- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Re: Removing charge-off with debt validation

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Removing charge-off with debt validation

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Removing charge-off with debt validation

I hope you guys can give me some insight. I have a charge off from an old car loan. The original bank was wachovia and since wachovia was bought by wells fargo they now report my charge off to the bureaus.

Date of last activity was Sep 28th 2009 so by the end of this year per statue it should fall off my report. However i am going to have to purchase a house before that and this charge off aint looking too good.

My question. Would a validation letter help me get this removed totally before that. since Wachovia originally had my loan and its quiet a paper trail?

Is there anything i can do to get it removed a few months early?

FYI i called wells fargo, whos reporting the charge off and they are playing dumb and telling me i should contact the bureaus for removal.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Removing charge-off with debt validation

Debt validation applies only to debt collectors, not to creditors. It is questionalbe as to whether transfer of the debt to another creditor makes the new creditor a debt collector under the definition provided in the FDCPA. Was the debt already delinquent when transferred?

The item for which you are seeking removal is a charge-off, not a collection. Use of the DV process does not appear to be applicable.

Lacking in the post is any assertion that the charge-off by the creditor was improper or inaccurate.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Removing charge-off with debt validation

@Anonymous wrote:I hope you guys can give me some insight. I have a charge off from an old car loan. The original bank was wachovia and since wachovia was bought by wells fargo they now report my charge off to the bureaus.

Date of last activity was Sep 28th 2009 so by the end of this year per statue it should fall off my report. However i am going to have to purchase a house before that and this charge off aint looking too good.

My question. Would a validation letter help me get this removed totally before that. since Wachovia originally had my loan and its quiet a paper trail?

Is there anything i can do to get it removed a few months early?

FYI i called wells fargo, whos reporting the charge off and they are playing dumb and telling me i should contact the bureaus for removal.

How exactly is it reporting? Is it reporting as a charge off with a balance due, or no balance? Is there a separate collection reporting as well?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Removing charge-off with debt validation

@Anonymous wrote:

@Anonymous wrote:I hope you guys can give me some insight. I have a charge off from an old car loan. The original bank was wachovia and since wachovia was bought by wells fargo they now report my charge off to the bureaus.

Date of last activity was Sep 28th 2009 so by the end of this year per statue it should fall off my report. However i am going to have to purchase a house before that and this charge off aint looking too good.

My question. Would a validation letter help me get this removed totally before that. since Wachovia originally had my loan and its quiet a paper trail?

Is there anything i can do to get it removed a few months early?

FYI i called wells fargo, whos reporting the charge off and they are playing dumb and telling me i should contact the bureaus for removal.

How exactly is it reporting? Is it reporting as a charge off with a balance due, or no balance? Is there a separate collection reporting as well?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Removing charge-off with debt validation

The reporting is by the creditor.

Verification of the debt would require filihg of a dispute under the FCRA, which, unlike as DV request sent to a debt collector, requires some showing of an actual inaccuracy in the debt in order to obtain their investigation and response.

Is the debt valid?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Removing charge-off with debt validation

@RobertEG wrote:The reporting is by the creditor.

Verification of the debt would require filihg of a dispute under the FCRA, which, unlike as DV request sent to a debt collector, requires some showing of an actual inaccuracy in the debt in order to obtain their investigation and response.

Is the debt valid?

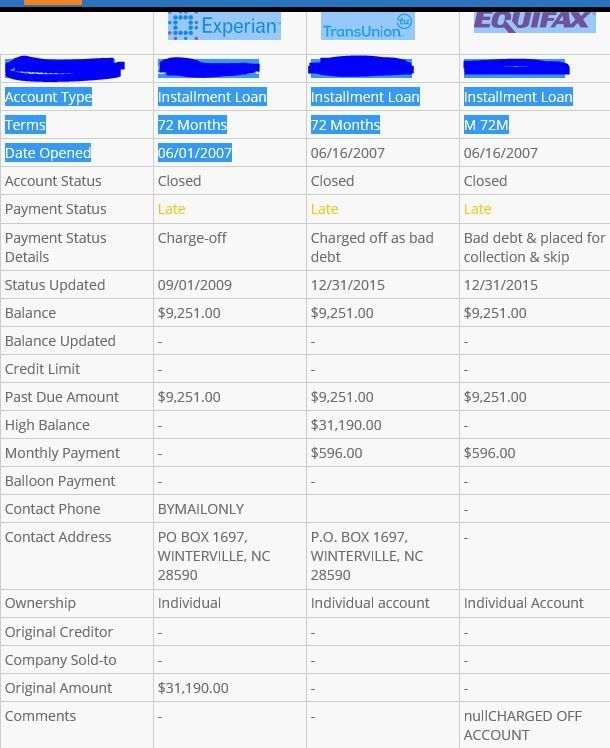

yes it is valid. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Removing charge-off with debt validation

You can try the early exclusion 6 months in advance with TU and 1-3 months with the other 2 CRAs. Exclusion doesnt mean its stil not uncoverable by mortgage lenders as a full factual report would more than likely show it till its at least 10 years old. Best way would be to make a PFD settlement offer to whomever is reporting the debt.