- myFICO® Forums

- Types of Credit

- Student Loans

- Disputing Late Student Loan Payments

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Disputing Late Student Loan Payments

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Disputing Late Student Loan Payments

I have 3 30 day late payments on my student loan (Navient) from 2015 that I would like to dispute online with each of the credit bureaus. What reason should I select on the dispute form in order to ensure that the late payments are removed from my credit>

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Disputing Late Student Loan Payments

3 things to note:

- Never dispute online, it's irresponsible and lazy. If you have a real dispute, do it in writing, CMRRR via USPS. I've seen disputes go the wrong way because of online disputes being too restrictive.

- Never dispute over the phone, it's even lazier. I've seen disputes go the wrong way because a phone rep coded the dispute in wrong.

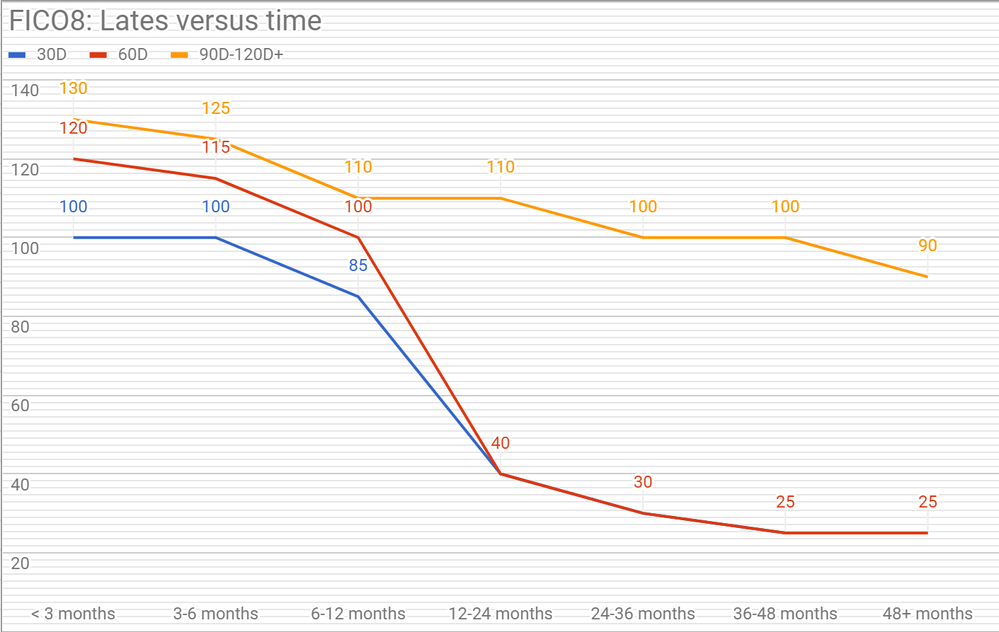

- 30D lates don't mean much after 3 years, see my chart:

Note that these values aren't 100% accurate for 100% of people, but just averages I've tracked from many data points people share with me. 3 years after your lates, they barely count at all (25-30 points).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Disputing Late Student Loan Payments

How is their reporting inaccurate?

What is the basis for your dispute?

I agree that disputing online is usually not the best, particularly if you have supporting documentation or extensive argments that you wish to ensure are received by the creditor.

As an alternative, you may also consider filing a direct dispute, which totally avoids any CRA involvement, and ensures that all docmentation and arguments are received by the creditor, with no CRA sanitation of your dispute by their referral process, which is almost always done using their e-Oscar electronic referral process, and with removal of some documentation and arguments.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Disputing Late Student Loan Payments

I disputed online, which I know is not the recommended course. You should definitely do this via snail mail. That said, I just received my resolution back today, which apears to indicate success! I had 28 lates across 4 accounts(7 each), up to 180 days past due. I received a retroactive forbearance to bring my account current. I disputed on the grounds that I should show lates if the account was in forbearance. I think I typed the following into the "additional information", "How can I have have late payments on my account if I was in forbearance at the time?".

They sent monthly detail in the resolution with zero's each month for "Amount Past Due" and it said they updated information in my fime. Nowhere did it say that anything was "Verified as Accurate". Also, this came back within 2-3 weeks, so it wasn't a case of Navient just not responding.