- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Received response....

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Received response....

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Received response....

@goosedog wrote:This woildn't be the first CA to buy a junk debt without documentation and they wont be the last. The 2nd and 3rd hand collection agencies usually buy the account, with no supporting documents to go with it. Chase may sell an account to assest, assest may try for 2 years to collect, give up, sell it to ARROW for example, they may try for a year and half, give up, sell it to a low level scumbag agency like westbay. Collection accounts are like a timshare. Everyone wants to sell them off, they look juicy and great at first but the older they get, the less useful they are.

This is an awesome post. Great information in there. Thanks for posting goosedog!

July 2013 score: EQ FICO 819, TU08 778, EX "806 lender pull 07/26/2013

Goal Score: All Scores 760+, Newest goal 800+

Take the myFICO Fitness Challenge

Current scores after adding $81K in CLs and 2 new cars since July 2013

EQ:809 TU 777 EX 790 Now it's just garden time!

June 2017 update: All scores over 820, just pure gardening now.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Received response....

Diverisifed Consultants, Inc has stated to CFBP that I sent a dispute, however their response from BBB they admit that I sent validation, yet they still reported without providing validation which is in fact in violation of FCRA which states:

FDCPA 809b

(b) If the consumer notifies the debt collector in writing within the thirty-day period described in subsection (a) that the debt, or any portion thereof, is disputed, or that the consumer requests the name and address of the original creditor, the debt collector shall cease collection of the debt, or any disputed portion thereof, until the debt collector obtains verification of the debt or any copy of a judgment, or the name and address of the original creditor, and a copy of such verification or judgment, or name and address of the original creditor, is mailed to the consumer by the debt collector.

Under FDCPA 809b, I requested validation within 30 days of dunning notice. DCI failed to validate the debt yet still reported it to my credit report, therefore they did in fact violate FCRA "the debt collector shall cease collection of the debt, or any disputed portion thereof, until the debt collector obtains verification of the debt or any copy of a judgment, or the name and address of the original creditor, and a copy of such verification or judgment, or name and address of the original creditor, is mailed to the consumer by the debt collector. "

DCI, states they are removing the tradeline as a courtesy, I accept that. However I do not accept the rest of their statements which are false. I have attached copies of the Debt Validation Letter letter, original dunning notice as well as the return receipt from Diversified Consultants, Inc.

Discover, BOA, GE, Cap 1, Chase, Barclay!

Gardening Start: 04/22/2013

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Received response....

@2FixMyCredit wrote:Diverisifed Consultants, Inc has stated to CFBP that I sent a dispute, however their response from BBB they admit that I sent validation, yet they still reported without providing validation which is in fact in violation of FCRA which states:

FDCPA 809b

(b) If the consumer notifies the debt collector in writing within the thirty-day period described in subsection (a) that the debt, or any portion thereof, is disputed, or that the consumer requests the name and address of the original creditor, the debt collector shall cease collection of the debt, or any disputed portion thereof, until the debt collector obtains verification of the debt or any copy of a judgment, or the name and address of the original creditor, and a copy of such verification or judgment, or name and address of the original creditor, is mailed to the consumer by the debt collector.

Under FDCPA 809b, I requested validation within 30 days of dunning notice. DCI failed to validate the debt yet still reported it to my credit report, therefore they did in fact violate FCRA "the debt collector shall cease collection of the debt, or any disputed portion thereof, until the debt collector obtains verification of the debt or any copy of a judgment, or the name and address of the original creditor, and a copy of such verification or judgment, or name and address of the original creditor, is mailed to the consumer by the debt collector. "

DCI, states they are removing the tradeline as a courtesy, I accept that. However I do not accept the rest of their statements which are false. I have attached copies of the Debt Validation Letter letter, original dunning notice as well as the return receipt from Diversified Consultants, Inc.

A DV is a dispute. By asking for validation you have to dispute the entire debt or part of it.

They did violate the FDCPA by reporting and not validating. first.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Received response....

LOL didn't copy and paste everything, that is the response I want to send it, how does it look.?

Discover, BOA, GE, Cap 1, Chase, Barclay!

Gardening Start: 04/22/2013

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Received response....

Diversified Consultants, Inc has agreed to delete the debt from my credit report however I have other concerns.

Diverisifed Consultants, Inc has stated to CFPB that I sent a dispute however they failed to say said dispute was a request for validation, within the 30 day time period that I was allowed per FDCPA 809b. DCI failed to validate the debt after the validation request, yet still reported the debt to my credit, which is in fact in violation of the below:

FDCPA 809b

(b) If the consumer notifies the debt collector in writing within the thirty-day period described in subsection (a) that the debt, or any portion thereof, is disputed, or that the consumer requests the name and address of the original creditor, the debt collector shall cease collection of the debt, or any disputed portion thereof, until the debt collector obtains verification of the debt or any copy of a judgment, or the name and address of the original creditor, and a copy of such verification or judgment, or name and address of the original creditor, is mailed to the consumer by the debt collector.

FDCPA 809b clearly states "the debt collector shall cease collection of the debt, or any disputed portion thereof, until the debt collector obtains verification of the debt or any copy of a judgment". By reporting this debt to my credit report they were still collecting on the debt which was in violation.

Discover, BOA, GE, Cap 1, Chase, Barclay!

Gardening Start: 04/22/2013

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Received response....

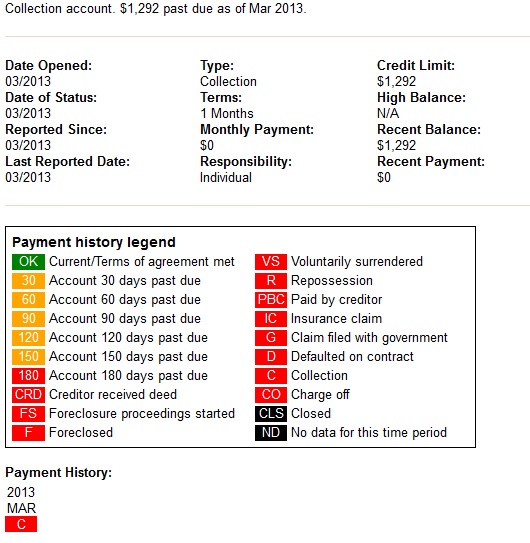

Well I just got notification that they re-added this after they deleted it last Monday. This is after they agreed to delete via CFPB and BBB it and still haven't provided validation. They are reporting the DOFD as 03/13 but what I've been able to find out about this alleged debt from the OC (sprint) is that the DOFD was 10/2012.

I don't have the money to hire a consumer attorney, do I have any other options at this point? I'm fuming over this!!!!

Discover, BOA, GE, Cap 1, Chase, Barclay!

Gardening Start: 04/22/2013

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Received response....

It could be an error on their part. You could call and ask them. If they readded it after being told to delete by CFPB and BBB they could be facing some issues.

If they do not, I would do a follow up with the CFPB and let them know what they did.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Received response....

They agreed to delete it because they didn't provide validation, they were not told. Will that make a difference? They have yet to provide any!

They aren't going to delete they are still claiming they have done nothing wrong. Should they be reporting based on the DOFD of alleged debt? They are reporting it as if it is a new debt from 03/13 but it isn't based on what I could find out like mentioned before.

Discover, BOA, GE, Cap 1, Chase, Barclay!

Gardening Start: 04/22/2013

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Received response....

Discover, BOA, GE, Cap 1, Chase, Barclay!

Gardening Start: 04/22/2013

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Received response....

It should be removed based on the DoFD of the OC. I didn't see that anywhere in your posts. Do you know what it is?