- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- "KD" reporting on Experian long after debt is sett...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

"KD" reporting on Experian long after debt is settled (Midland)

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: "KD" reporting on Experian long after debt is settled (Midland)

@Shogun wrote:Well, first off, this is pretty much a moot point. As a CA, Midland is not allowed to post a monthly derog... PERIOD. That is reserved for the OCs only. File off a complaint on them that they are supplying monthly derogs as a CA. This is a big NO NO.

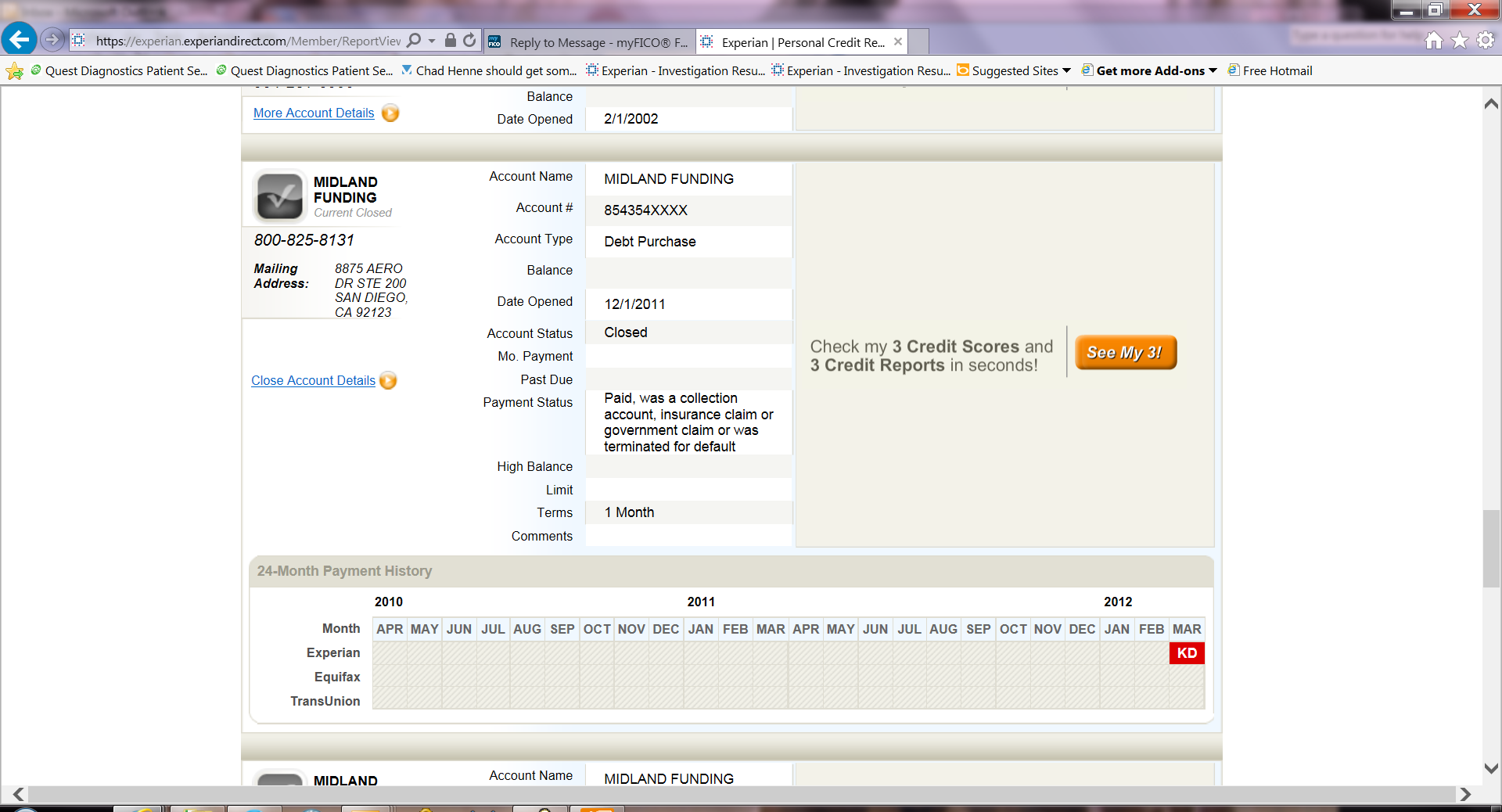

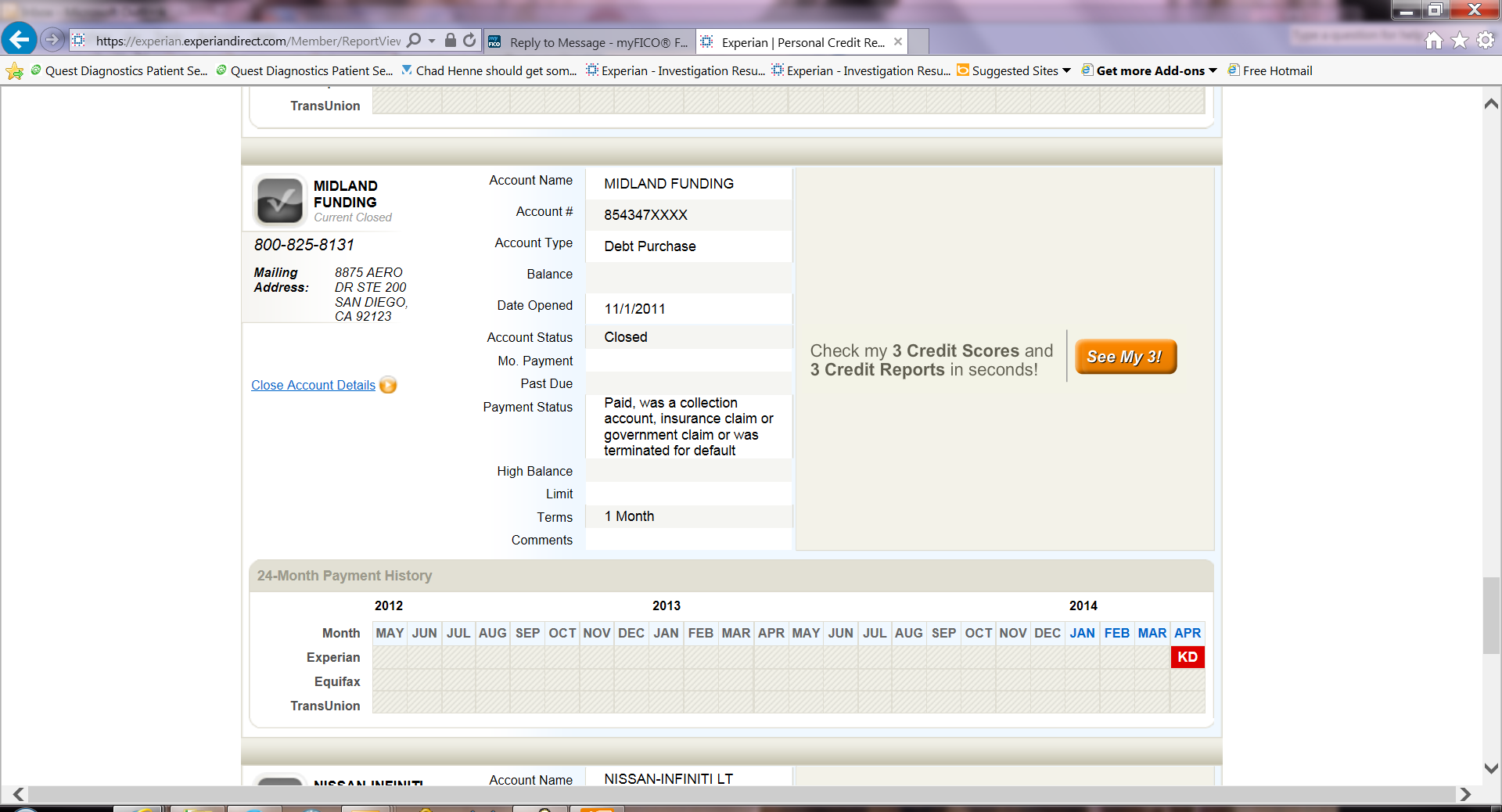

Are you sure? It shows up as a "KD" in the one month on my Experian FAKO report, and my other MIdland settled collection for that matter has a single "KD" in March of 2012 (I think that's when I settled that one). My myFICO Equifax report doesn't have the monthlies for the two Midland TLs -- just that it was settled.

I would looooooove to get these two Midland TLs off of my reports COMPLETELY, if at all possible. If I can use this a hammer to try to get that done, that'd be great but I want to make sure I'm on solid ground. Should I maybe start with a dispute phone call to Experian and ASK them where this Midland "KD" is coming from -- is it coming from Midland, or is that something internally that Experian is showing?

thanks,

Pigeye

2007 - 2010 low point: mid-500s

With the help of myFICO community, now: 714 EQ FICO

"At the end of every hard-earned day, people find some reason to believe." (Bruce Springsteen)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: "KD" reporting on Experian long after debt is settled (Midland)

Experian is the only CRA that uses KDs. Now if you are looking at a 3rd party report,(which myFICO supplies), it can get skewed. I'd pull a report directly from EX and see exactly what they are posting. Because CAs are not allowed to post monthly derogs,,, period. They would even have to be reporting as a Factoring Company for there even be that category to have a monthly derog because collections don't even have a monthly input.

July 2013 score: EQ FICO 819, TU08 778, EX "806 lender pull 07/26/2013

Goal Score: All Scores 760+, Newest goal 800+

Take the myFICO Fitness Challenge

Current scores after adding $81K in CLs and 2 new cars since July 2013

EQ:809 TU 777 EX 790 Now it's just garden time!

June 2017 update: All scores over 820, just pure gardening now.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: "KD" reporting on Experian long after debt is settled (Midland)

It is the Experian-produced report that is clearly showing the "KD" in one month of each of my two Midland tradlines that show up there.

Should I start with Experian, or directly dispute with Midland?

2007 - 2010 low point: mid-500s

With the help of myFICO community, now: 714 EQ FICO

"At the end of every hard-earned day, people find some reason to believe." (Bruce Springsteen)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: "KD" reporting on Experian long after debt is settled (Midland)

2007 - 2010 low point: mid-500s

With the help of myFICO community, now: 714 EQ FICO

"At the end of every hard-earned day, people find some reason to believe." (Bruce Springsteen)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: "KD" reporting on Experian long after debt is settled (Midland)

Here's the other, more-recent one:

2007 - 2010 low point: mid-500s

With the help of myFICO community, now: 714 EQ FICO

"At the end of every hard-earned day, people find some reason to believe." (Bruce Springsteen)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: "KD" reporting on Experian long after debt is settled (Midland)

I'm not seeing those... show's a broken image or something.

July 2013 score: EQ FICO 819, TU08 778, EX "806 lender pull 07/26/2013

Goal Score: All Scores 760+, Newest goal 800+

Take the myFICO Fitness Challenge

Current scores after adding $81K in CLs and 2 new cars since July 2013

EQ:809 TU 777 EX 790 Now it's just garden time!

June 2017 update: All scores over 820, just pure gardening now.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: "KD" reporting on Experian long after debt is settled (Midland)

@Shogun wrote:Experian is the only CRA that uses KDs. Now if you are looking at a 3rd party report,(which myFICO supplies), it can get skewed. I'd pull a report directly from EX and see exactly what they are posting. Because CAs are not allowed to post monthly derogs,,, period. They would even have to be reporting as a Factoring Company for there even be that category to have a monthly derog because collections don't even have a monthly input.

Quick question on this one... I am in a similar situation where a CA has been reporting KD since I had an account go into collections with them. What kind of trouble would they get in for this? I saw you said in an earlier post to contact the CFPB regarding this situation... what would an outcome from this scenario generally look like?

As of 5/22/15 EX: 698, EQ: 700, TU: 703

Barclay Rewards: $2750, Capital One Quicksilver one: $4300, Discover IT : $300, Amazon Visa: $100. Best Buy Credit Card: $3000, Kohl's Charge: $300, Express: $2600, Overstock $1650, Chase Freedom $4700, AMEX Everday $1500, Serta iComfort $4700, Walmart $1600, Target $300

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: "KD" reporting on Experian long after debt is settled (Midland)

It depends on what exactly is being reported and it has to do with the monthly derogs. When reporting as a CA, there is not even a place for them to report a monthly derog. It's when they file as a Factoring Agency that gives them this option to even report it. And a CA cannot report monthly derogs. You need the factual report to make absolutely sure what is being reported.

July 2013 score: EQ FICO 819, TU08 778, EX "806 lender pull 07/26/2013

Goal Score: All Scores 760+, Newest goal 800+

Take the myFICO Fitness Challenge

Current scores after adding $81K in CLs and 2 new cars since July 2013

EQ:809 TU 777 EX 790 Now it's just garden time!

June 2017 update: All scores over 820, just pure gardening now.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: "KD" reporting on Experian long after debt is settled (Midland)

Got ya. I went on ahead and reported it to the CFPB, since they're not able to do that. The company that agreed to a Pay for Deletion has been quite shady in their practices lately, so I've been contemplating what I need to be do. This KD situation might help out quite a bit. i found it strange that the only other collection on my record was only reported the first time it went into collections, but never again.

As of 5/22/15 EX: 698, EQ: 700, TU: 703

Barclay Rewards: $2750, Capital One Quicksilver one: $4300, Discover IT : $300, Amazon Visa: $100. Best Buy Credit Card: $3000, Kohl's Charge: $300, Express: $2600, Overstock $1650, Chase Freedom $4700, AMEX Everday $1500, Serta iComfort $4700, Walmart $1600, Target $300

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: "KD" reporting on Experian long after debt is settled (Midland)

***UPDATE***

Well, poop. Here is their response, via the CFPB dispute just now. Looks like I struck out on this:

Response Mr. (Pigeye), you write that Midland Credit is reporting inaccurate information on your consumer credit files, namely listing the account as a "key derogatory." Midland Credit is not reporting the account as "key derogatory." The credit bureaus determine which accounts should be marked as a "key derogatory" and marks them as such. In addition, it is Midland Credit's understanding that only the consumer can see the notation of "key derogatory." You are encouraged to communicate directly with the credit bureaus should you have any further concerns regarding the "key derogatory" notation. Midland Credit's business records indicate that it is accurately reporting the above-referenced account to the credit reporting agencies. Please see Midland Credit's comprehensive response letter, which is attached for additional information.

2007 - 2010 low point: mid-500s

With the help of myFICO community, now: 714 EQ FICO

"At the end of every hard-earned day, people find some reason to believe." (Bruce Springsteen)