- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- What's the deal with AmEx?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

What's the deal with AmEx?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What's the deal with AmEx?

@krmurrayjr10 wrote:

I believe around or just under 600. Aside from the chargeoffs, I think I'm still being held back partially by a bunch of inqs in recent months to get the accounts I have now (the BoA alone cost 2, plus 2 more for CapOne) and an AAoA of not even 1 year yet.

And, I don't know if the "maxed out" balance on one or more of the chargeoffs is figuring into it, too.

There's little I can do about any of these other than wait.

Inquiries don't "hold you back" to any great degree. they are the smallest portion of your scores, and only effect you for one year. You have much bigger issues - unpaid charge offs.

You have three cards needed for rebuilding. Forget any new cards for the next 6 months, and work on your derogatories. Settle the charge offs that are showing a balance with the OC - that most assuredly will help your scores. Unpaid charge offs are in the habit of spawning collections and judgments...

Grow the credit limits on the Cap One cards, and see what your scores are in six months.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What's the deal with AmEx?

So, my risk from a suit is near 0, and given how old they are already I'd prefer to let them fall off or do a PFD if I can get them to go low enough.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What's the deal with AmEx?

@krmurrayjr10 wrote:

All 3 of them are now with junk debt buyers and are at least 3-4 years old now. Two of them are for about $400 and one for $200. I know from personal experience that the junk debt buyers don't show up for their own suits in small claims court, and the SOL here in PA is 4 years ( and there's no wage garnishment in PA other than for support or the feds).

So, my risk from a suit is near 0, and given how old they are already I'd prefer to let them fall off or do a PFD if I can get them to go low enough.

Are the OC's reporting a balance or not - thats the key.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What's the deal with AmEx?

@krmurrayjr10 wrote:

All 3 of them are now with junk debt buyers and are at least 3-4 years old now. Two of them are for about $400 and one for $200. I know from personal experience that the junk debt buyers don't show up for their own suits in small claims court, and the SOL here in PA is 4 years ( and there's no wage garnishment in PA other than for support or the feds).

So, my risk from a suit is near 0, and given how old they are already I'd prefer to let them fall off or do a PFD if I can get them to go low enough.

A small reality check. Think about what you are saying vs what you are asking for.

On one hand, you are saying that even though you owe this money, you will do what you can to avoid paying it, because, well, its old stuff, yesterdays news.

On the other hand, you are asking someone to extend more credit to you because you have a history of being responsible and paying your debts.

Now, I'm not advocating going out and paying the old debts, though something this small, I would look at just taking care of them. I am suggesting that if you get denied credit that you realize it is caused by what is in your credit reports, your history. Most people here are here to learn how to move past this, correct it if they can, deal with it if it can't be fixed. While 3 small unpaid debts might seem minor to you, to creditors, they see one, might be okay, 2, perhaps, but at 3, it is a definite pattern.

Put yourself in the creditors shoes. Would you loan money to someone who has a history of not paying it back? Some people will, some won't. Amex is in the category of they won't.

Dan

Wait.... I think I just heard a heartbeat!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What's the deal with AmEx?

@redbeard wrote:

Put yourself in the creditors shoes. Would you loan money to someone who has a history of not paying it back? Some people will, some won't. Amex is in the category of they won't.

Dan

They won't loan money to someone with a history of paying it back too LOL... I filed Ch 13 and did exactly that.

AmEx, Chase, Discover, Citi... not BK friendly at all. If you burned them they blacklist you. I didn't burn any of them.

AmEx denied in 2013... 4 years after filing. Approved $5k Delta in 2014... 5 years after filing.

Discover denied in 2013... 4 years after filing. Approved $1500 in 2014... 5 years after filing.

Citi and Chase denied in 2013 and 2014... citing the Ch 13. Recon was also denied.

They'll be throwing cards at me in another 3-6 months when everything falls off my reports. Not worried about it either way... they aren't the only lenders out there and I've come this far without them already.

Hard INQs last 12 months: EQ: 5 | TU: 8 | EX: 9

Verizon Visa $8500 Amex Delta Reserve $10,000 Care Credit $18,000

NFCU CashRewards $7500 Apple Card $7000 Best Buy $8000 Amazon $5000

NFCU auto loan (2022 Ford Bronco Sport Badlands - Cactus Gray) 6.95%

NFCU motorcycle loan (2024 Harley Davidson Road Glide - Alpine Green & Chrome) 9.45%

Total CL: $64,000 --- Total CC UTI: 27% --- AAoA: 5.5 years --- Income: $200k

Last app: 4-6-24

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What's the deal with AmEx?

So you're refusing to pay debt that you owe and still expect AmEx to give you money?

Are we all doing this now? Is that a new trend somewhere? ![]()

Starting score May 2015 500's across the boards

Now - 610 EQ 598 TU 597 EX

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What's the deal with AmEx?

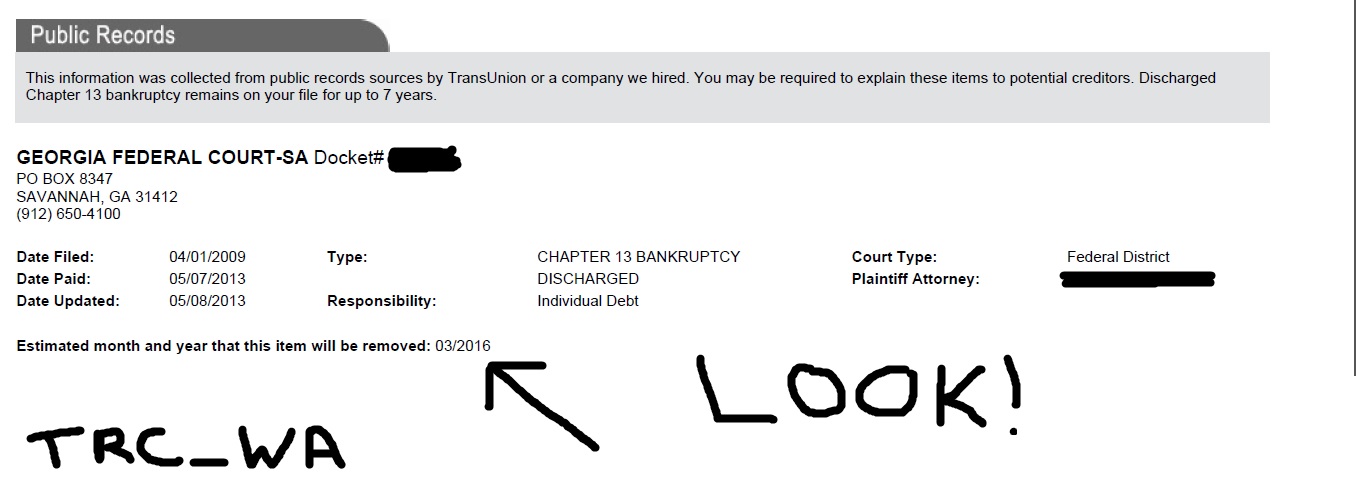

Oh... almost forgot.

I took these yesterday in response to a poster who claimed that he knew Discover and AmEx wouldn't touch people with a BR still on their reports and was calling people out for fabricating stories... as if I have a reason to do that on an internet forum.

![]()

Hard INQs last 12 months: EQ: 5 | TU: 8 | EX: 9

Verizon Visa $8500 Amex Delta Reserve $10,000 Care Credit $18,000

NFCU CashRewards $7500 Apple Card $7000 Best Buy $8000 Amazon $5000

NFCU auto loan (2022 Ford Bronco Sport Badlands - Cactus Gray) 6.95%

NFCU motorcycle loan (2024 Harley Davidson Road Glide - Alpine Green & Chrome) 9.45%

Total CL: $64,000 --- Total CC UTI: 27% --- AAoA: 5.5 years --- Income: $200k

Last app: 4-6-24

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What's the deal with AmEx?

PFD is often easier, and more negotiable when the debt is out of SOL. Since the debts are around 3+ years old, waiting a little longer may be worthwhile. However, in the meantime, the charge offs will continue to hurt your credit profile, and scores too, if one or more of them is frequently updating; Midland updates monthly like clockwork.

While CO balances count against utilization, it will make little difference in your situation due to the smallish amounts. A few decent limit cards will make up for the difference. High 600 scores is possible over time, which is good enough for many cards. Amex may be doable when your scores reach mid 600s with solid payment history on your current cards. After your scores exceed 650 or so, check Amex pre-approval site, which is a soft-pull, every month or so - you may be happily surprised.

With all that said, if you have an extra $1K or so to pay the debts, that may be the way to go verses waiting it out for years. You may get lucky with one or more of them agreeing to PFD or doing so afterwards with some follow-up; goodwill letters.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What's the deal with AmEx?

And I think it's a mistake to look at this with any greater sense of morality than the banks do. Their business is modeled on how much "y" they can get for "x", and when Mr. Jones applies for credit to fix his leaky roof and shelter his family, no one at the bank is thinking about the welfare of his children in deciding whether to give him a home equity loan. I'm just looking at it on the same level as they do: if I send $ to JDB Inc., what will I get in return?

Thus, my original question: what is the relative importance of 3 chargeoffs 4 years ago against a more recent period of clean history, or at what point (call it a score, if you will) are the chargeoffs not predictive?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What's the deal with AmEx?

@krmurrayjr10 wrote:

I would feel differently if these were still with the original creditors, but when the OCs sold them to the junk debt buyers, their interest in them disappeared, and it's now a matter of how much money, if any, the JDBs should receive when they themselves acquired the accounts for a few pennies.

And I think it's a mistake to look at this with any greater sense of morality than the banks do. Their business is modeled on how much "y" they can get for "x", and when Mr. Jones applies for credit to fix his leaky roof and shelter his family, no one at the bank is thinking about the welfare of his children in deciding whether to give him a home equity loan. I'm just looking at it on the same level as they do: if I send $ to JDB Inc., what will I get in return?

Thus, my original question: what is the relative importance of 3 chargeoffs 4 years ago against a more recent period of clean history, or at what point (call it a score, if you will) are the chargeoffs not predictive?

Actually, I have to say I don't really disgree with you on this. When it comes to paying collectors (JDBs), I look at it purely in terms of "whats in my best interest?" Any moral obligation, AFAIC, evaporates when the OC decides to sell my debt for pennies on the dollar - after that its simply a matter of whats best for me.

Sooo... again I ask, are ANY of the OCs reporting the charge-offs with an unpaid balance? That makes a difference in how you should proceed, IMO.

As for your question, you really do have to look at it from the perspective of the lender. Different lenders *do* have different standards regarding this - some put much more weight on recent history and will forgive past issues (like Capital One), while others put less weight on recent history.. AMEX is one that puts less. Both are business decisions and both are valid and work well for each company.