- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Re: Rebounding from years of lates on mortgage

Options

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Rebounding from years of lates on mortgage

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

Anonymous

Not applicable

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-06-2017

05:43 PM

02-06-2017

05:43 PM

Rebounding from years of lates on mortgage

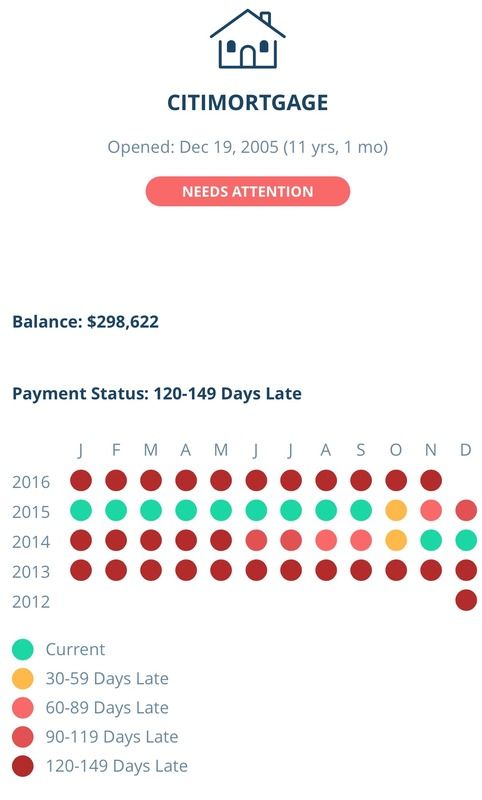

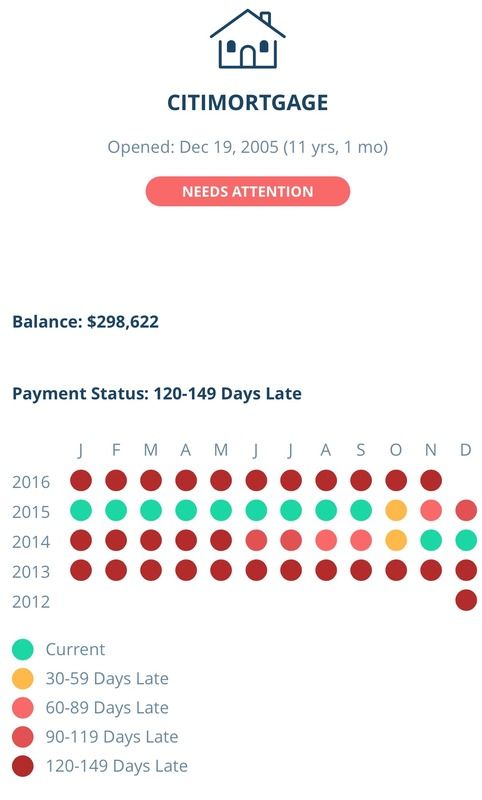

In 2012 my spouse and I opened a a business...lucky for us the business succeeded but as you can see...our mortgage took a MAJOR hit. We just paid our last trial period payment of the loan modification and will be brought current next month. Will any lender ever lend to me again?!? I've read that once an acct goes 120 days late...it's as bad as a bankruptcy...is that true? Any suggestions on rebounding from this?!

Labels:

Message 1 of 3

0

Kudos

2 REPLIES 2

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-06-2017

09:29 PM

02-06-2017

09:29 PM

Re: Rebounding from years of lates on mortgage

Never again is extreme.

The FCRA mandates that the reported delinquencies can no longer be included in any credit report issued by a CRA after 7 years from their respective dates of occurence.

Additionally, once you have established solid period of timely payments, you might contact the lendor and make a good-will request for voluntary deletion of the lates if you plan on refinancing of seeking other forms of credit prior to the mandated credit report exclusion of the delinquencies.

Message 2 of 3

0

Kudos

Anonymous

Not applicable

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-09-2017

11:35 AM

03-09-2017

11:35 AM

Re: Rebounding from years of lates on mortgage

I was being over dramatic...I know but that's how I feel. :-( Do you think they would delete ALL of those dates?!? I'm wondering how many GW lates will a creditor delete. 7 years is SUCH a LONG time!!! My babies will be off to college by then. :'(...ok, back to being over dramatic.

Message 3 of 3

0

Kudos

† Advertiser Disclosure: The offers that appear on this site are from third party advertisers from whom FICO receives compensation.