- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Re: What should my next move be?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

What should my next move be?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What should my next move be?

Hi all, still on my journey to improve my credit and just wanted to get some advice as to what I should do next.

Here's where I am:

As of 3/6/17 My Fico 8 scores. Hopefully they'll improve once my Cap1 QS starts reporting.

EX - 641

TU - 620

EQ - 633

I have an auto loan that I have had for 10 months, on time payments.

I have four store cards (via the SCT)

Overstock, Eddie Bauer, William Sonoma and Coldwater Creek all with very small SLs.

I just got approved for a Capital 1 QS card $300 (hasn't started reporting yet).

Current utilazation is down to 2%, which seems low to me, not sure.

Depending on the CRA, my AAoA ranges from 0.6 - 3.9 years.

My goal is to become a member of the 700 club ASAP. Any helpful suggestions will be appreciated.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What should my next move be?

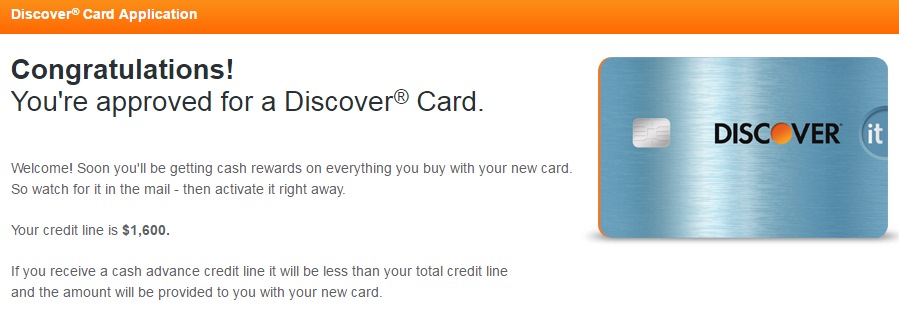

Our scores are very similar and I'm sure someone with much more experience will chime in with detailed suggestions but one idea would be to add one more bank card then garden the heck out of what you have for a while. I was recently approved for a Discover It card so you may have luck there. I hear the pre-approval is pretty worthless but I applied thinking I would take the secured card, if need be, to start building with them and was approved for $1200SL. YMMV but I'd recommend considering it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What should my next move be?

@Anonymous wrote:Hi all, still on my journey to improve my credit and just wanted to get some advice as to what I should do next.

Here's where I am:

As of 3/6/17 My Fico 8 scores. Hopefully they'll improve once my Cap1 QS starts reporting.

EX - 641

TU - 620

EQ - 633

I have an auto loan that I have had for 10 months, on time payments.

I have four store cards (via the SCT)

Overstock, Eddie Bauer, William Sonoma and Coldwater Creek all with very small SLs.

I just got approved for a Capital 1 QS card $300 (hasn't started reporting yet).

Current utilazation is down to 2%, which seems low to me, not sure.

Depending on the CRA, my AAoA ranges from 0.6 - 3.9 years.

My goal is to become a member of the 700 club ASAP. Any helpful suggestions will be appreciated.

You have the right pieces in place.

The next move is to be patient and wait.

If there's nothing left to get rid of or take care of on your reports, really all you can do is wait it out.

Spend time on the boards helping others get out of pits of sub-600 scores to feed your credit hobby and check in on your scores monthly. You'll see them start to grow bit by bit.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What should my next move be?

I would definitely say get another bank card. SCT cards will only give you toy limits and don't have a real ability to grow into real CL that you can use. You already have capital one... maybe try Discover? You are in that weird credit score that you are above most subprime cards but not big enough yet to get an AMEX. I got one of my credit cards through my local CU.

At the beginning of my rebuild I had SO add me as an AU to his accounts to raise my AAoA and show bigger credt lines.

Also with QS, make sure to ask for a CLI every 6 months.

Good job on your UTIL.

Current Scores: October 2017 EQ: 715 TU: 710 EX: 716

In My Wallet:

Cap1 QS: $4.8K - AMEX BCP: $4.2K - Old Navy Visa: $7K - Nordstrom $3.8K - VS $500 (FTW!)

BofA AU: $12K AMEX AU: $25K

Business: AMEX BCP $15K

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What should my next move be?

Thanks everybody for the replies and great suggestions. I know that I definitely want to get another bank card, just a bit gun shy about inquiries that don't convert. Also, I'm trying to decide if I want to refinance my car or upgrade to a new one. The interest rate on my auto loan is ridiculous, which I totally get given my credit situation last year. Are my scores strong enough for a decent refi?

Update: So, I decided to bite the bullet and apply for the Discover card. Yay, I was approved for the Discover It card! Now, I can relax and do a bit of gardening. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What should my next move be?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What should my next move be?

The highest weighted scoring category is your payment history.

Next steps in improving your payment history scoring requires knowledge of each of your payment history derogs, their type, age, and current status (still delinquent, or paid)

Include any charge-off or collection, along with its date of first delinquency, if known.