- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Re: building credit score

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

building credit score

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

building credit score

my husband has a retirement fund that we borrowed 28,000 dollars out of in july of 2013. He pays the loan back every 2 weeks out of his pay check. Can we have this added to our credit history/profile for good account and help raise our credit score.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: building credit score

Not that I am aware of.

Do you have any credit cards or car loans etc now?

Do you know what your scores are currently?

Have you pulled your credit reports ?

12/4/12 TU 589 MyFico ~EQ 579 MyFico ~EX 577(Fako)

Myfico 8 scores

6/12/20 TU 803 ~ EQ 814~ Ex 784

My Wallet: Cap1 3,500K ~FH 2950~Credit One 1750~Credit one #2 1250~Orchard Bank 400 ~NFCU nRewards 18,000~NFCU Cash Rewards 18,500 ~Care Credit 12000~Discover 6000~Lowes 5450~ Amex 5400.00 ~ Harvest King 8000 ~ Langley~Penfed~Service CRU~red stone cru~

UTL 17%

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: building credit score

Yes to all the above: Credit score recently took plunge due to new collections account added sat, which i called and pay the day it showed on credit report and asked them to remove the account. Guy stated he would remove and send letter to all three credit agencies and one to myself. said it could take up to 30 days. I also have another collection from 2010 that I am working on but cant seem to get into touch with CA about: ive called solutia number several times with no answer. Other than that no baddies except past late payments that are now a year old. Just got 2 credit cards in Dec one of which is 400 limit and showing 94 dollars balance but paid credit card down to 50. The other is for 300 dollar and just recently reported: had to pay off another medical bill to keep off collection report for 125 dollars just last week and they also reported saturday. Prior to that was at 0 balance. So anything you can tell me would be helpful credit score went from 614 to 576 just off these few things.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: building credit score

Yes to all the above:

Credit score recently took plunge due to new collections account added sat, which i called and pay the day it showed on credit report and asked them to remove the account. Guy stated he would remove and send letter to all three credit agencies and one to myself. said it could take up to 30 days. Your score will recover a bit once this is removed :-)

I also have another collection from 2010 that I am working on but cant seem to get into touch with CA about: ive called solutia number several times with no answer.

Do you have the address for this one? Who is it and maybe we can help find a email address or another nother.

Other than that no baddies except past late payments that are now a year old.

Just got 2 credit cards in Dec Your score will take a dip with the new inquires but as the new accounts get older you will recover. They have less impact after a yr. I have seen improvement on mine as soon as 6mo.

One of which is 400 limit and showing 94 dollars balance but paid credit card down to 50. Good job paying it down. Has it reported yet?

The other is for 300 dollar and just recently reported: had to pay off another medical bill to keep off collection report for 125 dollars just last week and they also reported saturday. Both are fine.

You did the right thing paying the medical and with it reporting a balance and getting paid back down shows you can handle carrying a balance. Very short term impact and your score will go back up the next reporting cycle.

One thing to remember... FICO... does not remember balances(UTL) from 1 month to the next. Last month I could have all cards maxed out and take a score dip, then have them paid down to 9% or less(UTL) the next and my score will jump back up.

New accounts or Trade Lines (TL) can raise your score becuase it raises your overall available credit ( UTL) and as they get older ( age) your score will improve . Mine showed a new score jump at around the 1 yr mark.

Adding a new TL with out a inquiry can also help if you can afford it right now: SDFCU will give you a secured credit card and will not do a credit check. When the new TL reports it will boost your score. it will raise your UTL with out the inquiry ding.

So anything you can tell me would be helpful credit score went from 614 to 576 just off these few things.

By the next time your 2 accounts report and the collection drops you will see your scores go back up. :-)

While I am rebuilding my scores do the same up and down. Right now I know my high balances on my credit cards is holding me back and will go back up once they come down.

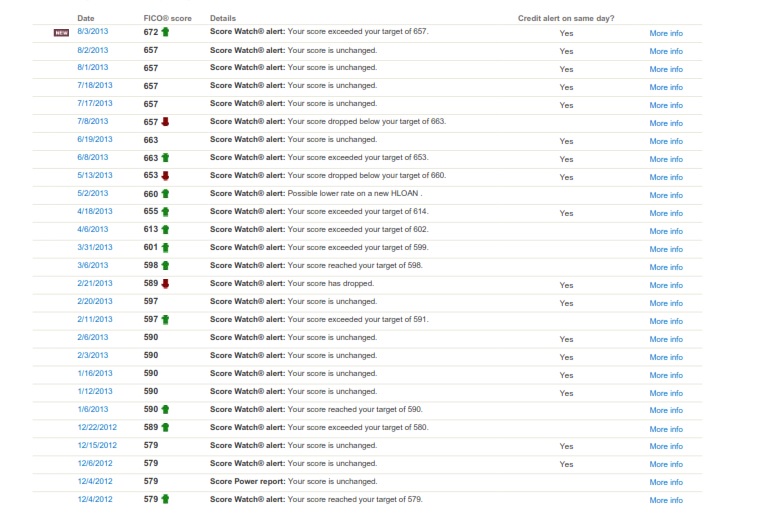

Heres a glance at mine just so you know, we all go through it and its ok :-)

12/4/12 TU 589 MyFico ~EQ 579 MyFico ~EX 577(Fako)

Myfico 8 scores

6/12/20 TU 803 ~ EQ 814~ Ex 784

My Wallet: Cap1 3,500K ~FH 2950~Credit One 1750~Credit one #2 1250~Orchard Bank 400 ~NFCU nRewards 18,000~NFCU Cash Rewards 18,500 ~Care Credit 12000~Discover 6000~Lowes 5450~ Amex 5400.00 ~ Harvest King 8000 ~ Langley~Penfed~Service CRU~red stone cru~

UTL 17%

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: building credit score

This was all I could find online regarding credit collection agency: Solutia, address: p.o.box 679 Columbia TN 38402, phone number listed online is 1888-252-5418

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: building credit score

Send them a email :-)

http://www.solutiarecovery.com/contact.php

12/4/12 TU 589 MyFico ~EQ 579 MyFico ~EX 577(Fako)

Myfico 8 scores

6/12/20 TU 803 ~ EQ 814~ Ex 784

My Wallet: Cap1 3,500K ~FH 2950~Credit One 1750~Credit one #2 1250~Orchard Bank 400 ~NFCU nRewards 18,000~NFCU Cash Rewards 18,500 ~Care Credit 12000~Discover 6000~Lowes 5450~ Amex 5400.00 ~ Harvest King 8000 ~ Langley~Penfed~Service CRU~red stone cru~

UTL 17%