- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- *** UPDATE **** I think my strategy worked!!!

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

*** UPDATE **** I think my strategy worked!!!

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

*** UPDATE **** I think my strategy worked!!!

So this is for my DH, he has 2 collections on EX and 1 on EQ... None on TU.

1 of the collections is from ID theft, the other is a bill from a law office he used during divorce, but he never received a final bill for $396 for the lawyer... We are thinking they sent the bill to his old house, which his wife got in the divorce. Keep in mind that he paid them over $3k during the course of this divorce

While reviewing his free annual credit reports, he discovered this this collection for $396 OC is a Law Office and the collection agency is MARS Inc..

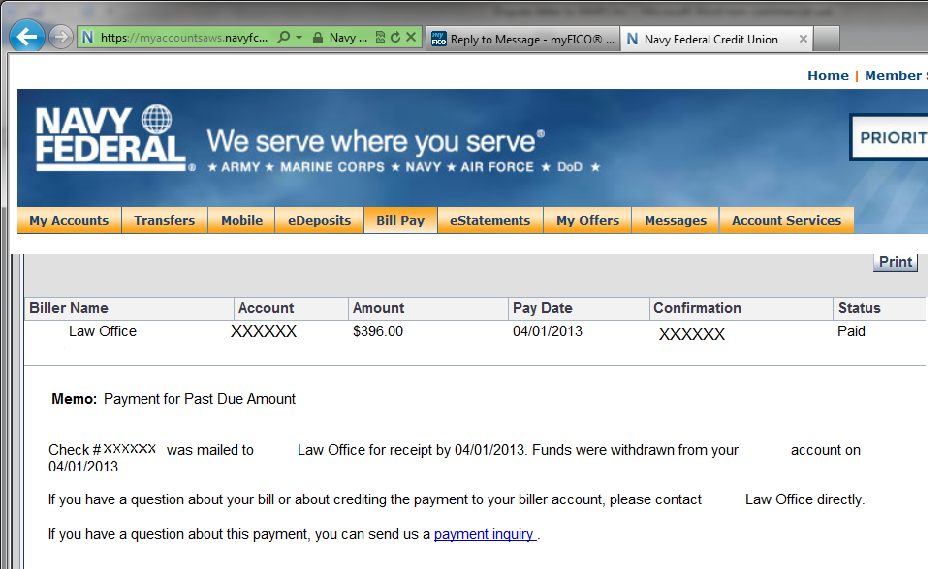

We used NFCU bill pay service to send the $396 to the Law Office. The item that appears on his report is from MARS Inc.

So, we received confirmation of the payment to the LAW Office on 4/1/13

Today we mailed out this letter to the Law Office.

Name

Address

City State Zip

Law Office

Address

City, State Zip

Re: Acct # **** with MARS Inc. for _____ Law Office

To Whom It May Concern:

I am sending this letter to you in response to a negative account listed on my consumer credit report. The account is listed as follows:

M.A.R.S.INC | |||

| Account No.: | ***** | |

| Original Creditor: | LAW OFFICE | |

| Responsibility: | Individual | |

| Original Balance: |

| |

| Balance: | $396 | |

| Date Opened: |

|

Be advised, this is not a refusal to pay, but a notice sent pursuant to the Fair Debt Collection Practices Act, 15 USC 1692g Sec. 809 (b) that your claim is disputed and validation is requested.

This is NOT a request for "verification" or proof of my mailing address, but a request for VALIDATION made pursuant to the above named Title and Section. I respectfully request that your office provide me with competent evidence that I have any legal obligation to pay you.

Please provide me with the following:

- What the money you say I owe is for;

- Proof that you attempted to notify me of a debt owed prior to reporting of such information on my consumer credit report, as required by law

- Explain and show me how you calculated what you say I owe;

- Provide me with copies of any papers that show I agreed to pay what you say I owe;

- Identify the original creditor;

- Prove the Statute of Limitations has not expired on this account;

- Show me that you are licensed to collect in my state; and

- Provide me with your license numbers and Registered Agent.

Please Note: I have paid the amount of $396 to Law Office via my online Bill Pay service, therefore, I insist that a debt is no longer owed. I am enclosing documentation to that effect, and have sent this documentation to MARS Inc. as well.

If your offices continue to report this information to any of the three major Credit Bureau's (Equifax, Experian or TransUnion), or to any other collection agency; said action might constitute fraud under both Federal and State Laws, since I do not owe your office any money. Due to this fact, if any negative mark is found on any of my credit reports by your company or the company that you represent I will not hesitate in bringing legal action against you for the following:

- Violation of the Fair Credit Reporting Act

- Violation of the Fair Debt Collection Practices Act

- Defamation of Character

If your offices are able to provide the proper documentation as requested, I will require at least 30 days to investigate this information and during such time all collection activity must cease and desist.

Also during this validation period, if any action is taken which could be considered detrimental to any of my credit reports, I will consult with legal counsel. This includes any information to a credit reporting repository that could be inaccurate or invalidated or verifying an account as accurate when in fact there is no provided proof that it is.

If your offices fail to respond to this validation request within 30 days from the date of your receipt, all references to this account must be deleted and completely removed from my credit file and a copy of such deletion request shall be sent to me immediately.

I would also like to request, in writing, that no telephone contact be made by your offices to my home or to my place of employment. If your offices attempt telephone communication with me, including but not limited to computer generated calls or correspondence sent to any third parties, it will be considered harassment and I will have no choice but to file suit. All future communications with me MUST be done in writing and sent to the address noted in this letter.

Best Regards,

Webhopper's husband

Filed Chapter 13 on 6/1/2017 after job loss. Discharged 6/1/2022.

Goal: Gardening!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What do you think of this strategy? MARS Inc.

And sent this letter to MARS Inc.

Name

Address

City State Zip

MARS Inc

Address

City State Zip

Re: Acct # ****** with MARS Inc. for Law Office

To Whom It May Concern:

I am sending this letter to you in response to a negative account listed on my consumer credit report. The account is listed as follows:

M.A.R.S.INC | |||

| Account No.: | XXXXX | |

| Original Creditor: | LAW OFFICE | |

| Responsibility: | Individual | |

| Original Balance: |

| |

| Balance: | $396 | |

| Date Opened: | 05/2011 |

Be advised, this is not a refusal to pay, but a notice sent pursuant to the Fair Debt Collection Practices Act, 15 USC 1692g Sec. 809 (b) that your claim is disputed and validation is requested.

This is NOT a request for "verification" or proof of my mailing address, but a request for VALIDATION made pursuant to the above named Title and Section. I respectfully request that your office provide me with competent evidence that I have any legal obligation to pay you.

Please provide me with the following:

- What the money you say I owe is for;

- Proof that you attempted to notify me of a debt owed prior to reporting of such information on my consumer credit report, as required by law

- Explain and show me how you calculated what you say I owe;

- Provide me with copies of any papers that show I agreed to pay what you say I owe;

- Identify the original creditor;

- Prove the Statute of Limitations has not expired on this account;

- Show me that you are licensed to collect in my state; and

- Provide me with your license numbers and Registered Agent.

Please Note: I have paid the amount of $396 to Law Office via my online Bill Pay service, therefore, I insist that a debt is no longer owed. I am enclosing documentation to that effect, and have sent this documentation to Law Office as well.

If your offices continue to report this information to any of the three major Credit Bureau's (Equifax, Experian or TransUnion), or to any other collection agency; said action might constitute fraud under both Federal and State Laws, since I do not owe your office any money. Due to this fact, if any negative mark is found on any of my credit reports by your company or the company that you represent I will not hesitate in bringing legal action against you for the following:

- Violation of the Fair Credit Reporting Act

- Violation of the Fair Debt Collection Practices Act

- Defamation of Character

If your offices are able to provide the proper documentation as requested, I will require at least 30 days to investigate this information and during such time all collection activity must cease and desist.

Also during this validation period, if any action is taken which could be considered detrimental to any of my credit reports, I will consult with legal counsel. This includes any information to a credit reporting repository that could be inaccurate or invalidated or verifying an account as accurate when in fact there is no provided proof that it is.

If your offices fail to respond to this validation request within 30 days from the date of your receipt, all references to this account must be deleted and completely removed from my credit file and a copy of such deletion request shall be sent to me immediately.

I would also like to request, in writing, that no telephone contact be made by your offices to my home or to my place of employment. If your offices attempt telephone communication with me, including but not limited to computer generated calls or correspondence sent to any third parties, it will be considered harassment and I will have no choice but to file suit. All future communications with me MUST be done in writing and sent to the address noted in this letter.

Best Regards,

Webhoppers Husband

Filed Chapter 13 on 6/1/2017 after job loss. Discharged 6/1/2022.

Goal: Gardening!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What do you think of this strategy? MARS Inc.

Filed Chapter 13 on 6/1/2017 after job loss. Discharged 6/1/2022.

Goal: Gardening!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What do you think of this strategy? MARS Inc.

So, do you guys think this is the right strategy for us??

Filed Chapter 13 on 6/1/2017 after job loss. Discharged 6/1/2022.

Goal: Gardening!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What do you think of this strategy? MARS Inc.

@webhopper wrote:And sent this letter to MARS Inc.

Name

Address

City State Zip

MARS Inc

AddressCity State Zip

Re: Acct # ****** with MARS Inc. for Law Office

To Whom It May Concern:

I am sending this letter to you in response to a negative account listed on my consumer credit report. The account is listed as follows:

M.A.R.S.INC

Account No.:

XXXXX

Original Creditor:

LAW OFFICE

Responsibility:

Individual

Original Balance:

Balance:

$396

Date Opened:

05/2011

Be advised, this is not a refusal to pay, but a notice sent pursuant to the Fair Debt Collection Practices Act, 15 USC 1692g Sec. 809 (b) that your claim is disputed and validation is requested.

This is NOT a request for "verification" or proof of my mailing address, but a request for VALIDATION made pursuant to the above named Title and Section. I respectfully request that your office provide me with competent evidence that I have any legal obligation to pay you.

Please provide me with the following:

- What the money you say I owe is for;

- Proof that you attempted to notify me of a debt owed prior to reporting of such information on my consumer credit report, as required by law

- There is no law that says they have to noftify you prior to reporting.

- Explain and show me how you calculated what you say I owe;

- Provide me with copies of any papers that show I agreed to pay what you say I owe; They don't have to do this.

- Identify the original creditor;

- Prove the Statute of Limitations has not expired on this account; They aren't required to prove this

- Show me that you are licensed to collect in my state; and No requirement

- Provide me with your license numbers and Registered Agent. No requirement

Please Note: I have paid the amount of $396 to Law Office via my online Bill Pay service, therefore, I insist that a debt is no longer owed. I am enclosing documentation to that effect, and have sent this documentation to Law Office as well.

If your offices continue to report this information to any of the three major Credit Bureau's (Equifax, Experian or TransUnion), or to any other collection agency; said action might constitute fraud under both Federal and State Laws, since I do not owe your office any money. Due to this fact, if any negative mark is found on any of my credit reports by your company or the company that you represent I will not hesitate in bringing legal action against you for the following:

- Violation of the Fair Credit Reporting Act

- Violation of the Fair Debt Collection Practices Act

- Defamation of Character

If your offices are able to provide the proper documentation as requested, I will require at least 30 days to investigate this information and during such time all collection activity must cease and desist.

Also during this validation period, if any action is taken which could be considered detrimental to any of my credit reports, I will consult with legal counsel. This includes any information to a credit reporting repository that could be inaccurate or invalidated or verifying an account as accurate when in fact there is no provided proof that it is.

If your offices fail to respond to this validation request within 30 days from the date of your receipt, all references to this account must be deleted and completely removed from my credit file and a copy of such deletion request shall be sent to me immediately.

I would also like to request, in writing, that no telephone contact be made by your offices to my home or to my place of employment. If your offices attempt telephone communication with me, including but not limited to computer generated calls or correspondence sent to any third parties, it will be considered harassment and I will have no choice but to file suit. All future communications with me MUST be done in writing and sent to the address noted in this letter.

Best Regards,

Webhoppers Husband

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What do you think of this strategy? MARS Inc.

I am confused as to what you are attempting to get out of the letters. You paid the debt - so why do you now need validation/verification? They are not required to remove the tradeline just because you paid the account... I think it would have been better to just GW them rather than threaten them. However, I am still new to this so that is just my opinion.

Rebuilding Scores: EQ (MyFico): 597 (6/11/13) TU (MyFico): 606 (6/12/13)

Current Scores: EQ : 665 TU : 649 EX : 704

Cards: SDFCU $250 | Cap1 Secured $750 | Victorias Secret $500 | Amex BCE $4k | Chase FU $2k | Cap1 QS $1k | PenFed Promise $3.5k | Wayfair $1k | Care Credit $1k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What do you think of this strategy? MARS Inc.

Considering that DH never received a bill or a phone call regarding the alleged debt, he is quite pissed.... especially if they sent the bill to the house which the attorney knows was granted to ex-wife in divorce.

A better solution would have been to phone him up, get an updated address, and send a bill... Keep in mind that my husband had already paid thousands, so $396 is not a big deal if he actually knew about it, it could have been paid and avoided this whole CA scenario

Anyways, there is no debt remaining hopefully, and if there were that's fine, but DH needs to have the documentation.

The $396 is fine, its a drop in the bucket so to speak.... the fact that there is a collection on his credit is infinitely worse.

Hopefully since there is no debt, there will be nothing to validate, and the CA will stop reporting.

We do know that this CA in particular does not own the debt, they just collect on behalf of the OC.

Ideally, since there is no debt, and nothing was actually paid to the CA there will be a deletion of this on the Credit Report.

Filed Chapter 13 on 6/1/2017 after job loss. Discharged 6/1/2022.

Goal: Gardening!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What do you think of this strategy? MARS Inc.

Just because the OC was paid they do not have to delete their TL. No regulations or laws say they do.

When they acquired the debt, there was a debt owed them. Whether or not it was on behalf of the OC or not. All they really have to do is update to paid and closed.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What do you think of this strategy? MARS Inc.

Maybe my thinking is flawed... ![]() I don't know much about CA's other than that if you pay the OC, then there shouldn't be a collection anymore, and the CA is not involved at that point

I don't know much about CA's other than that if you pay the OC, then there shouldn't be a collection anymore, and the CA is not involved at that point

Filed Chapter 13 on 6/1/2017 after job loss. Discharged 6/1/2022.

Goal: Gardening!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What do you think of this strategy? MARS Inc.

@guiness56 wrote:Just because the OC was paid they do not have to delete their TL. No regulations or laws say they do.

When they acquired the debt, there was a debt owed them. Whether or not it was on behalf of the OC or not. All they really have to do is update to paid and closed.

I see, thanks for the explanation.

I had received a collection notice on a phone bill that I had co-signed for a friend once upon a time... ( I know its bad to co-sign, but I did co-sign knowing that I might one day be responsible for a bill)

So anyways, I called up the phone company, asked them about the charges, and then paid them over the phone with my credit card, then sent DV to the collection agency, and they wrote back saying that the collection was withdrawn, no debt owed.

Filed Chapter 13 on 6/1/2017 after job loss. Discharged 6/1/2022.

Goal: Gardening!