- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- US Dept of Education help

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

US Dept of Education help

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

US Dept of Education help

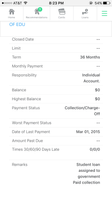

I recently posted about a CK FAKO score drop after an old (3 years) item was updated to say "paid collection"

I'm not sure what (if any) this has on my FICO however, I would like some advice on how to potentially get this removed.

Basically I had a grant overpayment that I didn't even know about until I received a letter from the US dept of Education. This was over 3 years ago. I immediately called and paid the total (around $150) and was told nothing would be reported to credit bureaus since I paid immediately. Well obviously it was reported, but never seemed to have a negative effect as it only said $0 and "student loan assigned to government"

Well fast forward over three years later, the account was updated on 8/5/2017 and the comment "paid collection" was added.

I also noticed it says the "term" is 36 months?? There was NEVER a "term". It was simply a letter from US Dept of edu. Staying I owed money and needed to pay before it was reported.

At this point I would really like to have this removed but I don't know how to go about this.

I have learned not to dispute things..although I'm wondering if it's not the best course of action in this instance? Should I contact them? The credit bureau? At this point I don't even know when this would be removed? Why update it with a comment after three years? I'm so confused!

Any advice is much appreciated! Thank you!

I will attempt to add CK screenshots

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: US Dept of Education help

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: US Dept of Education help

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: US Dept of Education help

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: US Dept of Education help

I have a similar situation on my credit report. Long story short, disputing it made the situation worse. I sent a "goodwill" delete letter a few weeks ago but haven't seen any results from that. If I don't get a response from the goodwill letter, I'm going to try disputing it again. I can let you know the outcome. Oddly, this account is only reported to Equifax and Experian. My Transunion score has always been at least 20 points higher-- so I believe it does have an impact on my credit score. I've included more details about my situation below if you're curious.

Details:

I received a Pell Grant for Spring semester a few years ago. I reduced the amount of classes I was taking which resulted in an overpayment. I found out about the overpayment when registering for Fall classes and paid it off in full. I didn't think about it again until I went to buy a house a few years later. There was an account from the U.S. Dept of Education reporting as closed but with a balance. I mistakenly thought it was one of my student loans-- they had both been transferred to Navient-- and that they had failed to update the account when it was transferred.

I called the U.S. Dept of Education and tried talking to them but was told there was nothing they could do except provide a letter that there was no balance on the account. Super helpful, right?

I then proceeded to dispute the account with the credit agencies (still thinking this was a transferred student loan). I don't recall the reason I selected for dispute but it came back as "updated." They updated it to "collection" and 120 days late. Gee, thanks guys. I called the Dept of Education again and finallly figured out this was a Pell Grant Overpayment. Many more phone calls, arguing with supervisors, etc and the best result I could get was "paid collection" with the 120 day late notation. This was good enough for me to get a mortgage with a decent rate so I dropped it and moved on with my life. This was almost 2 years ago.

Flash forward to last month, and the morons have "updated" my status from 120 days late to "failure to pay." My EQ and EX scores both dropped almost 30 points. The notes sections still says "paid collection." It's been almost 4 years since the initial overpayment but that change in status obviously hurt my scores. This is the only negative item on my credit reports.

My Overpayment account is with Direct Loan Servicing (aka U.S. Department of Education) with a Texas address listed in the details. I understand that they are no longer a provider of student loans/financial aid and that they're technically "closed" although they seem to still manage some accounts. I wonder if these sudden changes in reporting are a last grab before they really close the doors.

I will let you know if I have any success with either the Goodwill letter of disputing (again) through the credit agencies.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: US Dept of Education help

I recently had some old negative US Dept of Education loans that was added and updated to my credit report, it dropped my score by 25 points. They were only updated on Transunion. I wonder what is going on with the old loans suddely updating. I'm afraid to dispute for making things worse and they start collections.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: US Dept of Education help

This is exactly my same situation. I get a notification of derogatory on CR. Dept of Ed is reporting a pell overpayment of $183 owed from 2013. I paid that, however now they are reporting it as paid as agreed with 36 payments showing from 7/14 to 7/17. WRONG. I never made any payments. With the way they have it reported, it would have my first delinquency as 8/17, when it should be 2/2013. Getting them to correct this has been nothing but problems with no one that is helping. DOES ANYONE HAVE ANY ADVICE FOR ME? WHAT CAN I DO?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: US Dept of Education help

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: US Dept of Education help

Honestly I am not trying to fight it but it would’ve been nice for them to not lie about it reporting. Also noted it reported over a year after the payment was made.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: US Dept of Education help

I've filed a complaint with the US Dept of Education. After talking with a manager at Experian, she stated that DofE can't report false information. She has already pulled my first dispute out that they verified as information is correct and updated. Not at all true. I wrote a to DofE again today, advising them that this account should be reported as a collection. Then showing that day being the date of delenquency. Erase 36 month contract as that is absolutely false. In notes, they need to state that this is a pell overpayment that was assigned to DofE for collection. The letter was sent to Experian, and they have included it with a dispute filed again today. If they do not update and provide accurate information within 30 days, Experian will delete the account. I'll let you know if I have any success with this.