- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- is a card recommenmdation the same as a preapprova...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

is a card recommenmdation the same as a preapproval?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

is a card recommenmdation the same as a preapproval?

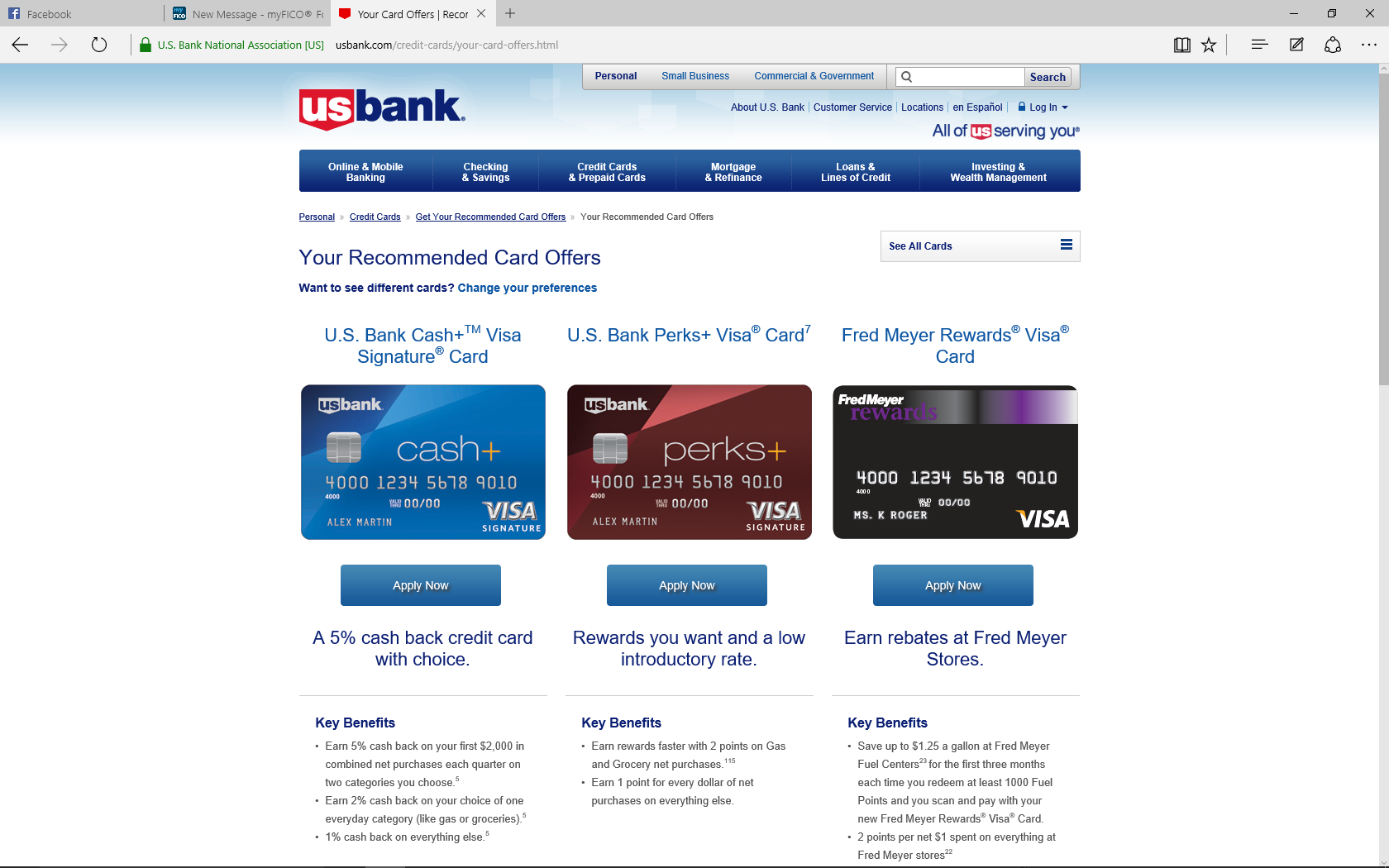

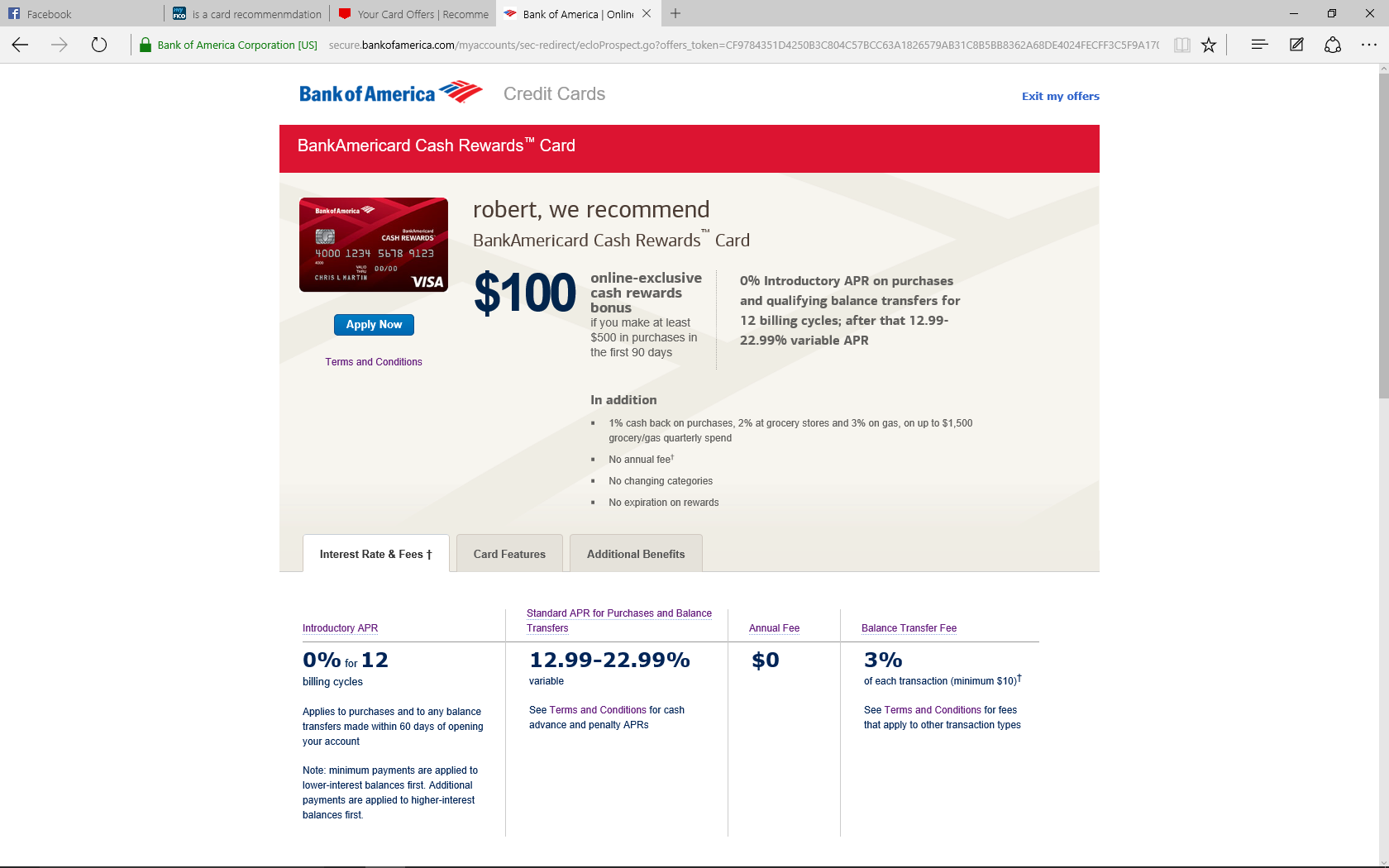

i have been to several credit card preapproval sites and some give an outright preapproval and other give recomendations, the capital one cardfinder tool says no recommendations at this time so obviously that is not a preapproval. the US Bank preapproval site comes back with 3 recommended cards.. not interested in a hard pull for a rejection and am a bit confused.. Bank of America comes back with a very similar message.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: is a card recommenmdation the same as a preapproval?

similar screenshot from BofA

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: is a card recommenmdation the same as a preapproval?

what are your present scores and whats your profile look like (the good, the bad and the ugly)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: is a card recommenmdation the same as a preapproval?

last year i had to file chapter 7 due to unexpected layoff at work. my discharge was in march. I reaffirmed my 2 year old car loan with Ford Motor Credit and it was and is in good standing with no late or missed payments. I did not reaffirm my home loan but kept the house and still make the payments..( also no late or missed payments). since discharge i have a first premier CC with a $700 limit and it has been paid on time since i got it in april. it currently has zero balance , also have a Motorola and Overstock accounts which have all been paid on time and have zero balance. motorola has a $1500 limit and Overstock has a $2000 limit. I also have a fingerthut card with an $1100 limit and a zero balance. my Equifax score is 659 with an auto 8 score of 682.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: is a card recommenmdation the same as a preapproval?

@Alpha wrote:last year i had to file chapter 7 due to unexpected layoff at work. my discharge was in march. I reaffirmed my 2 year old car loan with Ford Motor Credit and it was and is in good standing with no late or missed payments. I did not reaffirm my home loan but kept the house and still make the payments..( also no late or missed payments). since discharge i have a first premier CC with a $700 limit and it has been paid on time since i got it in april. it currently has zero balance , also have a Motorola and Overstock accounts which have all been paid on time and have zero balance. motorola has a $1500 limit and Overstock has a $2000 limit. I also have a fingerthut card with an $1100 limit and a zero balance. my Equifax score is 659 with an auto 8 score of 682.

I would suggest apping for Cap One Platinum, even if they were in your BK - their blackout period for charge offs is only 12 months. If you ARE in a blackout period with them they won't even pull your reports when you app.

Most of the pre-approval sites are total crap. Cap One's is considered the best, but often it will just give the "we couldn't find a specific offer but you might like..." message even though you would be approved.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: is a card recommenmdation the same as a preapproval?

Look for offers that you receive that are identified as being made based on the creditor having received your name from a listing provided them by a CRA.

Those do have legal stipulations relating to what pre-approval means...... they are a "firm offer for credit."

If a creditor submits criteria to a CRA, they can obtain a listing of consumers who meet their specified criteria.

A creditor's offer that is made based on a listing obtained froma CRA is considered as a "firm offer for credit" under the FCRA, and is not the normal junk-mail pre-approval offer. See FCRA 604(c).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: is a card recommenmdation the same as a preapproval?

@Anonymous wrote:

@Alpha wrote:last year i had to file chapter 7 due to unexpected layoff at work. my discharge was in march. I reaffirmed my 2 year old car loan with Ford Motor Credit and it was and is in good standing with no late or missed payments. I did not reaffirm my home loan but kept the house and still make the payments..( also no late or missed payments). since discharge i have a first premier CC with a $700 limit and it has been paid on time since i got it in april. it currently has zero balance , also have a Motorola and Overstock accounts which have all been paid on time and have zero balance. motorola has a $1500 limit and Overstock has a $2000 limit. I also have a fingerthut card with an $1100 limit and a zero balance. my Equifax score is 659 with an auto 8 score of 682.

I would suggest apping for Cap One Platinum, even if they were in your BK - their blackout period for charge offs is only 12 months. If you ARE in a blackout period with them they won't even pull your reports when you app.

Most of the pre-approval sites are total crap. Cap One's is considered the best, but often it will just give the "we couldn't find a specific offer but you might like..." message even though you would be approved.

Nevermind about the Cap One - I see on your other thread that you seem to be in the blackout. Call them and see if you can find out when it expires.