- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Removing a State Tax Lien

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Removing a State Tax Lien

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Removing a State Tax Lien

The proper way to get a lien removed is to have the entity that filed it withdraw it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Removing a State Tax Lien

What is the proper way to request a withdrawal of the lien?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Removing a State Tax Lien

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Removing a State Tax Lien

It was just announced that tax liens and civil judgements would be removed from CR in July 2017.

Millions of consumers could soon see their FICO credit scores increase as the three credit reporting agencies — Equifax, Experian, and TransUnion — take another step to overhaul their systems by excluding certain negative information related to tax liens and civil judgments from credit reports.

The Wall Street Journal reports that starting July 1 the CRAs will remove tax lien and civil judgment data from reports if the information does not provide complete details on consumers. For example, the marks will be removed if the data does not include a person’s name, address, Social Security number, or date of birth.

Additionally, if public court records aren’t checked for updates on lien and judgment information — such as cases where a debt collection firm has taken a consumer to court — at least every 90 days, they will have to be removed from credit reports.

Most of what I read says that most tax liens and judgements do not have all 4 peices of that information so most will be removed. Best of luck hope this helps!

Current Scores: (JUNE 2017) EQ: 747 TU: 725 EXP: 733

Updated Goal Scores: 775

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Removing a State Tax Lien

@Anonymous wrote:What is the proper way to request a withdrawal of the lien?

You need to contact the agency that entered it and ask that it be withdrawn now that its been paid

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Removing a State Tax Lien

I have a paid state tax lien filed in 2013 from Kansas on my CR with all 3 bureaus. I entered an online dispute request yesterday with Experian to remove it because it had been released. Later the same day, I called Experian on a different issue: an old auto loan that was included in a bankruptcy that was discharged and removed from my CR several years ago. The Auto loan shows in the status - Included in Bankruptcy/Never Late. I asked that they remove the part about bankruptcy from the status, as it calls attention to a BR that has long since been removed from my CR.

I got a very nice rep who took quite a bit of time researching it and came back and told me that they were going to remove the auto loan account completely from my credit report.

This morning, I had an email stating that the auto loan had been removed. When I pulled up my CR to verify, it was indeed gone. But, much to my surprise, so was the state tax lien! I was not notified that the dispute had been resolved on the lien, but my report clearly states 'no public records to display.'

I'm not quite sure how/why it was removed, as the lien was released (not withdrawn) by the state. Kansas has no process for withdrawal of a paid state lien. I did not attach the document from the state showing it was released to my dispute request, because the credit report already shows the status accurately as paid in full. But, apparently, it is possible to get a state tax lien removed simply by filing a dispute.

So, my advice is to give it a try! I filed disputes on the state lien with the other two bureaus yesterday as well. I spoke directly with Equifax and the rep there said that it would likely be removed. I'll report back how it goes with Equifax and Transunion.

This all may become moot if state liens are going to be removed if they do not contain all 4 items mentioned in an earlier post on July 1. But, in the case of tax liens, the information that is required is all available in your tax return, so may very likely be included in the court filed documents. This would mean that they would remain on your report for 7 years, unless you are successful in disputing the item with the credit bureau. Good Luck!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Removing a State Tax Lien

I disputed my MN state tax lien on all 3 agencies. Experian delete, Equifax came back as verified, and Transunion is still pending. Let me know how the rest of the gencies handles your dispute as I am thinking of filing another dispute with Equifax.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Removing a State Tax Lien

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Removing a State Tax Lien

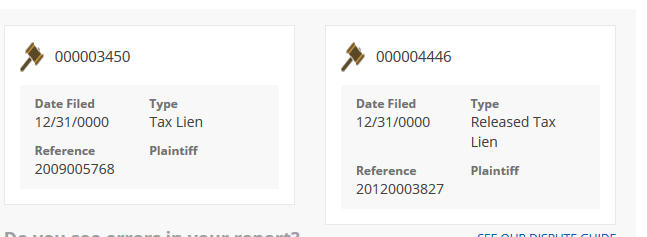

I sent my Equifax today disputing my state tax liens. My CCT Equifax report shows incomplete information, so I cited this as the reason. Both liens are released from the state, so hopefully they will delete based on my dispute. Funny thing is there is less information on my report now that there was prior to my first dispute. File dates on both now say 12/31/0000 which is incorrect. One was filed in 2009 and the other in 2012. 2012 was paid in full in 2015. 2009 was just released earlier this month. So I have until at least next year before they may possibly fall off.

I am confused about the 10/7 rule in California. I have read that it is 10 years from date of filing, or 7 years from the date paid.

I also read that the 7 years from date paid can not be any longer than 10 years from the filing date. I can not find clarification on this... So my second lien could fall off as soon as 2022 if there is a 10 year max on liens, but if it is a hard fast 7 years from paid, I have to wait until 2024! :-(

Either way, I want them gone now, and if I can use incomplete information loophole, I will. Hoping for the best results. I am already thankful Transunion deleted both! :-)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Removing a State Tax Lien

Update: Experian Removed; Equifax Verified and Kept on file; Transunion still waiting to hear.

In looking at feedback from others, looks like Equifax is the least likely to remove, in spite of citing the National Consumer law about to take affect.