- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Re: When do settled accounts drop off credit repor...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

When do settled accounts drop off credit reports?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When do settled accounts drop off credit reports?

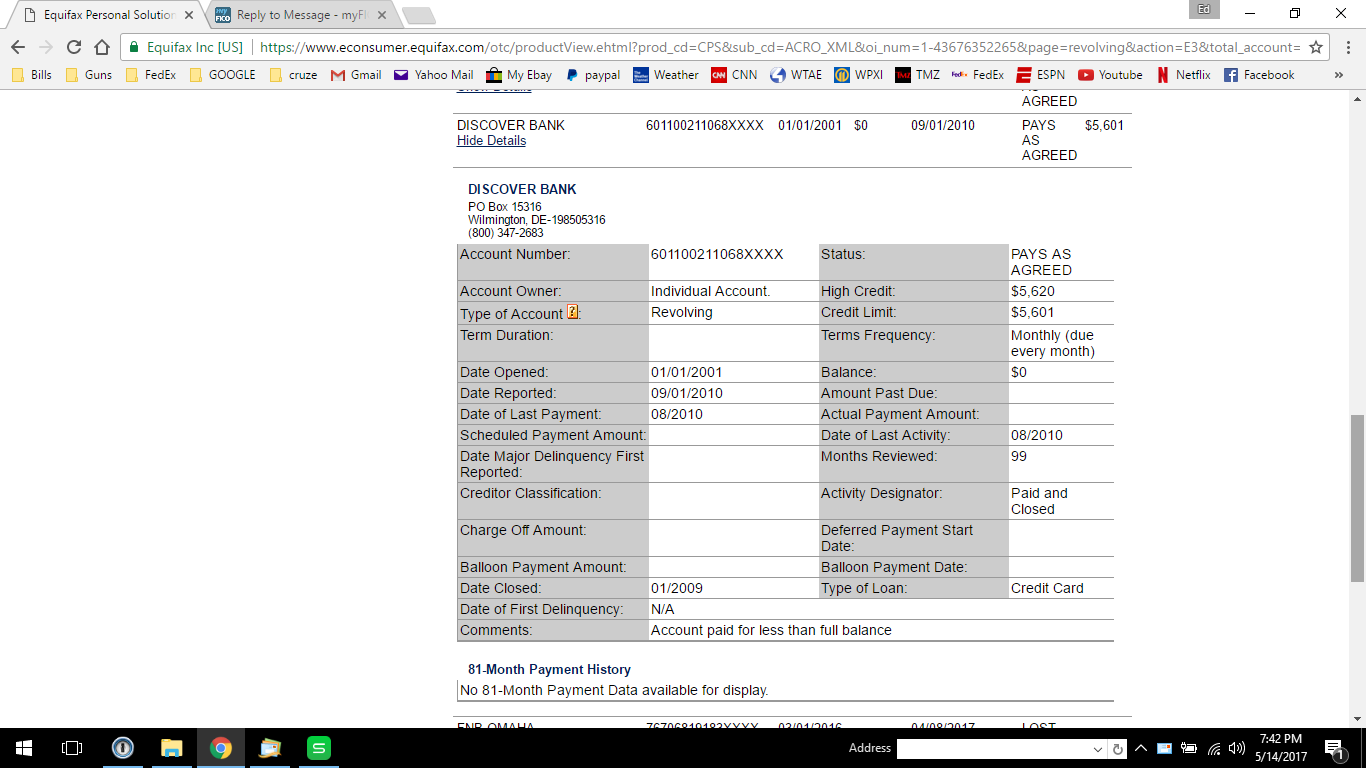

Discover card that i settled on. closed date 1/2009. last payment date 8/2010. last reported date 9/2010. on my credit report it shows "paid as agreed" but in the remarks it states "paid for less than full balance' Since the account is technically shown as current and paid, when will it drop off my report? will it be seven years since there is a derogatory remark or 10 years because it is shown as "pays as agreed" and from what date should it drop off; from the closed date, last payment date, or last reported date. if it should have already dropped off is this something that i can dispute or is it not worth it. thanks in advance

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: When do settled accounts drop off credit reports?

Credit report exclusion of OC account information applies only to adverse items of information reported on an account., More specifically, monthly delinquencies become excluded no later than 7 years from their date of occurence, and charge-offs no later than 7 years plus 180 days from the date of first delinquency.

The reporting of settled for less is an adverse item that should be excluded after 7 years from the settlement date per FCRA 605(a)(5).

The only time an entire account becomes excluded based on the FCRA is the case of an account with a reported charge-off that remains unpaid.

It qualifies for exclusion both of the CO and of the reporting of an unpaid debt, and thus the CRA will exclude the entire account.

Otherwise, once derogs have become excluded and the account is otherwise in good-standing, the account itself remains, and it will only be deleted if either the creditor explicitly reports deletion to the CRA, or the CRA exercises its subjective housecleaning policy at approx ten years after the date the account was closed.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: When do settled accounts drop off credit reports?

so. should the remark of "paid less than full balance" drop off that account after 7 years or is that stuck there cause the account is show paid current status. my EQ FICO is showing 60 points lower than TU and EX due to this remark.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: When do settled accounts drop off credit reports?

FCRA 605(a)(5) mandates that "any other adverse item of information" other than the four types specifically referenced in subsections 605(a)(1-4) must become excluded no later than 7 years from their occurence. It is a catch-all subsection that applies to any other adverse item of information.

A statement that an account was paid/settled for less the full amount of the debt is an adverse item of information, and has an exclusion date of no later than 7 years from the date of the adverse event (i.e., from the date the debt was settled).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: When do settled accounts drop off credit reports?

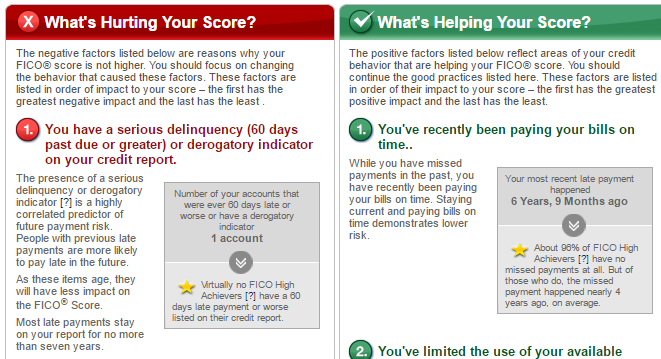

The thing that is weird too is that my EQ FICO score details show the dergatory indicator (the settled remark) and it shows a serious deliquency. But it also lists no negative items, every acccount opened or closed is in pays as full/current status. So where is the delinquncy???? it doesn't tell me what it is. I am assuming that it is the Discover card but it when you go to the details it shows nothing negative other than the settlement remark. it is bugging the heck out of me.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: When do settled accounts drop off credit reports?

here is what my equifax is saying. But if you go into the details to every single open or closed account there is not one account that shows late. they all show pays as agreed. The ONLY negative bit of info i can find is this on the discover card. but it shows no late payments either.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: When do settled accounts drop off credit reports?

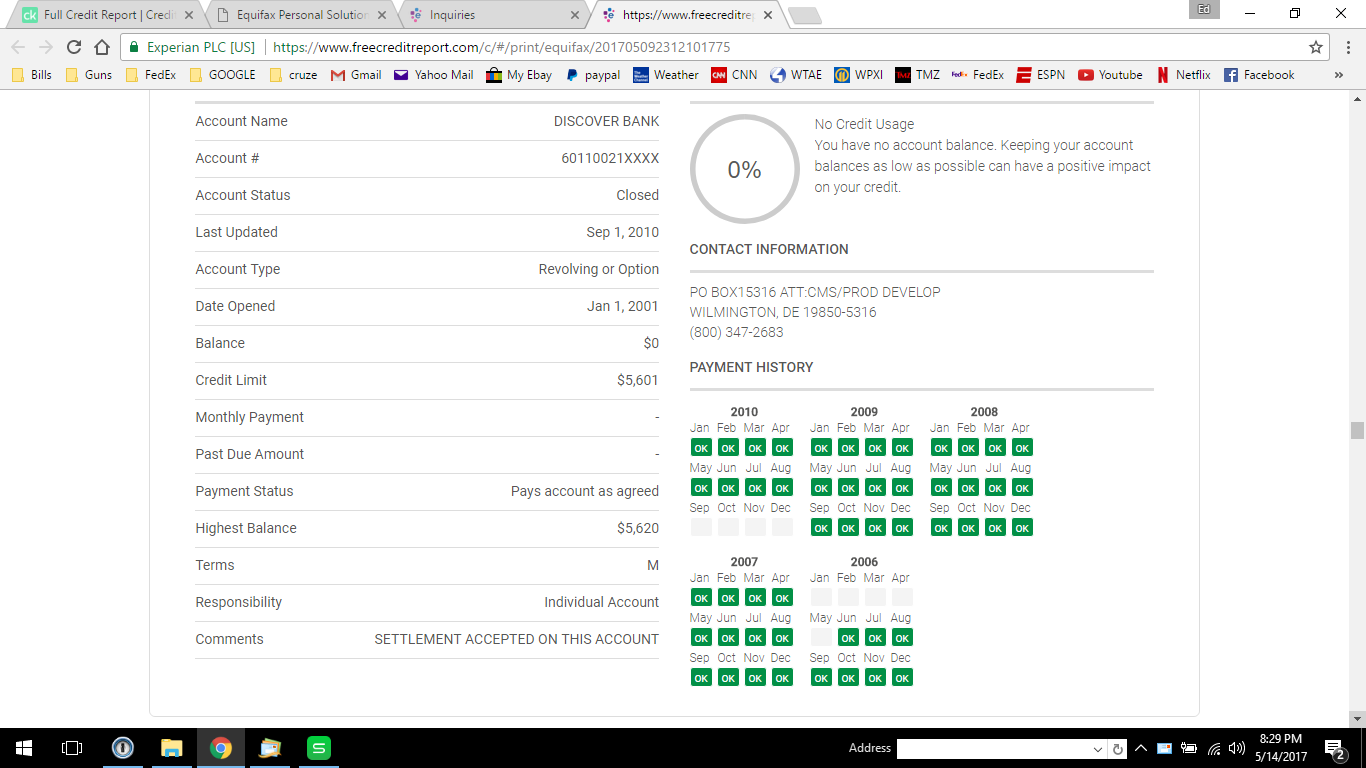

in one of the above photos it states that the last late payment was 6 years 9 months ago. that would make it 8/2010 which is the last payment date on the discover card. so i would think thats it, but look at this photo. nothing but green on the payments. i don't get it .

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: When do settled accounts drop off credit reports?

@RobertEG wrote:FCRA 605(a)(5) mandates that "any other adverse item of information" other than the four types specifically referenced in subsections 605(a)(1-4) must become excluded no later than 7 years from their occurence. It is a catch-all subsection that applies to any other adverse item of information.

A statement that an account was paid/settled for less the full amount of the debt is an adverse item of information, and has an exclusion date of no later than 7 years from the date of the adverse event (i.e., from the date the debt was settled).

From my understanding, this is not true anymore. It is still 7-years from the date of the first delinquency due to some changes made under the FCRA with Obama stating that is still removed after 7-years from the original date of delinquency and not the date of the last payment.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: When do settled accounts drop off credit reports?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: When do settled accounts drop off credit reports?

There was no amendment to the FCRA during the Obama administration that related to credit report exclusion.

Date of first delinquency is ONLY relevant to the exclusion of a charge-off or collection. It is not used in determining the exclusion date of any other adverse item of information.

See FCRA 605(a)(4), as clarified by FCRA 605(c) as to use of DOFD for exclusion of a charge-off or collection.

The only applicable exclusion provision of the FCRA that would apply to a statement that an account was settled for less would be FCRA 605(a)5).

Section 605(a)(5) does not base running of the 7 year period on the DOFD.