- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- debt consolidation a scam?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

debt consolidation a scam?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

debt consolidation a scam?

I've been trying to get a loan to pay off some high balances with high payments with no luck. My utllization is 75%, payment history excelent. I've been working on the method of paying the lowest balances first. How to pay the accounts down is not the question. My bank suggested I talk to a financial adviso,even though I said I had been. The first one told me the same thing as the one I was working with, I have a good budget, I just need more money and better luck. That I don't even have evenough money for debt consolidation (which I don't want) or a debt management program (don't want either). I am turned down for debt to income most often.

I finally got an approval, but it turned out to be debt consolidation. She got angry when I refused and said the only other way I could get out of debt was to win the lottery. Here come the questions. She said with this plan I would have $1000 left each month to pay what I wanted as if I had gotten a loan. But when she consolidated my cards she did not include all my credit cards, loans, or regulaur household bills. She did include 2 unsecued loans. The money left was not enough to pay the rest of the bills. Was she tryong to pull something over on me? Also she said FICO scoring only counts payment history at 10%. Is this new? And debt at 50% new also? I didn't care for her and I wasn't buying her product.

I don't know anything about debt consolidation, but she didn't seem on the up and up. She told me I was approved for a loan and then said I had to select "debt consolidation" to get a better rate. That set off a bell. I alredy knew I didn't want to go this route.

I got into this mess with family emergencies, helping bad friends, and 2 stolen credit cards, but I already have some of the lower ones paid. I have 3 accounts that if I could pay off I would free up $1200 a month. That was the minimum I was trying to borrow was the payoff on those, not everything.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: debt consolidation a scam?

@Reighn9 wrote:I've been trying to get a loan to pay off some high balances with high payments with no luck. My utllization is 75%, payment history excelent. I've been working on the method of paying the lowest balances first. How to pay the accounts down is not the question. My bank suggested I talk to a financial adviso,even though I said I had been. The first one told me the same thing as the one I was working with, I have a good budget, I just need more money and better luck. That I don't even have evenough money for debt consolidation (which I don't want) or a debt management program (don't want either). I am turned down for debt to income most often.

I finally got an approval, but it turned out to be debt consolidation. She got angry when I refused and said the only other way I could get out of debt was to win the lottery. Here come the questions. She said with this plan I would have $1000 left each month to pay what I wanted as if I had gotten a loan. But when she consolidated my cards she did not include all my credit cards, loans, or regulaur household bills. She did include 2 unsecued loans. The money left was not enough to pay the rest of the bills. Was she tryong to pull something over on me? Also she said FICO scoring only counts payment history at 10%. Is this new? And debt at 50% new also? I didn't care for her and I wasn't buying her product.

I don't know anything about debt consolidation, but she didn't seem on the up and up. She told me I was approved for a loan and then said I had to select "debt consolidation" to get a better rate. That set off a bell. I alredy knew I didn't want to go this route.

I got into this mess with family emergencies, helping bad friends, and 2 stolen credit cards, but I already have some of the lower ones paid. I have 3 accounts that if I could pay off I would free up $1200 a month. That was the minimum I was trying to borrow was the payoff on those, not everything.

You made the right decision! There is no question that she was trying to pull one over on you based on the info in your post.

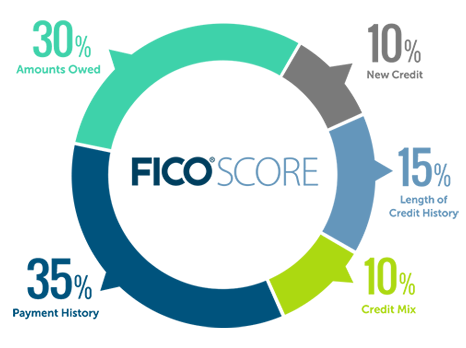

For her to respond inaccurately to your questions shows she is either confused herself or doesn't know the answer or was lying. The breakdown of what is included in FICO scores (as far as categories) is shown below and you knew it, but she apparently didn't. The other response about debt? I'm not sure if she is confusing DTI as a ratio her co uses for loans or if she is talking about utilization. But it doesn't matter - I hope you walked away from her and didn't take their bad deal.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: debt consolidation a scam?

By the way, one of the best ways to pull yourself out of heavy debt is to first come up with a plan, in writing.

Put down all of your debt on a spreadsheet - type, due dates, total due, interest rate etc

Come up with a budget you need to pay it down.

The snowball method works for me. Try this one https://www.daveramsey.com/budgeting/how-to-budget/

When you get your debt down far enough, you might be able to apply for a zero % credit card to move some of the debt to and pay down a little faster.

In the meantime, pick up some extra income and apply the payments to the debt. Extra income could come from:

- selling things around the house you no longer want or need (Craigslist or whatever selling app you prefer)

- side jobs on the weekends or after work with your particular skill set or even just brawn or brain that is needed for a gig for which you are paid

- Uber or Lyft type side job

Once you get in the habit of not using the credit cards and paying down the debt you will get out of debt. Putting it in writing is important and getting on the beans and rice budget is critical too.

You can do this without the help of these so-called 'debt consolidation' loans, most of which are scams anyway (from what I have seen).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: debt consolidation a scam?

Take a simplied case of a consumer with revolving and installment debt, all at a 12% APR, that the consumer consolidates into a single payment on a new loan at the same 12%

That is essentially shifting the deck chairs as far as debt oblitation is concerned.

The credit reporting implications, however, can be subtle.

The shifting of revolving credit to installment can result in improvement of the % util of revolving credit. Installmant credit has not % util scoring, and is scored based on the percent of remaining balance of the origninal loan. However, the % balane for installment loans has a very low scoring weighting as compared to % util of revolving, so some gain can be obtained by shifting revolving to installment debt.

Countering any scoring gain by shifting debt to installment is any hard pull requried to obtain the new installment loan, and the lowering of AAoA when the new loan reports.

Economic issues (money in pocket) can also become a consideration if the new loan is at a lower APR than existing credit cards, which is normally the case.

Thus, pure credit reporting impact may not be the only consideration.

Debt consolidation can be beneficial, either to scoring or to economic considerations, but it will vary based on the specifics.

Simply reducing payment fom multiple accounts to a single, consolidated payment would be the least of my considerations.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: debt consolidation a scam?

By the way, one of the best ways to pull yourself out of heavy debt is to first come up with a plan, in writing.

Put down all of your debt on a spreadsheet - type, due dates, total due, interest rate etc

Come up with a budget you need to pay it down.

I walked away at the point she said "debt consolidation" and a "better rate". I told her I just had a car dealer give me a bank I did not want for a "better rate". She claimed that it was different with secured loans.

I do keep a list, actually several, of all my bills. I have a monthly list with each statement balance, interest charged, minimum payment, due dates, and date and amount paid. I have another with complete information on my accounts, date opened, apr, CL. Here I keep track of a running balance, utilization, and age of accounts. I just recently made a new one listing the accounts from the lowest balance first to the highest so I can work on the smaller balances.

I have been trying to sell things but I come up short in that catagory. Nobody is buying. I couldn't sell a 1 year old 10,000 BTU a/c on Craigslist last summer in Texas. Three people called on it very interested but never came by. I've been thinking about a part-time job, I am only able to work part-time dependin on the type of work. I was thinking of applying to some of these Tax preparing companies for the season.

Deliveries or other driving type jobs I can do also if I can find anything around here.

One of the biggest problems I having paying down the debt is something keeps happening to cost me more money that I don't have. I can't get out from under the bad things happening or things just plain going wrong.

I never had any thoughts to go for debt consolidation or bankruptcy, I do not have a mortgage on my house, my oldest account is 20 years with AAoA of 6.9 years or better. My credit score was between 748-765 when I started getting hit with all the problems. I lost at least $1800 in income and my score is 660-676 now but I still don't have any missed payments or collections. I can't see where either of those programs would help.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: debt consolidation a scam?

@Reighn9 wrote:By the way, one of the best ways to pull yourself out of heavy debt is to first come up with a plan, in writing.

Put down all of your debt on a spreadsheet - type, due dates, total due, interest rate etc

Come up with a budget you need to pay it down.

I walked away at the point she said "debt consolidation" and a "better rate". I told her I just had a car dealer give me a bank I did not want for a "better rate". She claimed that it was different with secured loans.

I do keep a list, actually several, of all my bills. I have a monthly list with each statement balance, interest charged, minimum payment, due dates, and date and amount paid. I have another with complete information on my accounts, date opened, apr, CL. Here I keep track of a running balance, utilization, and age of accounts. I just recently made a new one listing the accounts from the lowest balance first to the highest so I can work on the smaller balances.

I have been trying to sell things but I come up short in that catagory. Nobody is buying. I couldn't sell a 1 year old 10,000 BTU a/c on Craigslist last summer in Texas. Three people called on it very interested but never came by. I've been thinking about a part-time job, I am only able to work part-time dependin on the type of work. I was thinking of applying to some of these Tax preparing companies for the season.

Deliveries or other driving type jobs I can do also if I can find anything around here.

One of the biggest problems I having paying down the debt is something keeps happening to cost me more money that I don't have. I can't get out from under the bad things happening or things just plain going wrong.I never had any thoughts to go for debt consolidation or bankruptcy, I do not have a mortgage on my house, my oldest account is 20 years with AAoA of 6.9 years or better. My credit score was between 748-765 when I started getting hit with all the problems. I lost at least $1800 in income and my score is 660-676 now but I still don't have any missed payments or collections. I can't see where either of those programs would help.

If you're not seeking a mortgage, and not in the market for a car, I would not even worry about scoring at this point. Just work on getting your overall debt load down in the most efficient way possible.