- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- UPDATE: DELETED! Last Item on Credit - inaccurat...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

UPDATE: DELETED! Last Item on Credit - inaccurate? Should I dispute? HELP PLS!

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

UPDATE: DELETED! Last Item on Credit - inaccurate? Should I dispute? HELP PLS!

Happy Friday! ![]()

Ok, so I've been in the process of paying all old accounts from when I went delinquent in 2011 off. All old CO's show a zero balance, even if sold to another lender and the associated collections have updated to $0 since I've paid them as well.

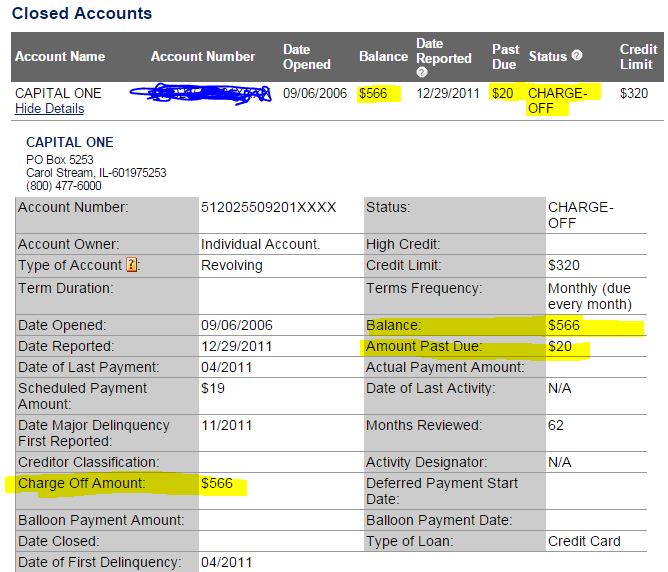

This is my LAST outstanding bad account that shows an outstanding balance on my EQ. It shows Cap 1 but it was actually an old HSBC Orchard Bank account that was Charged Off and then sold to Cavary Portfolio, whom I just paid off in the middle of August.

I don't understand how if it was CO and sold to another lender, how it can show a balance outstanding? All of my others went to $0 because it was sold. It doesn't seem fair that if they wrote it off and sold it and made some amount of money on the debt, that can still say there is the balance? I know someone else said before they can report this way.

I just want to confirm it wouldn't benefit me to Dispute and say balance should be ZERO? Can I do that? It is giving me OCD looking down my report seeing ZERO's for all the bad debt since I've paid it off and then this dumb $566.

BTW, I guess I should say that on my EX report it actually reports as HSBC (instead of Cap1) and shows CO but with no balance. And TU actually shows this account as Cap 1 but only the previous good history when I lost the card and re-issued... no history after it was re-issued and defaulted.

I'm not really worried about if I dispute and they bring it current w/ updated status date, as long as they update to $0 because I've experience some really nice credit score bumps from that.

PLEASE GIVE ME YOUR LOVELY ADVICE, I don't want to screw myself. Thank you!

5/15/19 -Discharged

Scores at Discharge: 550 EQ 471 TU 509 EXP (Last Updated 5/11)

5/16/19 - Rebuild Started - App'ed for Credit One - Approved for $2,000 starting line! (Increased to $2200 the following month)

6/7/19 - 606 EQ 544 TU 566 EXP - New CC reported w/ $75 Balance

12/10/19 - 616 EQ 581 TU 592 EXP

8/28/2021 - 698 EQ 670 TU 674EXP

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Last Item on Credit - is it inaccurate? Should I dispute? HELP PLS!

BUMP ![]()

5/15/19 -Discharged

Scores at Discharge: 550 EQ 471 TU 509 EXP (Last Updated 5/11)

5/16/19 - Rebuild Started - App'ed for Credit One - Approved for $2,000 starting line! (Increased to $2200 the following month)

6/7/19 - 606 EQ 544 TU 566 EXP - New CC reported w/ $75 Balance

12/10/19 - 616 EQ 581 TU 592 EXP

8/28/2021 - 698 EQ 670 TU 674EXP

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Last Item on Credit - is it inaccurate? Should I dispute? HELP PLS!

The creditor was required, per FCRA 623(a)(2), to have promptly updated the debt balance to $0 when they sold the debt.

If you are sure that the debt collector acutally owned the debt, then the OC reporing became inaccurate shortly after their sale of the debt, depenidng upon your interpretation of "promptly."

If the OC still owned the debt when you paid the debt collector, then they were required to have promptly updated ot $0 after notified by the debt collector that the debt was paid.

Thus, either way, if now paid, the debt balance being shown by the OC should be $0.

You can call the OC and make informal request that they promptly update, or you can file a formal dispute, either using hte direct dispute process or filing the dispute via the CRA First attempting informal correction could avoid posting of a pending dispute, which will temporarily effect your scoring.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Last Item on Credit - is it inaccurate? Should I dispute? HELP PLS!

@RobertEG wrote:The creditor was required, per FCRA 623(a)(2), to have promptly updated the debt balance to $0 when they sold the debt.

If you are sure that the debt collector acutally owned the debt, then the OC reporing became inaccurate shortly after their sale of the debt, depenidng upon your interpretation of "promptly."

If the OC still owned the debt when you paid the debt collector, then they were required to have promptly updated ot $0 after notified by the debt collector that the debt was paid.

Thus, either way, if now paid, the debt balance being shown by the OC should be $0.

You can call the OC and make informal request that they promptly update, or you can file a formal dispute, either using hte direct dispute process or filing the dispute via the CRA First attempting informal correction could avoid posting of a pending dispute, which will temporarily effect your scoring.

Thank you very much RobertEG for sharing your knowledge! I appreciate it. I will try that route first! =) Have a great Friday!

5/15/19 -Discharged

Scores at Discharge: 550 EQ 471 TU 509 EXP (Last Updated 5/11)

5/16/19 - Rebuild Started - App'ed for Credit One - Approved for $2,000 starting line! (Increased to $2200 the following month)

6/7/19 - 606 EQ 544 TU 566 EXP - New CC reported w/ $75 Balance

12/10/19 - 616 EQ 581 TU 592 EXP

8/28/2021 - 698 EQ 670 TU 674EXP

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Last Item on Credit - is it inaccurate? Should I dispute? HELP PLS!

So I called Cap 1 -- they can't find anything other than my current Cap 1 account in their systems. They transfer me to the HSBC division, who can pull up the acct and confirm it was sold to Calvary, who I paid off in June. I explain to her my issue and how it is reporting and she says, well you'll need to be transfered back tot he Capital One side if it's reporting in their name because that is their credit reporting and we can't update under them. And so I said, how is that supposed to happen when they can't even find record of the account (Ding ding![]() ) and she said, well if it's under their name and they can't validate the account then it can't be validated, because there is nothing that I can do if it is reporting that way.

) and she said, well if it's under their name and they can't validate the account then it can't be validated, because there is nothing that I can do if it is reporting that way.

SOOOOOOOOOOOOOO, that means, if I dispute the debt, Cap 1 won't be able to locate/validate and will have to be deleted correct? (Big Hopes!)

5/15/19 -Discharged

Scores at Discharge: 550 EQ 471 TU 509 EXP (Last Updated 5/11)

5/16/19 - Rebuild Started - App'ed for Credit One - Approved for $2,000 starting line! (Increased to $2200 the following month)

6/7/19 - 606 EQ 544 TU 566 EXP - New CC reported w/ $75 Balance

12/10/19 - 616 EQ 581 TU 592 EXP

8/28/2021 - 698 EQ 670 TU 674EXP

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Last Item on Credit - is it inaccurate? Should I dispute? HELP PLS!

@Shann0n_marie wrote:So I called Cap 1 -- they can't find anything other than my current Cap 1 account in their systems. They transfer me to the HSBC division, who can pull up the acct and confirm it was sold to Calvary, who I paid off in June. I explain to her my issue and how it is reporting and she says, well you'll need to be transfered back tot he Capital One side if it's reporting in their name because that is their credit reporting and we can't update under them. And so I said, how is that supposed to happen when they can't even find record of the account (Ding ding

) and she said, well if it's under there name and they can't validate the account then it can't be validated, because there is nothing that I can do if it is reporting that way.

SOOOOOOOOOOOOOO, that means, if I dispute the debt, Cap 1 won't be able to locate/validate and will have to be deleted correct? (Big Hopes!)

You can certainly dispute due to its errors in reporting as its been sold and should have been updated to a 0 balance when they did sell it. I will also give a word of warning frontline CSRs dont always find all accounts if its disputed their backdoor archive people may very well locate the debt and when it is updated to 0 balance since it hasnt updated since 2011 its going to give you a FICO score ding as it will look like a new CO in the eyes of Fico. a different approach might be to dispute it directly with Cap-1 instead of going the CRA route. Tough call you have here with this one.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Last Item on Credit - is it inaccurate? Should I dispute? HELP PLS!

@gdale6 wrote:

@Shann0n_marie wrote:So I called Cap 1 -- they can't find anything other than my current Cap 1 account in their systems. They transfer me to the HSBC division, who can pull up the acct and confirm it was sold to Calvary, who I paid off in June. I explain to her my issue and how it is reporting and she says, well you'll need to be transfered back tot he Capital One side if it's reporting in their name because that is their credit reporting and we can't update under them. And so I said, how is that supposed to happen when they can't even find record of the account (Ding ding

) and she said, well if it's under there name and they can't validate the account then it can't be validated, because there is nothing that I can do if it is reporting that way.

SOOOOOOOOOOOOOO, that means, if I dispute the debt, Cap 1 won't be able to locate/validate and will have to be deleted correct? (Big Hopes!)

You can certainly dispute due to its errors in reporting as its been sold and should have been updated to a 0 balance when they did sell it. I will also give a word of warning frontline CSRs dont always find all accounts if its disputed their backdoor archive people may very well locate the debt and when it is updated to 0 balance since it hasnt updated since 2011 its going to give you a FICO score ding as it will look like a new CO in the eyes of Fico. a different approach might be to dispute it directly with Cap-1 instead of going the CRA route. Tough call you have here with this one.

Thanks gdale6... so would the best route be to dispute it directly wit Cap 1 in writing (since ovbiously I can't do via the phone since they don't have the records?) I called Cap 1 twice yesterday and talked to 2 different people who checked and couldn't find accounts. They directed me to the dispute dept, who I called this morning and was able to locate them after transferring me to HSBC. So, I'm wondering if a dispute via writing (would that be a Direct Dispute?) would result in any change?

Latstly, this isn't something the EO could help me on since it isn't a satisfactory acct right? And will the update to my credit to a 0 balance cause harm because it re-reports as a charge off? Because I just paid quite a few charge offs of cc's that weren't sold to another lender, so when I paid them, it updated to a Paid after Charge Off, which actually gave my credit scores a boost. Perhaps it had something to do with utilization but I have an already low utilization of about 5% and tons of credit available.

I do want to make sure that I'm causing more harm than good, I just feel so good now that everything is cleared up and my report doesn't show any unpaid balances from past credit issues.

5/15/19 -Discharged

Scores at Discharge: 550 EQ 471 TU 509 EXP (Last Updated 5/11)

5/16/19 - Rebuild Started - App'ed for Credit One - Approved for $2,000 starting line! (Increased to $2200 the following month)

6/7/19 - 606 EQ 544 TU 566 EXP - New CC reported w/ $75 Balance

12/10/19 - 616 EQ 581 TU 592 EXP

8/28/2021 - 698 EQ 670 TU 674EXP

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Last Item on Credit - is it inaccurate? Should I dispute? HELP PLS!

@Shann0n_marie wrote:

@gdale6 wrote:

@Shann0n_marie wrote:So I called Cap 1 -- they can't find anything other than my current Cap 1 account in their systems. They transfer me to the HSBC division, who can pull up the acct and confirm it was sold to Calvary, who I paid off in June. I explain to her my issue and how it is reporting and she says, well you'll need to be transfered back tot he Capital One side if it's reporting in their name because that is their credit reporting and we can't update under them. And so I said, how is that supposed to happen when they can't even find record of the account (Ding ding

) and she said, well if it's under there name and they can't validate the account then it can't be validated, because there is nothing that I can do if it is reporting that way.

SOOOOOOOOOOOOOO, that means, if I dispute the debt, Cap 1 won't be able to locate/validate and will have to be deleted correct? (Big Hopes!)

You can certainly dispute due to its errors in reporting as its been sold and should have been updated to a 0 balance when they did sell it. I will also give a word of warning frontline CSRs dont always find all accounts if its disputed their backdoor archive people may very well locate the debt and when it is updated to 0 balance since it hasnt updated since 2011 its going to give you a FICO score ding as it will look like a new CO in the eyes of Fico. a different approach might be to dispute it directly with Cap-1 instead of going the CRA route. Tough call you have here with this one.

Thanks gdale6... so would the best route be to dispute it directly wit Cap 1 in writing (since ovbiously I can't do via the phone since they don't have the records?) I called Cap 1 twice yesterday and talked to 2 different people who checked and couldn't find accounts. They directed me to the dispute dept, who I called this morning and was able to locate them after transferring me to HSBC. So, I'm wondering if a dispute via writing (would that be a Direct Dispute?) would result in any change?

Latstly, this isn't something the EO could help me on since it isn't a satisfactory acct right? And will the update to my credit to a 0 balance cause harm because it re-reports as a charge off? Because I just paid quite a few charge offs of cc's that weren't sold to another lender, so when I paid them, it updated to a Paid after Charge Off, which actually gave my credit scores a boost. Perhaps it had something to do with utilization but I have an already low utilization of about 5% and tons of credit available.

I do want to make sure that I'm causing more harm than good, I just feel so good now that everything is cleared up and my report doesn't show any unpaid balances from past credit issues.

I think you meant that you want to make sure you dont cause more harm than good. ![]()

HSBC cant do anything they are not the ones who are reporting it, each creditor is responsible for what they report. What I would do is send Cap-1 a direct dispute with a copy of that TL on your CR requesting it either be removed or updated with the correct info. Its still a tough call either way you go, if it just gets updated its going to cause a Fico score drop your best outcome is the deletion but its not required by law they just have to correct any errors in reporting.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Last Item on Credit - is it inaccurate? Should I dispute? HELP PLS!

@gdale6 wrote:

@Shann0n_marie wrote:

@gdale6 wrote:

@Shann0n_marie wrote:So I called Cap 1 -- they can't find anything other than my current Cap 1 account in their systems. They transfer me to the HSBC division, who can pull up the acct and confirm it was sold to Calvary, who I paid off in June. I explain to her my issue and how it is reporting and she says, well you'll need to be transfered back tot he Capital One side if it's reporting in their name because that is their credit reporting and we can't update under them. And so I said, how is that supposed to happen when they can't even find record of the account (Ding ding

) and she said, well if it's under there name and they can't validate the account then it can't be validated, because there is nothing that I can do if it is reporting that way.

SOOOOOOOOOOOOOO, that means, if I dispute the debt, Cap 1 won't be able to locate/validate and will have to be deleted correct? (Big Hopes!)

You can certainly dispute due to its errors in reporting as its been sold and should have been updated to a 0 balance when they did sell it. I will also give a word of warning frontline CSRs dont always find all accounts if its disputed their backdoor archive people may very well locate the debt and when it is updated to 0 balance since it hasnt updated since 2011 its going to give you a FICO score ding as it will look like a new CO in the eyes of Fico. a different approach might be to dispute it directly with Cap-1 instead of going the CRA route. Tough call you have here with this one.

Thanks gdale6... so would the best route be to dispute it directly wit Cap 1 in writing (since ovbiously I can't do via the phone since they don't have the records?) I called Cap 1 twice yesterday and talked to 2 different people who checked and couldn't find accounts. They directed me to the dispute dept, who I called this morning and was able to locate them after transferring me to HSBC. So, I'm wondering if a dispute via writing (would that be a Direct Dispute?) would result in any change?

Latstly, this isn't something the EO could help me on since it isn't a satisfactory acct right? And will the update to my credit to a 0 balance cause harm because it re-reports as a charge off? Because I just paid quite a few charge offs of cc's that weren't sold to another lender, so when I paid them, it updated to a Paid after Charge Off, which actually gave my credit scores a boost. Perhaps it had something to do with utilization but I have an already low utilization of about 5% and tons of credit available.

I do want to make sure that I'm causing more harm than good, I just feel so good now that everything is cleared up and my report doesn't show any unpaid balances from past credit issues.

I think you meant that you want to make sure you dont cause more harm than good.

HSBC cant do anything they are not the ones who are reporting it, each creditor is responsible for what they report. What I would do is send Cap-1 a direct dispute with a copy of that TL on your CR requesting it either be removed or updated with the correct info. Its still a tough call either way you go, if it just gets updated its going to cause a Fico score drop your best outcome is the deletion but its not required by law they just have to correct any errors in reporting.

Thanks, I'll let you guys know the outcome!

5/15/19 -Discharged

Scores at Discharge: 550 EQ 471 TU 509 EXP (Last Updated 5/11)

5/16/19 - Rebuild Started - App'ed for Credit One - Approved for $2,000 starting line! (Increased to $2200 the following month)

6/7/19 - 606 EQ 544 TU 566 EXP - New CC reported w/ $75 Balance

12/10/19 - 616 EQ 581 TU 592 EXP

8/28/2021 - 698 EQ 670 TU 674EXP

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Last Item on Credit - is it inaccurate? Should I dispute? HELP PLS!

Update!! Dispute results came back within a few days -- DELETED from my reports!

![]() Thanks everyone!!!

Thanks everyone!!!

5/15/19 -Discharged

Scores at Discharge: 550 EQ 471 TU 509 EXP (Last Updated 5/11)

5/16/19 - Rebuild Started - App'ed for Credit One - Approved for $2,000 starting line! (Increased to $2200 the following month)

6/7/19 - 606 EQ 544 TU 566 EXP - New CC reported w/ $75 Balance

12/10/19 - 616 EQ 581 TU 592 EXP

8/28/2021 - 698 EQ 670 TU 674EXP