- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Re: Someone Please Explain This To Me

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Someone Please Explain This To Me

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Someone Please Explain This To Me

I have a Capital One account and a Finance company that were both included in my Chapter 13. The finance company was paid in full and Capital One got a portion of what I owed them. Both of these report the date of last activity as 6/10/15. This would reflect the last payment made from the Chapter 13 Trustee.

My Chapter 13 discharged and was completed in August 2015. Both of these accounts show date of first major delinquency as September 2015. My bankruptcy was filed in 2010. My older credit reports some only a few months old have a 2010 date listed as first major delinquency date. I have been disputing items for a few months now trying to get things to report the correct way.

I have am confused as to why it changed? How can something be delinquent if the Chapter 13 discharged a month before these dates? I paid everything I was supposed to pay according to the courts. I also have 1 paid collection for $59.00 that was medical from 2013. I paid it off last month. There is a Chase card that is being disputed because it was included in my Chapter 13 but does not state that.. It shows 4 late payments. These late payments would be from 2010.

A couple of my denials for credit have stated too recent serious delinquency. All of my other bankruptcy accounts have either fallem off early due to a dispute with no answer or they are reporting correctly.

Do you think it's the Chase account or the collection account that is doing this? I am current with all of my payments for the new credit I have. I have sent a GW letter to the collection agency but so far they have ignored me and not replied.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Someone Please Explain This To Me

@Anonymous wrote:I have a Capital One account and a Finance company that were both included in my Chapter 13. The finance company was paid in full and Capital One got a portion of what I owed them. Both of these report the date of last activity as 6/10/15. This would reflect the last payment made from the Chapter 13 Trustee.

My Chapter 13 discharged and was completed in August 2015. Both of these accounts show date of first major delinquency as September 2015. My bankruptcy was filed in 2010. My older credit reports some only a few months old have a 2010 date listed as first major delinquency date. I have been disputing items for a few months now trying to get things to report the correct way.

I have am confused as to why it changed? How can something be delinquent if the Chapter 13 discharged a month before these dates? I paid everything I was supposed to pay according to the courts. I also have 1 paid collection for $59.00 that was medical from 2013. I paid it off last month. There is a Chase card that is being disputed because it was included in my Chapter 13 but does not state that.. It shows 4 late payments. These late payments would be from 2010.

A couple of my denials for credit have stated too recent serious delinquency. All of my other bankruptcy accounts have either fallem off early due to a dispute with no answer or they are reporting correctly.

Do you think it's the Chase account or the collection account that is doing this? I am current with all of my payments for the new credit I have. I have sent a GW letter to the collection agency but so far they have ignored me and not replied.

I dont think the Date of First Major Delinquency matters. It should have a DoFD, which is Date of First Delinquency.

One of the best places to see the DoFD is on a CR directly from EQ, like from your annual credit report, or if they provide one directly. The TU report will show the expecetd date it will roll off, meaning 7 years past the DoFD. Other places you get your reports from do not show the DoFD as clearly.

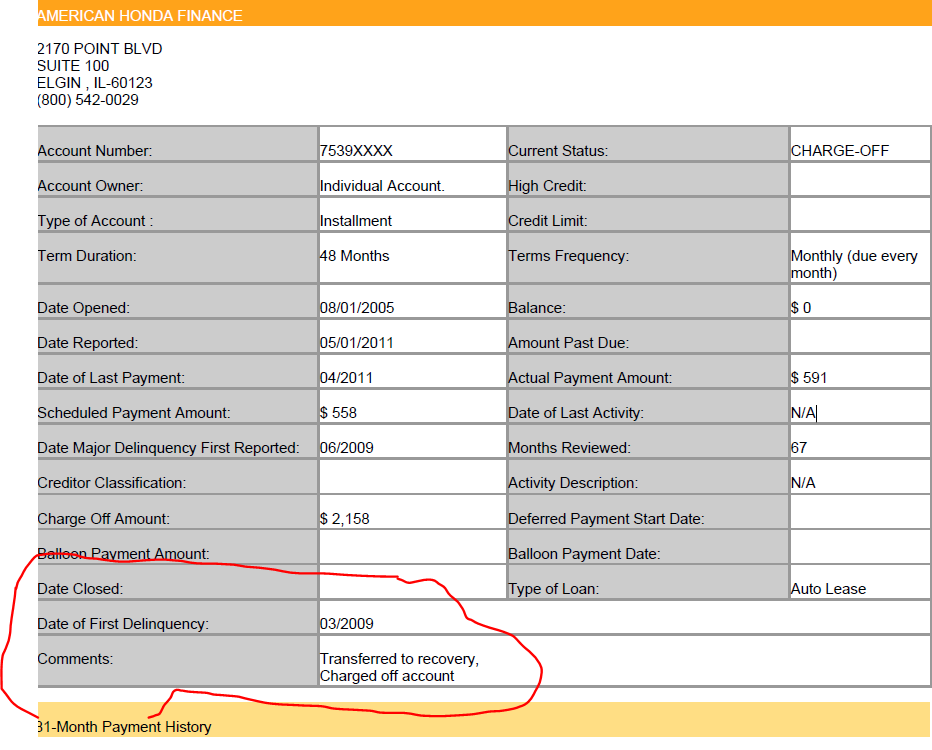

I have a CO that was an auto repo from 2009 and the two dates are shown on the snipet I took from my EQ credit report.

The date of major delinquency isnt very important for us, and it is well past the CO event, which was in May.

BTW, I miss that car, wish I could have kept it. If I could find another one like it now, I would probably get it, especially since it would be much more affordable now.

HTH

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Someone Please Explain This To Me

Under yur payment history profile, what specific derogs are being reported?

Apparently, they have not reported a new, major delinquency........?

DOFD would only be relevant if they have reported a charge-off.

The DOFD is then used as the date to determine the exclusion of the CO from your credit report.