- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Substantial progress in 5 years, and I want to con...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Substantial progress in 5 years, and I want to continue...

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Substantial progress in 5 years, and I want to continue...

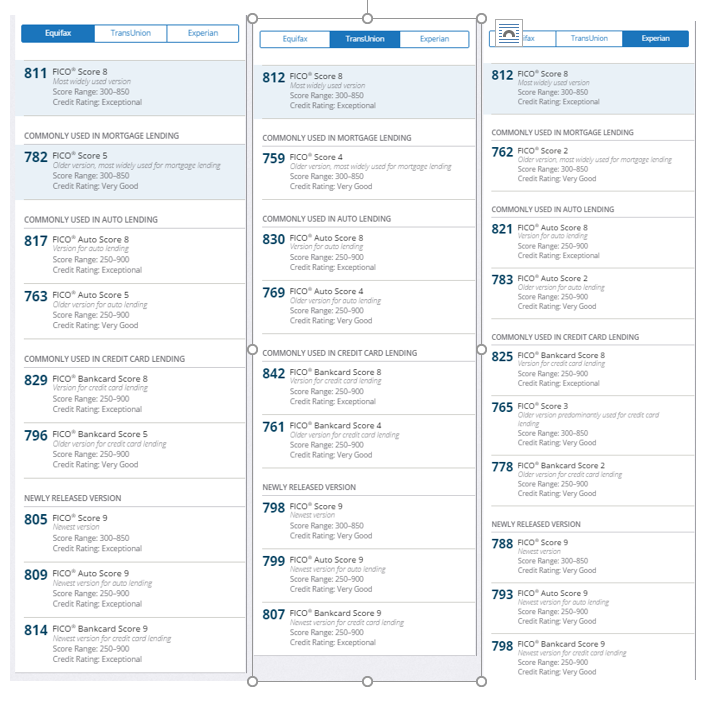

I went through a nasty divorce, racked up almost $100k in revolving and installment debt (attorney fees), and have spent five years digging out. Now I am in a much better position: Equifax 811, TU 812, Experian 812. I just pulled their 3B and see scores ranging from 759 to 842. My current wife is amazing, insisting that we pay off ALL revolving debt. I have zero derogs. Average age of accounts is still ~10ish years. Utilization is <2%. I have increased the limits on a couple of cards that only did SOFT pulls. I assume closing any accounts may hurt my util or Age of accounts.

We are buying a new house, and I still have three installment loans (aside from mortgage).

What else can/should I do? Should I be reaching out asking for limit increases (soft pulls only)? Should I close the accounts that are small limits, high rates, and hurting my average age of accounts? Do I do nothing but keep paying on time and just let it ride?

I would love to get my critical scores all >800 (this is a first for me, my financial situation has kept me <740 for almost 20 years).

I realize I am actually in fairly good shape...

TransUnion 696 4/15/2010

Equifax 683 4/15/2010

TransUnion 675 8/30/2010

Equifax 688 8/30/2010

Still trying to get my scores up =\ Opening new trades in the last 12 months didn't help. =(

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Substantial progress in 5 years, and I want to continue...

@jrdenver wrote:I went through a nasty divorce, racked up almost $100k in revolving and installment debt (attorney fees), and have spent five years digging out. Now I am in a much better position: Equifax 811, TU 812, Experian 812. I just pulled their 3B and see scores ranging from 759 to 842. My current wife is amazing, insisting that we pay off ALL revolving debt. I have zero derogs. Average age of accounts is still ~10ish years. Utilization is <2%. I have increased the limits on a couple of cards that only did SOFT pulls. I assume closing any accounts may hurt my util or Age of accounts.

We are buying a new house, and I still have three installment loans (aside from mortgage).

What else can/should I do? Should I be reaching out asking for limit increases (soft pulls only)? Should I close the accounts that are small limits, high rates, and hurting my average age of accounts? Do I do nothing but keep paying on time and just let it ride? Thats basically all you need to do. I would close any accounts that are of no real use (low limits, annual fees, etc) and not even worry about AAoA. As long as you dont keep opening new accounts, your AAoA will keep growing. Hope to be there along side you in about 6 more years....

I would love to get my critical scores all >800 (this is a first for me, my financial situation has kept me <740 for almost 20 years).

I realize I am actually in fairly good shape...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Substantial progress in 5 years, and I want to continue...

Do nothing.

You can't cut AAofA by closing accounts. They all count opened or closed. I would not close anything. I would leave well enough alone and then prune the dead wood after you've got your mortgage.

The law of unintended consequences is huge in the credit field.

Also make sure you DO NOT pay off any installment loans between now and when your mortgage funds. That will cut your score 20 points.

You have what we call "first world problems." LOL