Secret ($1.4K) | Walmart ($4.1K) | Paypal SC ($1.3K) | HSN ($2.5) | Sears ($2.6K) | Sams Club ($4.1K) |Goal|: Age with grace to 750 across the board |Last app|: 3/3/2014

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: EXP Reporting POST BK-Dispute made it worse!

It depends. If you are looking at only apping for computerized items after the BK falls off, I would not mess with it. It is probably helping you. However, in a manual review, they may notice the IIB notation. However, BK that far in the past will likely make no difference to a potential creditor.

Current Score: EQ 674 TU 679 Ex 686 EX

Goal Score: For now: 640s

Take the FICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: EXP Reporting POST BK-Dispute made it worse!

@jandj80 wrote:It depends. If you are looking at only apping for computerized items after the BK falls off, I would not mess with it. It is probably helping you. However, in a manual review, they may notice the IIB notation. However, BK that far in the past will likely make no difference to a potential creditor.

Well I guess the first one is only 5 months away....heck been living with that for 6.5 months so whats another 5 huh?

As for the second account that they re-aged, I'm still confused as to whether or not to let this rest because it is a positve now, but does it make it a full blown negative with the IIB notation?

Major CC's - Barclay's ($5.5K) | Barclay's Sallie Mae MC ($5K) | DCU ($7.5K) | Discover IT ($1.4K) | Genisys Visa ($1.4K) | NFCU Visa ($22K) | Navcheck ($15K) | Chase Freedom ($5K) | SDFCU Visa ($8K) | Amex BCP ($9.5K) | Amex Delta ($10K) |Store CC's| -Amazon ($4K) | Catherines ($850) | JCP ($4K) | Macy's ($1.7K) | Avenue ($850) | Victoria's Secret ($1.4K) | Walmart ($4.1K) | Paypal SC ($1.3K) | HSN ($2.5) | Sears ($2.6K) | Sams Club ($4.1K) |Goal|: Age with grace to 750 across the board |Last app|: 3/3/2014

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Re-aging resulted in positive account?

They have apparently deleted the charge-off.

As for the account being "positive," the reporting that the debt was discharged, not by way of payment by the consumer, but rather by its discharge under BK, is not what I would consider postivie.

As for continued reporting of a charge-off, it is most likely simply a repetiton of reporting of the same charge-off, and not the reporting of a new charge-off.

A charge-off is almost always a one-time event, occuring when they move the debt out of their active accounts reveivable ledger.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Re-aging resulted in positive account?

@RobertEG wrote:They have apparently deleted the charge-off.

As for the account being "positive," the reporting that the debt was discharged, not by way of payment by the consumer, but rather by its discharge under BK, is not what I would consider postivie.

You are talking about the second acct right (2nd and 3rd pics showing before and after)? If so the confusion for me was because they removed all of the lates and past due amount as if it never happened, and then adding in the IIB notiation. So the fact that the IIB is there is definitely negative....okay got it.

Now is this what is considered re-aging? I'm trying to figure out how to re-dispute this. I know that they have done something wrong but I'm not certain exactly what it is.

@RobertEG wrote:As for continued reporting of a charge-off, it is most likely simply a repetiton of reporting of the same charge-off, and not the reporting of a new charge-off.

A charge-off is almost always a one-time event, occuring when they move the debt out of their active accounts reveivable ledger.

This charge off is being reported for 5.5 years now on a debt that was IIB beginning in 2007. I thought that they were required to remove or stop reporting this status after the filing date, and any lates prior to the filing date is fair game but afterwards they can't.

Am I right or wrong? Have I misinterpreted the rules for reporting?

Major CC's - Barclay's ($5.5K) | Barclay's Sallie Mae MC ($5K) | DCU ($7.5K) | Discover IT ($1.4K) | Genisys Visa ($1.4K) | NFCU Visa ($22K) | Navcheck ($15K) | Chase Freedom ($5K) | SDFCU Visa ($8K) | Amex BCP ($9.5K) | Amex Delta ($10K) |Store CC's| -Amazon ($4K) | Catherines ($850) | JCP ($4K) | Macy's ($1.7K) | Avenue ($850) | Victoria's Secret ($1.4K) | Walmart ($4.1K) | Paypal SC ($1.3K) | HSN ($2.5) | Sears ($2.6K) | Sams Club ($4.1K) |Goal|: Age with grace to 750 across the board |Last app|: 3/3/2014

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Re-aging resulted in positive account?

The adverse information occured prior to discharge of the debt. Current status does not appear to be the issue, as that is only a snapshot of today.

If it occured prior to discharge of the debt, then its reporting remains accurate. Subsequent reporting that includes that item as an "update" that it occured would not be improper.

It remains as your payment rating prior to its current status, and as a reported item under your payment history profile, both of which appear accurate.