- myFICO® Forums

- Types of Credit

- Student Loans

- Help with DOFD

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Help with DOFD

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Help with DOFD

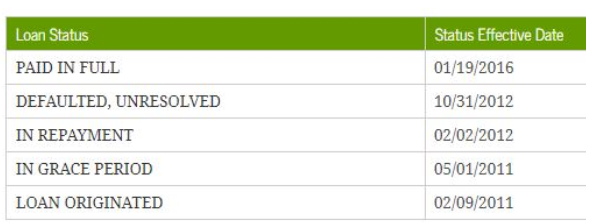

My ed.gov page says this:

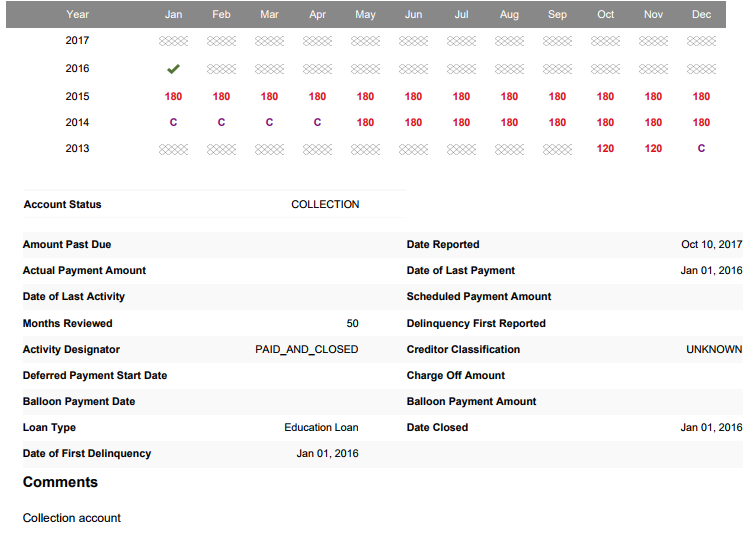

But my Equifax report (from annualcreditreport.com) says this:

If my loan defaulted on 10/31/12, wouldn't that mean I missed 270 days worth of payments at that point? Which would bring my DOFD to the first month after my grace period. This very recent delinquency is killing my scores and I'm looking for any avenue to attack it.

I've tried calling the original lender, the school. No luck. I tried good will to everyone with a snail mail address, no luck there either.

i also can't help but think this shouldn't be listed as a collections account still (?). The loan should also not be in default as I read on the ED web site that one of your options to get out of default is to pay the loan in full. Is that right?

Thanks.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help with DOFD

I dont see any reporting of a charge-off.

DOFD only applies under OC account reporting if there is a reported charge-off.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help with DOFD

Well I'll be darned. You're right.

I thought that accounts had to be charged off after 180 days? This account had never been brought current until the day I paid it off in full. Had I known then what I know now I would have rehabbed it first. Is there anything that can be done about the late payments, and in particular the ones in 2015/2016? The Perkins office fully admits that I was put into "special handling" (no info on this anywhere that I can find) but they said it implies that I had a payment agreement with them starting in May 2014.

Thoughts? Thanks again.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help with DOFD

The only purpose/use of DOFD in credit reporting is for use by the CRA in determining the exclusion date of a reported charge-off or collection.

If your report does not include a reported charge-off or collection, then there is no DOFD and no issue of its exclusion.

The monthly delinquencies each have their own exclusion dates of 7 years from their respective dates of delinquency.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help with DOFD

Dec 2013 shows C for Collections and it was coded as a collections account at that time. It looks like it was all in-house because there was no corresponding new account anywhere else in the same amount. Maybe that's what threw me.

I wish the student loan boards were a bit more active. I can't find anything about this "special handling" that the Perkins office keeps referring to in their emails. I know I entered into some sort of agreement, and this will totally destroy any faith you might have left in me, I just don't remember what it was nor can I find my notes on the matter. :/

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help with DOFD

I would suspect that the "special handling" they are referring to is that federal Perkins loans are specifically exempted from the normal exclusion of reported charge-offs and collections set forth under FCRA 605(a)(4). See section 463(c) of the Higher Education Act.

Thus, while they still report the DOFD to the CRA, the CRA handles Perkins loans under those special provisions, and does not exclude a collection or charge-off on an unpaid loan at the normal period after the DOFD.

Your loan is paid, so the normal exclusion of any reference to a collection or charge-off would now apply.

However, that would only require the CRA to discontinue the showing of a collection referral under your payment history profile.

It would not require removal of the entire OC account.

If the "C" designators refer to referral for collection, you can dispute any continued inclusion of that information in your credit report after a period of 7 years plus 180 days from the reported DOFD.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help with DOFD

@RobertEG wrote:I would suspect that the "special handling" they are referring to is that federal Perkins loans are specifically exempted from the normal exclusion of reported charge-offs and collections set forth under FCRA 605(a)(4). See section 463(c) of the Higher Education Act.

463(c)(5) : "Each institution of higher education shall notify the appropriate credit bureau organizations whenever a borrower of a loan that is made and held by the institution and that is in default makes 6 consecutive monthly payments on such loan, for the purpose of encouraging such organizations to update the status of information maintained with respect to that borrower."

I made those consecutive payments and so I'm not sure what it means when it says it will encourage them to update their info -- does that mean they can choose not to? How would I go about determining if the CRAs were "encouraged" to update their info?

Thus, while they still report the DOFD to the CRA, the CRA handles Perkins loans under those special provisions, and does not exclude a collection or charge-off on an unpaid loan at the normal period after the DOFD.

Your loan is paid, so the normal exclusion of any reference to a collection or charge-off would now apply.

However, that would only require the CRA to discontinue the showing of a collection referral under your payment history profile.

It would not require removal of the entire OC account.

I keep getting the distinct impression that I shot myself in the foot when I just paid the darn thing off -- not sure if that is really the intent here or just the message I should takeaway from this experience. The Perkins office listed it as a collections account as of yesterday. Just today I got a notification from Equifax that it has been changed from Collections to Paid in full, was 120+ days late -- not really much of an improvement but baby steps. Now to go after the late payments.

If the "C" designators refer to referral for collection, you can dispute any continued inclusion of that information in your credit report after a period of 7 years plus 180 days from the reported DOFD.

This DOFD appears nowhere that I can see in my file -- so is it just calculated then based on my last payment?

Thanks again for your help. I hope you are having a glass of champagne somewhere.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help with DOFD

The CRA never uses other information derived from payment history to determine the DOFD.

The process and requirements for obtaining the DOFD are set forth in detail under FCRA 623(a)(5), which requires the furnisher (i.e.,creditor or debt colllector, as the case may be) to separately and expressly report the DOFD to the CRA no later than 90 days after reporting of their collection or charge-off. Once reported, that date is stored in a special code called the "FCRA Compliance Date/ Date of First Delinquency."

For numerous reasons, the CRA cannot and does not infer or calculate the DOFD from other reported information.

If you dont see the reported DOFD in a commercial report, you can usually get it from annualcreditreport.com or by way of a report obtained directly from the CRA. If that is still unsuccessful, you can order that information from the CRA under the information request process set forth under FCRA609(a).

Again, unless a charge-off or collection is reported, then there is no DOFD and no requirement to report it to any CRA.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help with DOFD

It turns out that they did in fact report it as a charge off but only right before I paid it off in full. I'll have to go back and look at the timeline to be sure.

Well, I sent out an email to the one person in the financial aid office that seemed willing and interested enough to help.

Here's what I sent:

"Hi Ms. XYZ,

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help with DOFD

Looking at your payment history July 2013 is your DOFD. So July 2020 is when it will fall off your report. And 3 months before that you can EE from Experian. 6 months before that EE from Transunion. Good luck getting Equifax to take it off early. But rumors are one month early is possible from them. It should be listed now as paid in full was a collection.