- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Received notice of Collection Agency

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Received notice of Collection Agency

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received notice of Collection Agency

Hello, about 2 years ago my little brother tried to do his friend a favour. The favour was taking out an Iphone 4 on his name because, the friend didn't have any good credit history and was therefore declined by T-Mobile. Don't ask me how it happen, but the credit inquiry from T-mobile went straight to my credit report, we used to have the same first and last name only different was our Middle name. I tried to dispute with bureau and T-mobile with no success so well i just forgot about it. Here comes the problem, my bro's friend stop making payments and I just received a notice from Collection Agency. I don't know what to do if I should dispute it because they don't have my social Security # nor my date of birth; they have my brother's social and date of birth. I am afraid that they report it to my credit report since it already happen once with the inquiry.

Also, the amount owed to T-mobile is $353.92 Balance as of March 16, 2015 last time I called and asked.

The collection angency is charging me $442.40 so it looks like it went up by $88.48, I don't know if that's legal.

Mod cut. There is another name that you need to mask on the letter and then you're welcome to repost.

Thanks for your understanding,

MarineVietVet, myFICO moderator.

SHould I dispute it since they don't have my Social Security neither my Date of Birth, if I do that my brother might have to face the problem himself?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Received notice of Collection Agency

You could simply send a vanilla DV request to the debt collector, requesting validation, but chances are good that they wll verify.

I would include in your DV your arguments and showing that it is the debt of another.

Your brother may not be pleased, but it is his debt, not yours.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Received notice of Collection Agency

How can it be on your credit report if they do not have your social security number? Someone correct me if I am wrong, but don't you have to have a social security number to access your credit report? I would say that they have to have your social security number and most likely it was used for the account. If that is the case, then the only way to dispute it would be to have your brother arrested for identity theft and fraud, which are very serious charges, so I would avoid that and try to do a "pay for delete" on your brothers dime.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Received notice of Collection Agency

@Anonymous wrote:How can it be on your credit report if they do not have your social security number? Someone correct me if I am wrong, but don't you have to have a social security number to access your credit report? I would say that they have to have your social security number and most likely it was used for the account. If that is the case, then the only way to dispute it would be to have your brother arrested for identity theft and fraud, which are very serious charges, so I would avoid that and try to do a "pay for delete" on your brothers dime.

SSN is actually #6 on the list for tagging a TL to ones credit report. They dont need much, name and address is sufficient to have it appear on your file.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Received notice of Collection Agency

First you have to do the DV, but do not under any circumstance furnish them with any information.

Second, you use that letter to dispute directly with the CFPB, bypass the credit bureaus.

What you don't want to do is let the collection agency get your information linked with the debt. Right now you have them, but if they get the chance they will get you. Do not offer anything. Get rid of it. Then let your brother deal with it.

@Anonymous wrote:How can it be on your credit report if they do not have your social security number? Someone correct me if I am wrong, but don't you have to have a social security number to access your credit report? I would say that they have to have your social security number and most likely it was used for the account. If that is the case, then the only way to dispute it would be to have your brother arrested for identity theft and fraud, which are very serious charges, so I would avoid that and try to do a "pay for delete" on your brothers dime.

It is easy to get stuff on a report, the standards are pretty loose. If they can match a couple of the criteria it is on there. Ever wonder how a bounced check ends up on your credit report? Do you remember giving them your social? Nope you likely never did. But they matched enough of your name and address and because they PAY the credit bureaus a butt load of money, it's put it on the report until someone squeals loud enough to cry foul or just rolls over and pays it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Received notice of Collection Agency

you dont have an identity theft issue, as you are aware of the debt, and dont contest that someone used your identity.

You assert an error in the identification of you as the responsible party.

You dont have the option of filing a dispute with the CFPB as opposed to the CRA.

There are only two dispute options under the FCRA. A dispute via a CRA, or a direct dispute with the furnisher of inaccurate information.

You file a complaint with the CFPB, and not a dispute. If the issue is one of inaccurte reporting, you must first exercise your dispute rights before filing a complaint with the CFPB for some lack of compliance with the dispute process.

You are contesting the debt, which is the purpose of the DV process. Send a DV requestng they investigate the debt and reach a finding as to your responsibility.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Received notice of Collection Agency

Thanks for the reply everyone.

Yes, in this case there is no identity theft since I am aware of the debt AND my brother never used my social secusity # as his.

When he opened the account, he opened it on his name using his social Security # and his Date of birth; And then I got credit inquiry on my credit report maybe because when this account was opened we used to have the same name and we still live in the same address. Also maybe because i have better credit history than him they chose to pick on my credit report instead of his. I tried to dispute the credit inquiry with no success and since a credit inquiry is not a big deal i just let slide.

I don't know if I should go by what they said.

I spoke with a woman. She said "We have not reported to Credit Bureau yet, We only report to Credit bureau after 45 days after we received the debt, if the debt is paid before the 45 days there will be no reporting."

I don't know if I just should go by what the woman told me and make my brother pay for the debt and then we are on the safe side.

Also I asked for letter in writing staying everything she told me about not reporting the account , She replied "We don't do that"

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Received notice of Collection Agency

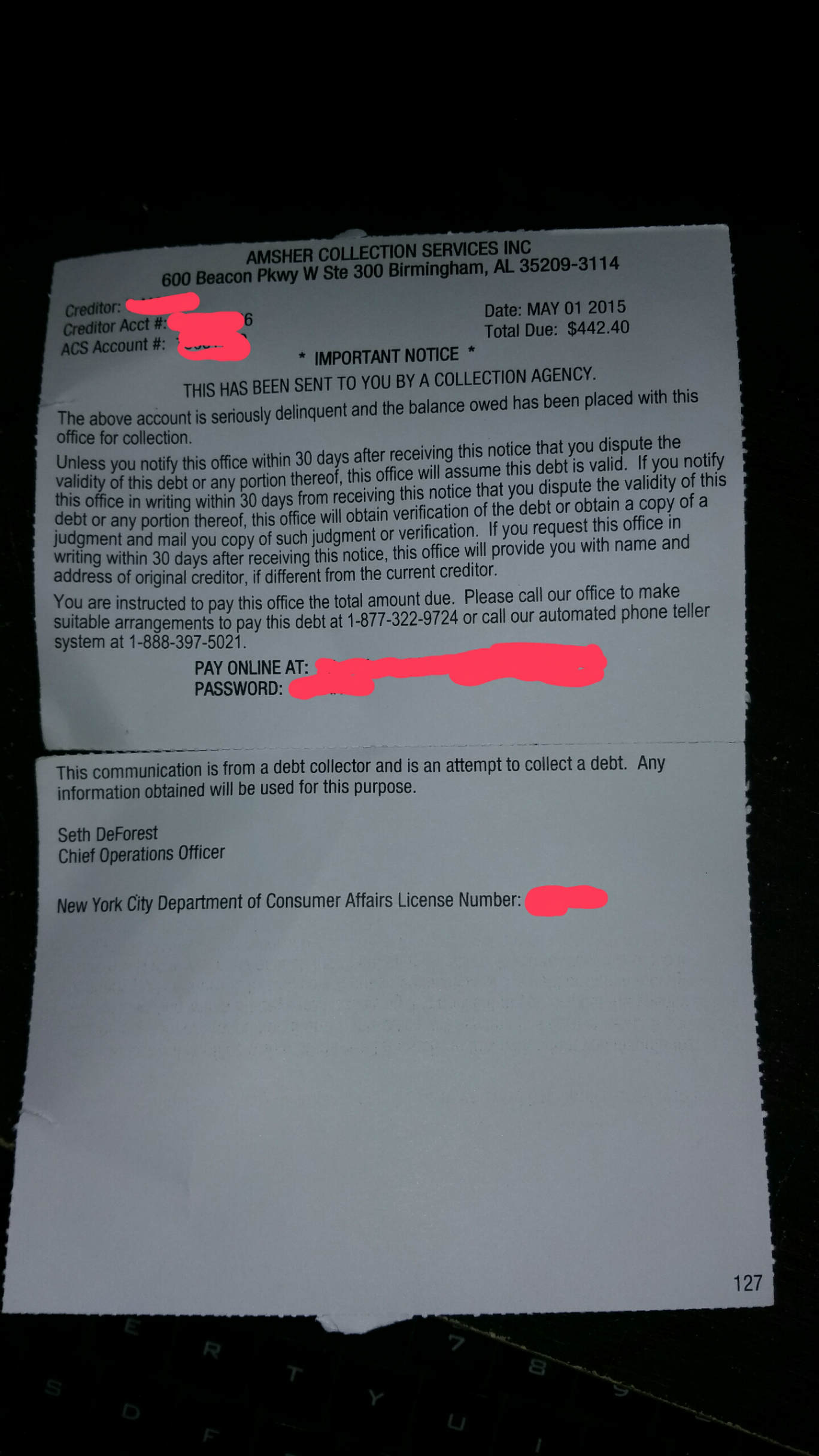

Below is a picture of the Notice I received from the collection Agency, i masked information that I consider to be confidential.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Received notice of Collection Agency

First off, smack your brother in the back of his head for being an idiot. Then tell him its his responsibility to make good on the debt. At this point you can either pay it yourself to clear it and keep it from reporting, and then take it out of your brothers hide, or you can keep on him until he pays it in the 45 day grace period the CA has given you.

A 30-45 day grace period is common with a lot of CA's.

edit: Let your brother "deal" with his friend as he deems appropriate....

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Received notice of Collection Agency

thanks for the reply,

Yeah I think that is best option in this case, it just I don;t kinda believe them I was afraid that after i paid they still report it.

one more question what about the $88.48 they added to the balance, the amount my bro owed was only $353.92 and they are charging are him $442.40?