- myFICO® Forums

- Types of Credit

- Student Loans

- Re: I don't want to be "Paid Ahead"

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

I don't want to be "Paid Ahead"

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don't want to be "Paid Ahead"

95% of my student loans are with Great Lakes.

When I make extra payments... they put my status as "paid ahead". I'm pretty sure this means that they just reduced next month's payment, they didn't actually pay down my principal balance. Please someone let me know if I am wrong.

I don't want to be "paid ahead"... doesn't that just mean that I will end up accruing the same interest as if I never made an extra payment? I'll just be done sooner? But it won't actually reduce the amount I will pay over the long run?

It is difficult to get "good"/clear information from their website. I can never seem to find the piece of information I want to find.

2/4/15 - Transunion Score of 671

5/07/15 Transunion Score of 725

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I don't want to be "Paid Ahead"

I would think when you sent it payment it would have to state to apply the extra amount to the principal balance or else they would not.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I don't want to be "Paid Ahead"

No matter what I do... no matter what I say when I send my payment... they just indicate "paid ahead" on the account balance and talk in circles about accrued interest.

2/4/15 - Transunion Score of 671

5/07/15 Transunion Score of 725

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I don't want to be "Paid Ahead"

--------$32,000-------------$30,000-----------$30,000-----------$30,000-----$13,000---------$18,200----------$15,000---------$6,500----

FICO - TU: 780 EX: 784 EQ: 781

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I don't want to be "Paid Ahead"

I am with Great Lakes as well and I am paid ahead as well. However, my monthly payments aren't being reduced, they are just being pushed ahead. It doesn't change anything for me since my principal is going down and all the additional payments are going towards the principal, the interests are reduced every month.

I am not sure where you look, but you can see all this information by clicking on the payment history or by looking at the interest accrued when you clicking on your account information. Do you see your balance decreasing?

Here is my situation:

My monthly payment is $269, but I have been paying $1300 or so every month.

My balance was 9760 last month, interest accrued was $1.60 every day so it came to about $9808 this month (9760+$48), I then made a payment of $1308. $48 of this went towards interest and the rest ($1260) towards the principal. My balance is now $8500, accrued interests have gone down to $1.40 a day so by the time I make my next payment on June 15th, my balance would have accrued about $42 ($1.40 x 30 days).

At the same time, I am paid ahead by over $7000 with a due date being November 2017. It means I could stop paying and wait until November 2017 to make my next payment, but interests would accrue in the meantime (my balance would be 8500+accrued interests). Basically, the way I understand it is that I have reached in May 2015 what my balance would have been in November 2017 had I made minimum payments these past few months.

I hope this helps you, this is indeed confusing.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I don't want to be "Paid Ahead"

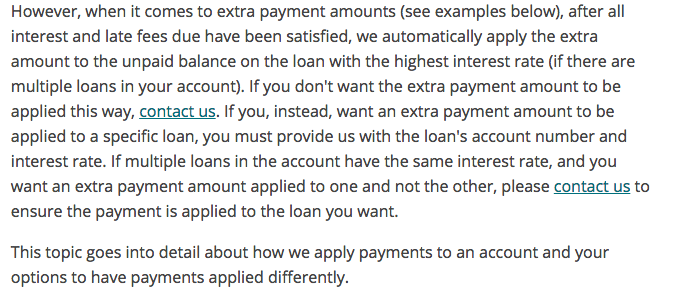

This US News article provides a good overview of how payments are applied to your federal student loans. These rules are the same for all servicers, because federal loan rules are dictated by Congress and the Department of Education. When you pay extra, your payment is applied in the same way every time: Fees > Interest > Principal. The only thing you and your servicer can control is how your extra payment changes the due date of your next regular payment.

By default, extra payments push that due date forward, but you can ask that your due date not be advanced. Sometimes you can do this by checking a box on the payment submission, but Great Lakes may require you to call in, or submit your payment by mail with written directions to do this. Honestly, it's not worth the trouble. Your payment is applied the same no matter what, and by letting the due date roll forward, you just build yourself a cushion of time when you don't HAVE to pay. You might never need it, but a month or two of no payments could come in handy if you have a personal emergency.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I don't want to be "Paid Ahead"

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I don't want to be "Paid Ahead"

At Navient loan processing (formerly Sallie Mae) there is an option when one pays ahead online, it is either (a) pay ahead as in your case or (b) continue future payments as scheduled; I choose option B and my principal goes down and still make regular scheduled future payments. On this website it tells you based on the kind of loan you have how extra payments work, for example, extra payment will pay penalties first if any, interest, then principal in that order.

Research your loan type/contract for your loan processor at their website.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I don't want to be "Paid Ahead"

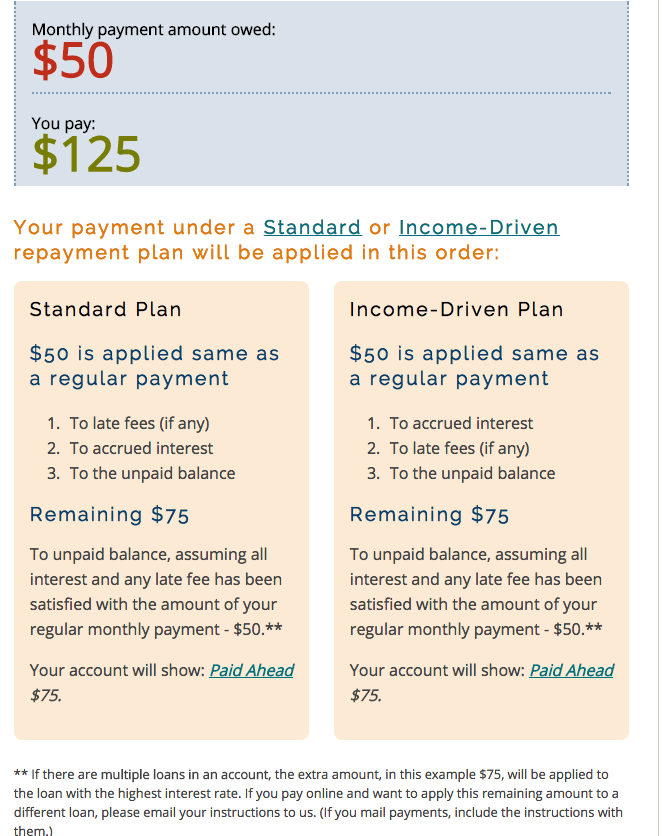

OP if that helps, I took this screen shot from the Great Lakes website:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I don't want to be "Paid Ahead"

Here is an example to illustrate taken again from the Great Lakes website: