- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Re: This sooooo dont look right!!!!

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

This sooooo dont look right!!!!

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

This sooooo dont look right!!!!

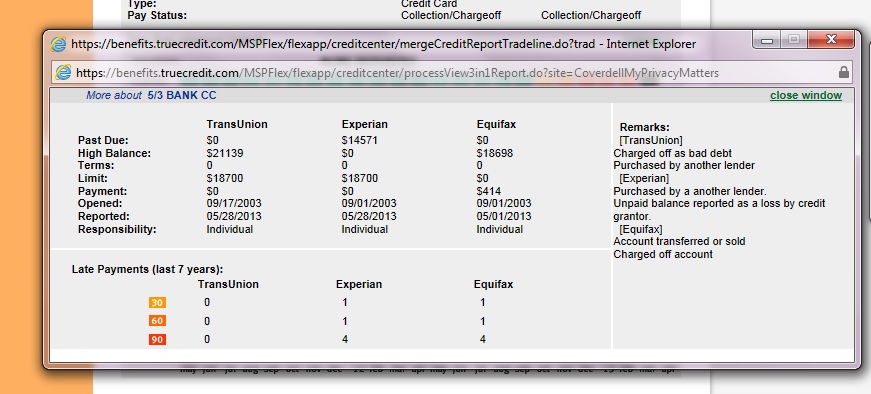

History: Was a CO with 5/3rd bank bought by Asset Accept;

I filed a dipute with EQ ( valid reason)but look at the 90 day lates... even if 5/3rd is has always been 4

Here is Before:

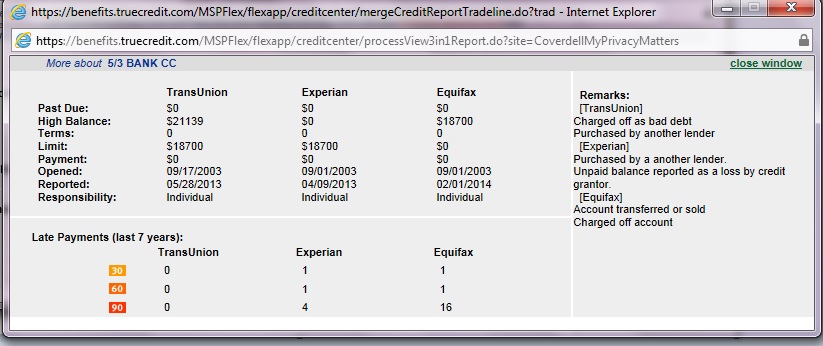

AFTER:

I realize they updated the report but really?? 16 90days can they do this?

12/4/12 TU 589 MyFico ~EQ 579 MyFico ~EX 577(Fako)

Myfico 8 scores

6/12/20 TU 803 ~ EQ 814~ Ex 784

My Wallet: Cap1 3,500K ~FH 2950~Credit One 1750~Credit one #2 1250~Orchard Bank 400 ~NFCU nRewards 18,000~NFCU Cash Rewards 18,500 ~Care Credit 12000~Discover 6000~Lowes 5450~ Amex 5400.00 ~ Harvest King 8000 ~ Langley~Penfed~Service CRU~red stone cru~

UTL 17%

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: This sooooo dont look right!!!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: This sooooo dont look right!!!!

5/3rd Bank is the OC who we had a CO with.

DOFD is 11/11 and they Charged off in June of 2012 And

SOLD the account to Asset Acceptance Company in May of 2013.

12/4/12 TU 589 MyFico ~EQ 579 MyFico ~EX 577(Fako)

Myfico 8 scores

6/12/20 TU 803 ~ EQ 814~ Ex 784

My Wallet: Cap1 3,500K ~FH 2950~Credit One 1750~Credit one #2 1250~Orchard Bank 400 ~NFCU nRewards 18,000~NFCU Cash Rewards 18,500 ~Care Credit 12000~Discover 6000~Lowes 5450~ Amex 5400.00 ~ Harvest King 8000 ~ Langley~Penfed~Service CRU~red stone cru~

UTL 17%

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: This sooooo dont look right!!!!

If those lates happened prior to the account being sold and they never updated, yes, once they did, all of those could be reported.

If any of the lates is after it was sold, no, they cannot.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: This sooooo dont look right!!!!

12/10 =30 days

1/11=60 day

2/11= 90 days ( 1 90 day late)

3/12= 12 months later would be 4 more 90 days lates

4/13= 12 more months (SOLD) would be 4 more 90 days lates

Total should only be 9 90 day lates at most not 16

12 months per yr div by 90 days ( 3months) =4 90 day lates

So with them adding more lates than what there should be how bad is this hurting since they updated it?

12/4/12 TU 589 MyFico ~EQ 579 MyFico ~EX 577(Fako)

Myfico 8 scores

6/12/20 TU 803 ~ EQ 814~ Ex 784

My Wallet: Cap1 3,500K ~FH 2950~Credit One 1750~Credit one #2 1250~Orchard Bank 400 ~NFCU nRewards 18,000~NFCU Cash Rewards 18,500 ~Care Credit 12000~Discover 6000~Lowes 5450~ Amex 5400.00 ~ Harvest King 8000 ~ Langley~Penfed~Service CRU~red stone cru~

UTL 17%

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: This sooooo dont look right!!!!

I think once you hit 90 days late the next month is 90 days unless you make a payment.Meaninging once it goes to 90 days it doesn't start over with 30 day lates unless you made a payment.. But I am not sure.