- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Re: What is a healthy number of cards to build wit...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

What is a healthy number of cards to build with?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What is a healthy number of cards to build with?

@guiness56 wrote:You want overall utilization to be at 9% or under.

Ok great. And just to make sure I completely understand, I want to use less than 9% of my overall available credit, and I can do this on one card.

i.e. If I have 4 cards (each with $100 available credit) = $400 total available credit.

I should spend for example $28 (7%) per month, and I can put that all on 1 card while keeping the other 3 at a zero balance.

Would this be correct?

Thanks again.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What is a healthy number of cards to build with?

In that situation, you would have one card at 28% UTL with all others at zero, making an overall 7% UTL rating. That scenario might work, but I'm not sure if the UTL is per card or per report. If the former, you would still have one TL reporting at 28% (anything above 30 is considered maxed out). I've heard the best thing to do is never let the card report at more than 9% for any TL listed, so you might want to bring the balance down on that one card to 9% or less.

Starting Score: TU 486 | EX 510 | EQ ???

Starting Score: TU 486 | EX 510 | EQ ???Current Score: TU 486 | EX 510 | EQ ???

Goal Score: 700

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What is a healthy number of cards to build with?

The more cards the better when you're building/rebuilding, in general. You already have 4 cards, which is plenty to start with. Perhaps wait several months for your scores to go up before you applying for another card. Having two many new accounts in addition to baddies may trigger credit limit decreases.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What is a healthy number of cards to build with?

@subzeroepsilon wrote:In that situation, you would have one card at 28% UTL with all others at zero, making an overall 7% UTL rating. That scenario might work, but I'm not sure if the UTL is per card or per report. If the former, you would still have one TL reporting at 28% (anything above 30 is considered maxed out). I've heard the best thing to do is never let the card report at more than 9% for any TL listed, so you might want to bring the balance down on that one card to 9% or less.

All cards are scored individually then you have the overall utilization. Anything above 30% is not maxed out, FICO will start dinging maxed out between 70 and 90% per card.

It isn't really the number of cards you have but how you manage them.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What is a healthy number of cards to build with?

By the way, your cards dont report well if you dont use them. so what would be best for all cards is if you have something (anything) on the card. SO you can buy a candybar with every card and hold that $2 balance every month. Its weird but had a guy who was super rich and aiming for the elusive 850 and he was at like 840 or something for years. Our credit advisor asked if he had paid off his cards. He had. He said he should hold a VERY small balance on his cards. In 3 months, he hit 850. Evidently if you dont utilize your card, it is not reported as being used for that month cycle

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What is a healthy number of cards to build with?

I will just add one thing. You mentioned that you wanted all your "hard pulls together" That only applies for rate shopping products, like installment loans (auto, etc.) and morgage accounts. So, each credit card you apply to will create a hard inquiry. The good news is that usually the credit card inquiries only pull from one credit bureau.

Current Score: TU 818 EX 815 EQ 807

Goal Score: 800

Take the FICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What is a healthy number of cards to build with?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What is a healthy number of cards to build with?

@mykalli wrote:

@guiness56 wrote:You want overall utilization to be at 9% or under.

Ok great. And just to make sure I completely understand, I want to use less than 9% of my overall available credit, and I can do this on one card.

i.e. If I have 4 cards (each with $100 available credit) = $400 total available credit.

I should spend for example $28 (7%) per month, and I can put that all on 1 card while keeping the other 3 at a zero balance.

Would this be correct?

Thanks again.

Not available credit but CL. You are keeping overall at 9% or below and not showing a 0 balance on all CC which FICO doesnt' like to see.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What is a healthy number of cards to build with?

@mykalli wrote:Hi all,

Quick question. Like most, I'm looking to build a strong, positive credit history. I'm wondering if I need to apply for one more card.

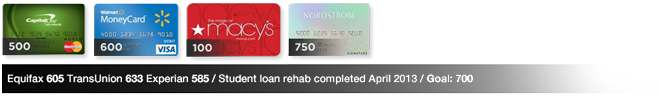

I currently have:

- CapitalOne Cash Rewards $500

- Walmart $600

- Macy's $100

- Nordstrom $750

I was considering getting one ore unsecured card. (CreditOne Platinum). My reasoning is to get all my hard pulls grouped closely so they may fall off together while I garden a healthy amount of credit movement. Not sure if there is a sweet spot. Afraid of too many, but also weary of too few slowing the process. Any assistance is appreciated!

Thank you

I have 9 and am an AU on 4 of my wifes CC's and my credit score is fairly decent.

I think its more about following the rules than having one or two too many, otherwise I should have been zapped for having too many by now, Id think. Instead I keep getting offers for more preapproved cards, loans of $25K or more and offers for upgrades on my cards (such as I just got a Capitol One upgrade offer today).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What is a healthy number of cards to build with?

@guiness56 wrote:

@subzeroepsilon wrote:In that situation, you would have one card at 28% UTL with all others at zero, making an overall 7% UTL rating. That scenario might work, but I'm not sure if the UTL is per card or per report. If the former, you would still have one TL reporting at 28% (anything above 30 is considered maxed out). I've heard the best thing to do is never let the card report at more than 9% for any TL listed, so you might want to bring the balance down on that one card to 9% or less.

All cards are scored individually then you have the overall utilization. Anything above 30% is not maxed out, FICO will start dinging maxed out between 70 and 90% per card.

It isn't really the number of cards you have but how you manage them.

Take the advice above. You want to use your cards, not just 1 card and let the other cards sit. Creditors want to see you actually use the card, and not just have a card, to have it,. Also fico scoring depends on if the card has activity on it and is paid off (shows payment history). One thing I realized with FICO scoring is it looks at your overall management of your cards and if you can responsibiliy use them and manage them in a way you stay under the 30% (10% ideal) . The more you have the UTL spread out, the better your FICO score will grow. a ZERO balance on card does nothin for you, I have been using the cards I have the last 2 months. When UTIL goes up, the score goes down, when UTIL goes down, score goes up.