- myFICO® Forums

- Types of Credit

- Student Loans

- Help for my wife on loans

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Help for my wife on loans

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Help for my wife on loans

Hey there group! Thought I'd ask this question here seeing as how you guys helped me get out of a huge bind with my credit.

So, my wife has a large amount of Stafford Federal student loans. She had loans that at one time, were no more than $15,000 (I think) that ballooned up to over $30,000.

She had the loans consolidated from the Fed to Chase (I think) at one point in time. This is where I think she went wrong. She had been paying small payments here and there, and then times got tough for us both, so instead of asking for forebearances or deferments, she just stopped paying on them.

Last year, she got her loans passed back over to NELNET as part of a 'bad debt forgiveness' loan program. She paid a certain amount and was able to get her loans brought current at that time. Unfortunately, they placed her loan on some HUGE payment plan that she can't make, and she was only sending in $100 a month. They've been reporting her as PAYS-30-120 late.

My question is two fold:

When we pulled her credit, the old Chase loans are still on there as TRANSFERRED/CLOSED. Is there a way we can get them off of there since they don't service the loan, and B:

Is there some way we can get this UNGODLY amount of her loan interest taken down a notch? She doesn't owe $17,000 in the original principal amount, but it looks as if Chase and others made the interest part of the principal when they passed it back to NELNET.

Starting Score: 605 (Experian); 588 (Equifax); 590 (TransUnion)

Current Score: 626 (Experian); 667 (Equifax); 670 (TransUnion)

Goal Score: 800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help for my wife on loans

Are you sure she didn't rehab these loans? If she stopped paying completely, and that went on for long enough, then she could have defaulted. What you are describing with Nelnet picking up the loans would fit, then. This makes a difference in terms of how the Chase loans are reporting. If she didn't rehab, then yes, the Chase tradelines could still show. If she did, there's a chance they are reporting incorrectly.

As to the interest...entirely possible there's not much to be done on that level. Interest and fees get added. I don't know of anyone that's successfully pulled off a counterargument there.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help for my wife on loans

She did rehab the loan back last year, I believe, through ASA or AES, I think. After she got done doing that, her new service provider is Nelnet and AES isn't involved anymore. If she rehabbed the loan, should those tradelines show, you think?

Bummer on the interest. She did the rehab paying what she could afford, then at the end of it, she got this HUMONGOUS payment that's more than our car note. No way she could pay that, so she paid what she could. She just doesn't make enough to put a good dent into it.

They started reporting her as late, of course.

Starting Score: 605 (Experian); 588 (Equifax); 590 (TransUnion)

Current Score: 626 (Experian); 667 (Equifax); 670 (TransUnion)

Goal Score: 800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help for my wife on loans

The old tradelines can still show but the default information should have come off. They should also show as "transferred/closed" with a zero balance due.

The other thing is that there are repayment plans available post-rehab that would have helped lower her payment. She could have looked into getting into an ICR (income-contingent repayment) or IBR (income-based repayment), either of which might have helped. I know it's difficult to pick up the phone, but honestly, not doing so is one of the worst mistakes one can make.

So where is she now, then? Are the payments still too high? Has she gotten caught up?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help for my wife on loans

@InvincibleSummer3 wrote:The old tradelines can still show but the default information should have come off. They should also show as "transferred/closed" with a zero balance due.

The other thing is that there are repayment plans available post-rehab that would have helped lower her payment. She could have looked into getting into an ICR (income-contingent repayment) or IBR (income-based repayment), either of which might have helped. I know it's difficult to pick up the phone, but honestly, not doing so is one of the worst mistakes one can make.

So where is she now, then? Are the payments still too high? Has she gotten caught up?

Well, what she did (under my prodding) was contacted Nelnet and got herself on a reduced payment forebearance paying what she's paying right now. She'll pay that for a year, then after that, they'll evaluate if she can pay the regular payment or what she can afford. The old tradelines are showing Transferred/Closed, but I need to double check the default info again to see what they are reporting.

Starting Score: 605 (Experian); 588 (Equifax); 590 (TransUnion)

Current Score: 626 (Experian); 667 (Equifax); 670 (TransUnion)

Goal Score: 800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help for my wife on loans

They can report the lates leading up to the default, but the default should come off, including in the comments. (Although there's been some debate on this...am investigating myself.) The recent lates are going to be your biggest issue, though, because they're so new. Recent derogatory information hurts a credit score worse than older information. If she can get to a place where she's no longer being reported as late, that's going to help. Good behavior will help mitigate what happened in the past.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help for my wife on loans

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help for my wife on loans

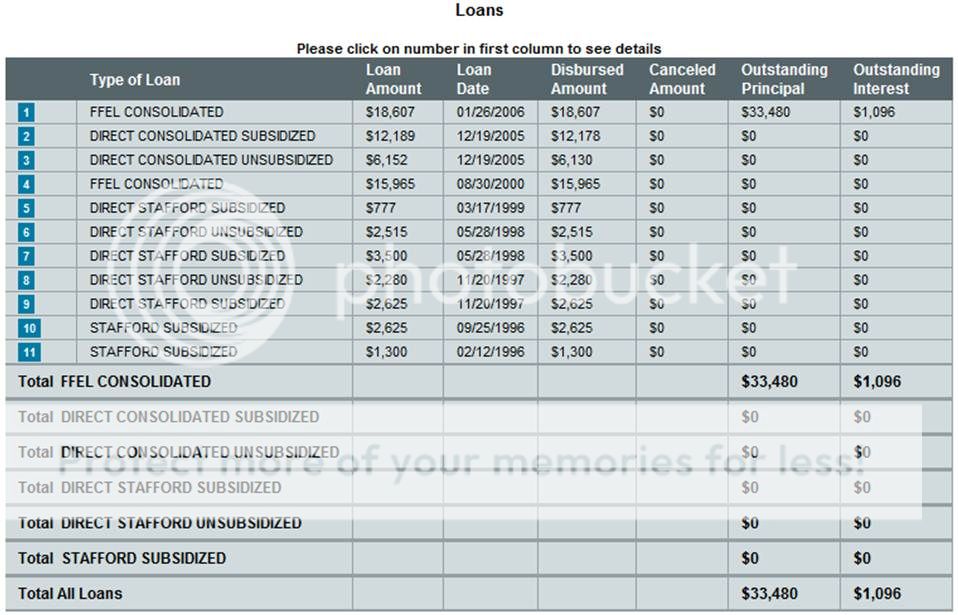

Here's what is bothering me:

If you look here, the math adds up until 2006. How did the outstanding principal JUMP almost twice the amount?!?

She had the recondition (or whatever it's called) through American Student Assistance (ASA). I know that they have a 18.5% 'collection cost' that they tack onto that. But even with that - she didn't owe THAT much interest on this loan.

Starting Score: 605 (Experian); 588 (Equifax); 590 (TransUnion)

Current Score: 626 (Experian); 667 (Equifax); 670 (TransUnion)

Goal Score: 800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help for my wife on loans

Are you sure she only took out $15k in loans?

Because this looks like two sets of loans; one set disbursed in the late '90's that were consolidated in 2000. Then, somehow, there's a second set of direct loans dating back to 2005. This looks to be a completely separate set of loans despite the "consolidation" in the titles. It would be really odd to consolidate a second time, not to mention consolidating from a single loan into two runs counter to the idea of consolidation. Generally you put loans together to be one big loan, not split them up again. Does that make sense? $16k plus an additional $18k would get you to that grand total you see before you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help for my wife on loans

@alexhortdog wrote:Here's what is bothering me:

If you look here, the math adds up until 2006. How did the outstanding principal JUMP almost twice the amount?!?

She had the recondition (or whatever it's called) through American Student Assistance (ASA). I know that they have a 18.5% 'collection cost' that they tack onto that. But even with that - she didn't owe THAT much interest on this loan.

Okay, which of these loans are closed? I'm trying to figure out what loans got consolidated into what, to try & help you figure this out. When I added up the loans #5-11, I got a number slightly less than what is listed for loan #4, so I figured with interest, that's probably what that was. But then I couldn't figure out if she took out additional loans, resulting in loans #1-3, or what.